Chart your course in the changing auto industry: Key considerations for suppliers

The shift in propulsion from internal combustion engines (ICE) to electric vehicles (EVs) is driving fundamental and rapid change in the mobility and automotive industry. Product development and engineering are starting to shift to EV technologies, while customers still require components for their ICE programs. To successfully manage the transition, suppliers must develop new strategies that require innovation and investment, manufacturing simplification, and flexible, sustainable business approaches.

The shift in propulsion from internal combustion engines (ICE) to electric vehicles (EVs) is driving fundamental and rapid change in the mobility and automotive industry. Product development and engineering are starting to shift to EV technologies, while customers still require components for their ICE programs. To successfully manage the transition, suppliers must develop new strategies that require innovation and investment, manufacturing simplification, and flexible, sustainable business approaches.Suppliers have always had to respond to changes in technology, so what’s different now? We’re often asked this question, and the answer is this: the sheer magnitude and overarching nature of the transition, coupled with the short timeframe — about 15 to 20 years — across all OEMs. Production processes, supply chains, plant equipment, information technology systems — all aspects of your current business are going to be impacted.

During a recent webinar, we asked some 250 suppliers about their experiences and plans with respect to the EV transition. Fifty percent reported increased EV order volumes over the past 12 months. At the same time, 50% expressed concern about responding to the increase. Thirty-two percent reported uncertainty about their current level of preparedness, and less than one-quarter reported that they have and are executing on an effective strategy. In summary, many suppliers remain challenged by not having a strategy to guide their near-term and long-term decision-making.

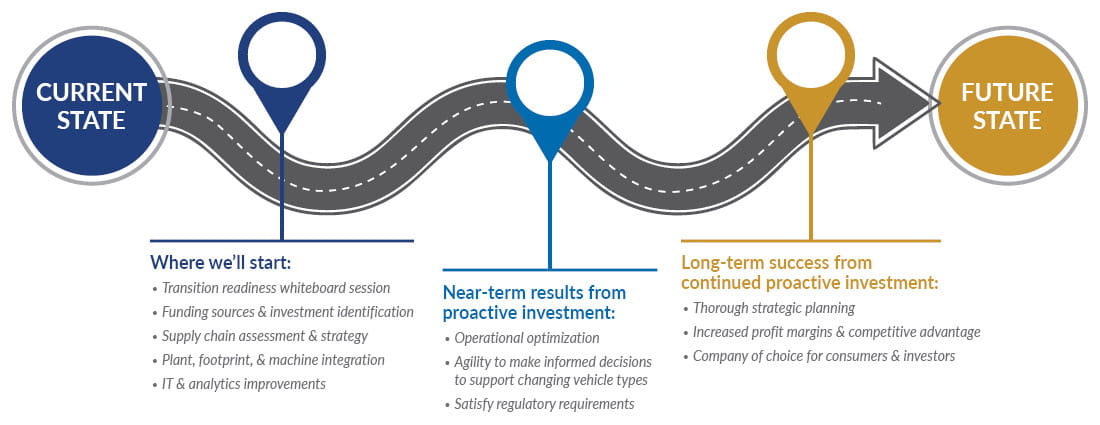

Consider the following actions as you weigh the strategic implications of the EV transition on your business and forge a path forward in the changing automotive value chain.

It all starts with your product portfolio

Charting your course begins with assessing the products you currently provide and the impact of the EV transition on your product portfolio. Is your existing product or technology being phased out with EVs? For example, if you’ve been producing alternators, the answer is yes.

Is your product innovative and aligned with your customers’ respective needs as EV programs grow? Keep in mind that innovation can be incremental, such as improvements to or new versions of products, or it can be radical, with disruptive technologies or manufacturing processes that create new product markets.

Align your competencies with future demand. Maybe you’ve been making injection-molded parts that EVs don’t use. Are there new parts EVs do require that you can produce instead? Develop a comprehensive business plan to scale with the transition.

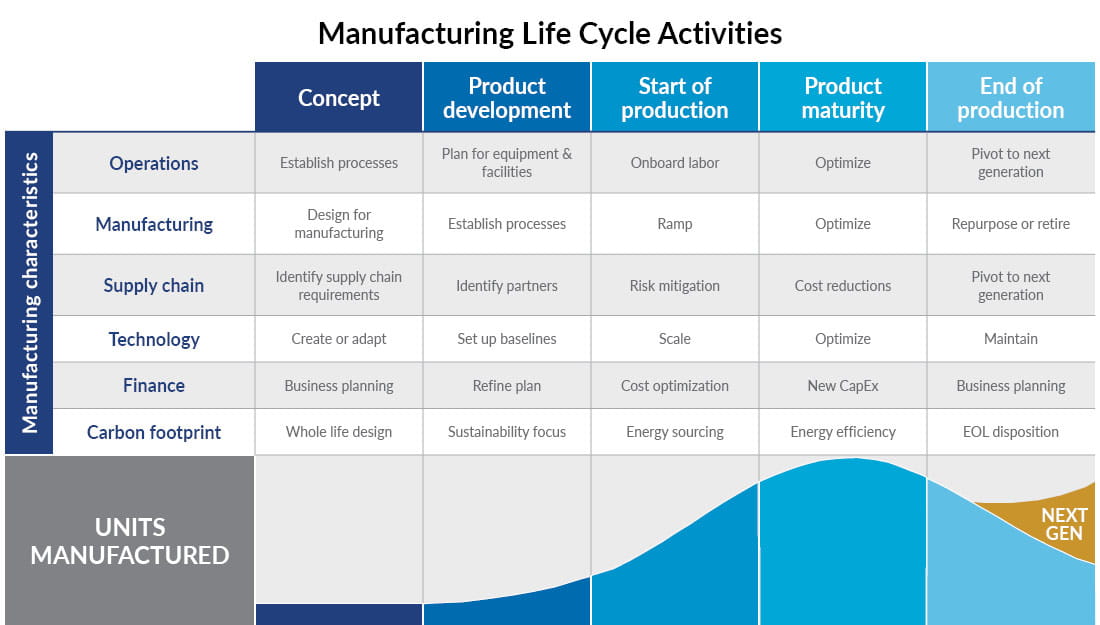

How do your manufacturing processes need to adapt?

New products require new manufacturing processes. As you consider innovation of your product portfolio, are you prepared to scale? Consider the supplier new to the auto industry with a highly sought after technology for EVs. Manufacturing capacity needs to scale up to meet new EV customer demand. This supplier must look at whether its product is properly designed for high-volume auto manufacturing and what changes might be needed to support those volumes.

Identify requirements for new operations, facilities, and locations

Given the changes required in your product portfolio and manufacturing processes, can your current operations be retooled, expanded, or retrofitted, or will you need new facilities? Does your existing footprint allow for a dual path, i.e., continued ICE as well as new EV components?

As you weigh your operations and footprint, also consider labor supply. EV component production requires different skill sets. Where are the pools of skilled labor? What are going rates, and who are you competing with for that labor? If you’re considering a greenfield facility, does it make sense to build in a different location? This also ties into your OEM alignment strategy; where are the customers you serve located?

Many suppliers are also asking what to do with excess capacity. Should you retrofit the capacity or are there other solutions to consider? You may also have commitments to manufacture ICE service parts for several more years and may need to evaluate whether to maintain that business or consider selling it.

Improve IT and analytics

Many suppliers are investing or will need to invest in smart manufacturing, which includes new shop floor equipment as well as information and operational technologies for real-time data capture and improved analytics. Can your current IT systems support the transition to new EV technologies and your new business model? Will your information systems be able to scale with your growth?

The ICE-to-EV transition presents an opportunity to put improved technologies and data models in place to enable required business processes and improved decision-making moving forward.

Reassess your supply chain to meet procurement needs

Given your new strategies and business plans, do you have the right suppliers in place to procure the materials you need? Can your current suppliers support you in the transition and scale with your growth, or will you need to identify new partners? As your supply base changes, so should your risk planning. Build redundancy and visibility into your new supply model to ensure resilience against future disruption.

Identify funding sources and investment needs

Many suppliers are wondering how they’re going to finance capital requirements in the face of dual (and uncertain) OEM ICE and EV program volumes. Suppliers aren’t unfamiliar with uncertain volumes and, particularly now, there’s no easy answer. That’s why it’s so important to collect as much data as possible and put your analytics tools to work.

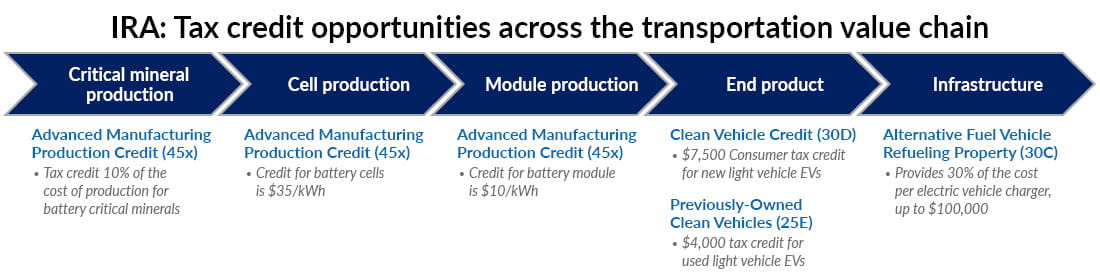

Determine which grants and tax credits your business might be eligible for to help offset investments. The Inflation Reduction Act (IRA) includes nearly $500 billion for projects that repurpose retired fuel infrastructure and employ displaced workers, creating an ecosystem of credits and incentives supporting green energy, broadly defined.

As part of the funding appropriated under the IRA, the U.S. Department of Energy has made a package of loans, grants, tax incentives, and credits available to support the EV transition. This includes over $40 billion in funding made available through the Advanced Technology Vehicles Manufacturing (ATVM) Loan program.

Charge ahead

For your business to thrive, your product and production transition has to occur both sustainably and profitably, even as ICE and EV volumes in the interim are likely to remain uncertain. Wherever your business is in the transition, consider the factors, questions, and strategic implications above to continue charting your unique course in our EV future.

For your business to thrive, your product and production transition has to occur both sustainably and profitably.

To dive deeper into these issues, watch our “Charging into an EV future” webinar or start a conversation with our mobility experts.

.jpg)