The fog of monetary policy

Two years later (to the day) after much of the U.S. shut down, yesterday’s Fed announcement marked a meaningful move away from the policies that it put in place to support the U.S. economy during the early days of the COVID-19 pandemic. As widely expected, the Fed announced its first step toward tightening in the form of a quarter-point rate hike, as FOMC Chair Jay Powell laid out the case for interest rate hikes:

“The probability of a recession within the next year is not particularly elevated. Aggregate demand is currently strong, and most forecasters expect it to remain so. All signs are that this is a strong economy.”

So, it begins.

The announcement comes as the global focus is firmly fixed on the weeks-old war in Ukraine. We would acknowledge the overwhelming human cost of the war, which can’t be reasonably estimated at this point. Since our initial commentary was released, further sanctions have been imposed, dealing a significant blow to the Russian economy. Although the brunt of the impact is apparent there, the economic impact is also rippling through the global economy. The price of oil and other commodities since the Russian invasion have surged. Oil prices briefly topped $130/barrel but have fallen sharply in recent days to below $100/barrel. Still, current pricing is well above the $75 range where it started the year and is likely to remain elevated for some time.

Even so, oil may not present the greatest challenge, as other producers, including the U.S. shale industry, are expected to increase production to offset lost Russian production. Agricultural commodities could present a greater problem, lifting food prices. While many economists had anticipated that inflation was close to peaking, most now anticipate that in the near term, the disruptive impact of the war and related sanctions could both intensify and prolong the inflationary pressures that continue to build. Inflation pressures are still projected to ease in the latter half of the year, but inflation indexes are unlikely to subside to the sub-2% level anytime soon.

The uncertainty that plagues the situation in Ukraine reflects the idea of “the fog of war,” a term that describes the inherent uncertainty that exists in the chaos of battle. Military strategy can be fluid, and outcomes are certainly not known. Unintended consequences can complicate conditions. It’s impossible to plan for every potential outcome. Ultimately, getting a clear picture of what’s happening on the ground can be exceptionally difficult, if not impossible, in real time.

A similar dynamic exists for monetary policy. When disruptive forces emerge, it’s impossible to reliably predict what will happen in a complex global economy. Conditions are constantly evolving, and exogenous forces — like the outbreak of war — can swiftly and materially impact conditions and the outlook. That has been readily apparent in the past year, as Fed policymakers underestimated the inflation problem, expecting a greater return of workers to the labor force and a more rapid repair of global supply chains. In his comments yesterday, Powell acknowledged as much, saying that with the benefit of hindsight, they should have raised rates sooner. Additionally, the outbreak of war in Ukraine changed the calculus for policymakers, creating a significant new risk to geopolitical stability but also to the global growth outlook.

When disruptive forces emerge, it’s impossible to reliably predict what will happen in a complex global economy.

Expectations for near-term Fed policy have gyrated wildly since December, as labor market conditions tightened further, and gauges of consumer inflation edged even higher. The case for the Fed to turn hawkish was strong, but the onset of war, and the potential for growth to slow, narrows the path for policymakers. They now find themselves caught between the proverbial Scylla and Charybdis for monetary policymakers, who are now caught between the “rock” (inflation) and the “hard place” (slowing growth). The former calls for policy tightening; the latter, for caution and accommodation.

The Fed’s solution? Action…but with a cautious tone. Announcing a larger 0.5% increase could have spooked markets, which have already been on an unsteady footing in recent weeks. Doing nothing could have ratcheted up fear that the Fed was at risk of falling further behind the curve.

The Fed ultimately concluded that raising rates into that uncertainty about growth was critical to combat inflation and to send a message to the markets. The subsequent stock rally suggests that the markets embraced that balanced approach.

What did we learn?

Beyond the expected rate increase, the major questions coming into yesterday’s announcement surrounded the Fed’s forecasts for growth, inflation, employment, and interest rates. Additionally, markets were still seeking clarity around the Fed’s plans for its balance sheet in the form of quantitative tightening (QT), which would withdraw liquidity from the economy, likely pushing long-term rates higher as well.

The statement itself yielded few insights, indicating only an intent to begin to reduce those holdings “at a coming meeting.” In his press conference, Powell was more candid, indicating that a decision could come as soon as the FOMC’s May meeting without committing to it. He further indicated that the runoff of the balance sheet would be more rapid than in the last cycle. It also comes much earlier in the cycle than was the case in the last expansion — a necessary step given the accelerated recovery in labor markets and the persistent upward pressure on prices.

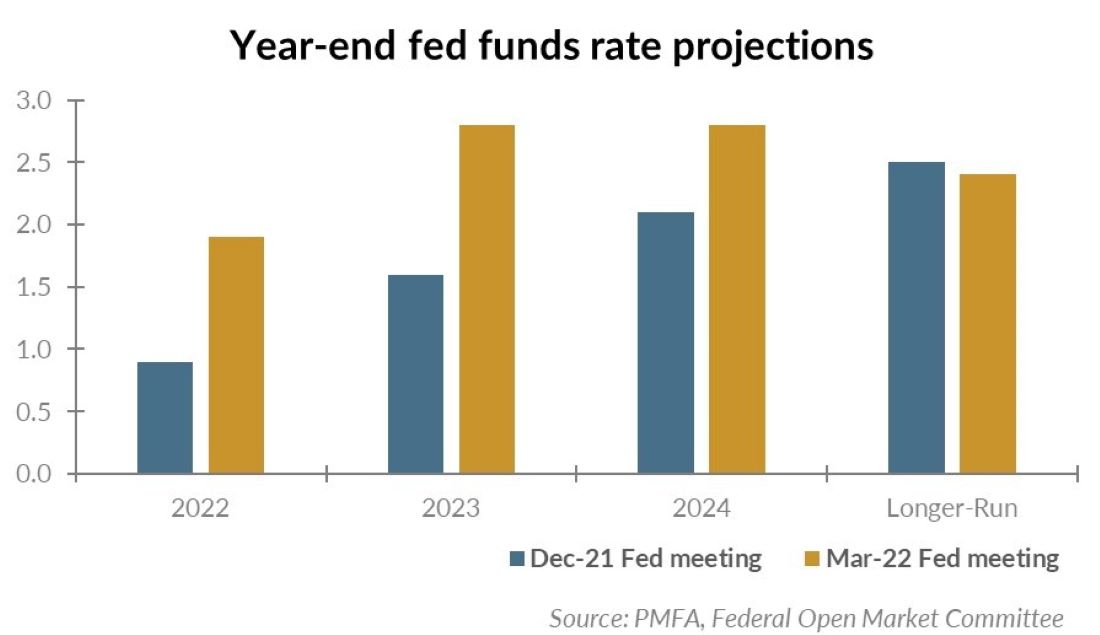

For the policy rate path, the answer was much clearer. The Fed’s updated forecast provided a baseline that would move the policy rate from the 0–0.25% range that had been in place since March 2020 to a range of 1.75–2.0% by the end of this year. Beyond yesterday’s hike, another 150 bps of upside is projected this year, with the policy rate projected to reach 2.8% by the end of 2023. While not explicitly stated, some have speculated that suggests a series of quarter-point hikes at each scheduled meeting this year. In his press conference comments, Powell indicated that they would remain flexible, keeping the door open for a more aggressive approach if appropriate. The significant change in expectations in recent months reinforces how quickly plans could change if conditions warrant.

In the near term, the policy rate will remain accommodative, with the forecast path suggesting that the Fed could push the effective rate through the Fed’s 2.4% neutral rate and into restrictive territory at some point in 2023. The Fed’s intent was clear: to send a message that tightening has begun, that they will move more aggressively than in the last cycle, and that they stand ready to adjust as conditions “on the ground” change, the “economic fog” gradually lifts, and they have a clearer view of the balance of risks.

What does it mean?

First, it means that policymakers believe that the economy is on a firm enough footing to justify moving away from the extreme accommodation that was necessary to support the economy through the worst of the pandemic. That’s good, and not surprising, news.

Second, it means that the cost of capital will continue to rise, weighing on bond prices, rippling through to the pricing of other financial assets to some degree, and sopping liquidity out of the financial system. In time, that should cool the economy and will also help to relieve pockets of froth in the capital markets. We’ve already seen the effects of that in recent months, as highly valued tech stocks, cryptocurrencies, and growth stocks in general took a step back in anticipation of Fed tightening.

Third, the economic effects will not be as immediate. As the economist Milton Friedman famously observed, monetary policy works with a long and variable lag. The full effects of yesterday’s hike likely won’t be felt for at least six months and perhaps longer. But beyond rate hikes, other forces are also at work. Financial conditions were already tightening before yesterday’s hike. The economy, both in the United States and globally, are poised to slow from unsustainably strong growth toward trend. Of course, there’s the risk that growth could falter further than is anticipated, but recessions haven’t historically occurred when policy is this loose, and there’s still significant positive momentum in the United States. As Powell stated yesterday, the probability of the slowdown morphing into a recession in the near term remains relatively low.

The full effects of yesterday’s hike likely won’t be felt for at least six months and perhaps longer.

Fourth, as we’ve discussed in previous commentaries, periods of policy transition often create market turbulence as investors recalibrate their expectations. Despite that volatility, equities have typically performed well during periods of Fed tightening. The risk isn’t so much in rate increases, but in the potential for the Fed to become more aggressive than markets anticipate if the combination of rate hikes, tighter financial conditions, and the gradual clearing of global supply chain challenges doesn’t allow inflation to recede over time.

Fifth, we wouldn’t read too much into yesterday’s post-announcement surge in global equities, but there’s no question that the improved clarity around the Fed’s plans was well received. Yesterday’s rally seemingly reflected the old maxim “sell the rumor, buy the news.” Whether it signals the start of a more sustained improvement in sentiment remains to be seen. It does reinforce our view that there is still plenty of cash on the sideline waiting to step in and support equity markets. There’s a good deal of risk priced in, and the multiyear upside for equities looks increasingly positive.

Finally, we would still caution investors to be prepared for the potential for further market volatility. Even with this additional clarity, there is still significant risk globally. Having outlined their current strategy, the Fed hasn’t definitively solved the inflation problem. The war in Ukraine is far from over, and the risk of spillover effects beyond Ukraine are still present. The economy could slow more than expected. Still, we know that de-risking after a market decline can be costly, and that periods of pessimism and elevated risks often create attractive buying opportunities for investors.

What should I do?

When uncertainty is high, there’s often a sense that “I need to do something.” The challenge is in discerning between actions that could be beneficial versus those that prove to be detrimental. One’s time horizon for decision-making is of utmost importance. What might appear sensible today can prove to be costly over a prolonged period. Markets could experience a surge that may embolden some investors to assume that the bottom is in and dive back in with both feet, only to find further downside risk ahead. Conversely, the fear of continued deterioration in equity prices could create the temptation to take money out of stocks, only to find that the point of maximum pessimism has already been reached and stocks have begun a new sustained upward leg in the bull market.

In the fog of uncertainty, there’s no way to know definitively which direction the markets will head in the near term. We do know that the global economy and capital markets have slogged through similar circumstances of economic uncertainty, price instability, and geopolitical risk on countless occasions in the past. The long-term direction for the economy and markets is clear, and it rewards those who take risk and are able to stay invested over time.

We strongly encourage you to remain committed to your long-term investment policy, rebalancing as necessary. We would advise you to maintain adequate liquidity that will position you to meet your near-term cash needs, while avoiding holding excess cash that’s still yielding very little.

We will continue to monitor global conditions and evaluate the overall positioning of your portfolio through the lens of a careful risk/return framework with a long-term time horizon. To the extent that we believe that these changing conditions and considerations warrant adjustments to relative allocations, we will take steps to consult with you and make changes.

In the interim, if you have any questions or concerns, please don’t hesitate to reach out.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.