Real estate as an inflation hedge in an investment portfolio

For more than a decade, consumers and investors have not worried much about inflation risk. Now, inflation risk looms large in the wake of the COVID-19 pandemic. As the United States and other economies recover following an acute economic disruption, costs are spiking across numerous sectors.

In June 2021, the U.S. Bureau of Labor Statistics reported a 5.4% year-over-year growth in the Consumer Price Index (CPI). Comparatively, year-over-year inflation numbers have fluctuated between 0% and 3% for the last decade. Many economists and policymakers remain uncertain whether this trend is transitory or will persist through the next few years.

Persistent inflation at this rate could have serious adverse effects on an investor’s portfolio. Nonetheless, our clients are taking notice of this potential risk and asking how they can hedge against the impact of inflation on their portfolios. One option is commercial real estate.

How does commercial real estate hedge against inflation?

Commercial real estate can act as a strong hedge against inflation for two reasons:

- Construction costs impact the value of not only newly built real estate, but also existing real estate via the concept of replacement cost. As the inputs for new construction (e.g., labor, lumber, steel, etc.) rise in price, so too must the cost of the output — the newly constructed building.

When investors look to acquire existing real estate, a common barometer of a “good deal” is the asset’s price relative to its replacement cost. For example, if the cost to construct a new apartment building now is $350 per square foot, a buyer may be comfortable paying $300 or $325 per square foot for a comparable existing building despite it having been constructed for less only several years ago. As a result, rising costs for new construction will elevate pricing for existing buildings as well. - Certain real estate asset classes utilize lease structures that can further improve the property’s inflation-hedging characteristics. For instance, some commercial leases may have periodic (annual or other) scheduled rental increases of either a fixed percentage or linked directly to CPI. This helps grow the rents (and therefore, income) with the rising cost of operating the property. On the other end of the spectrum, properties with short-term leases like apartments enjoy annual contracts that are set to market each year. It’s no coincidence housing costs (i.e., rent) comprise more than 40% of the CPI.

That said, there are supply-demand limitations to how quickly and how much both prices and rental rates can rise. Depending on the desirability of the market and asset type, there will always be theoretical limits to how much investors and tenants are willing to pay — regardless of the rate of inflation.

How have real estate values compared to inflation historically?

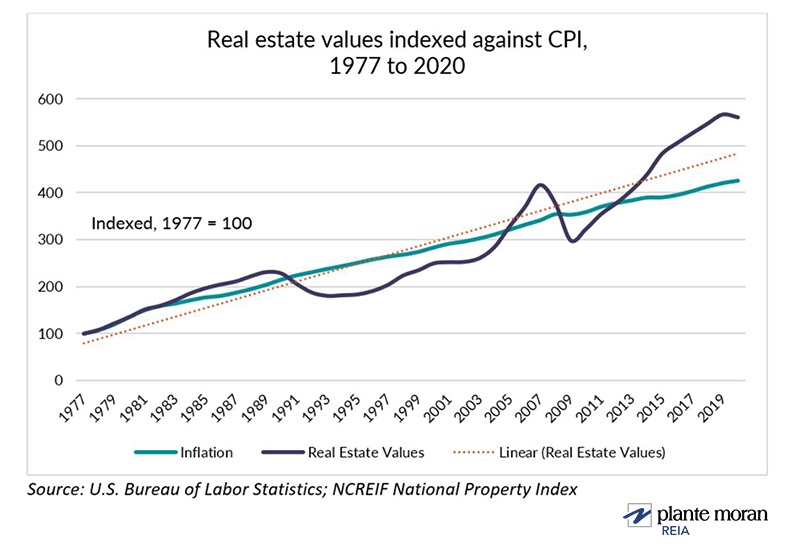

The proof of real estate’s hedging characteristic is in the data. Real estate values have closely followed inflation for more than four decades. The chart below reflects real estate values from the National Council of Real Estate Fiduciaries (NCREIF) National Property Index (NPI) indexed against CPI from 1977 to 2020. The dotted line represents the smoothed trendline of real estate values compared to inflation over the same time frame. What we see is a strong correlation of 0.92 between these data sets.

Moreover, this comparison only considers real estate values relative to the rate of inflation. It does not account for the added benefit of income from real estate. For example, NCREIF estimates that during the high inflation period of the late 1970s and early 1980s, real estate generated total annual returns (income plus appreciation) of 17.8% from 1977 to 1981, while inflation over the same period averaged 10.7%.

Should you consider real estate as an inflation hedge in your portfolio?

When factoring real estate’s many other attractive qualities — namely, portfolio diversification, lower volatility, and income — for many investors, it is worth considering how adding it to your portfolio can also help hedge against potential inflation risk.

If you are unfamiliar with the nuances of commercial real estate investing, there are several guidelines to keep in mind in order to build a diversified portfolio with the best risk-adjusted return profile that aligns with your investment goals, including property types, geographies, your risk/return tolerance, and the degree of control you want over your investments. Learn more about these considerations in our companion article.

Not sure how to start investing in commercial real estate? Our real estate investment consultants can help.