Are high-yield bonds attractive today?

With yields on noninvestment grade (high-yield) bonds hovering around 8% today, investors may be tempted to increase exposure to these high-income investments within their bond portfolios. However, absolute yield levels are only one piece of the puzzle, and within the bigger picture, high-yield bonds aren’t as attractive today as they may seem.

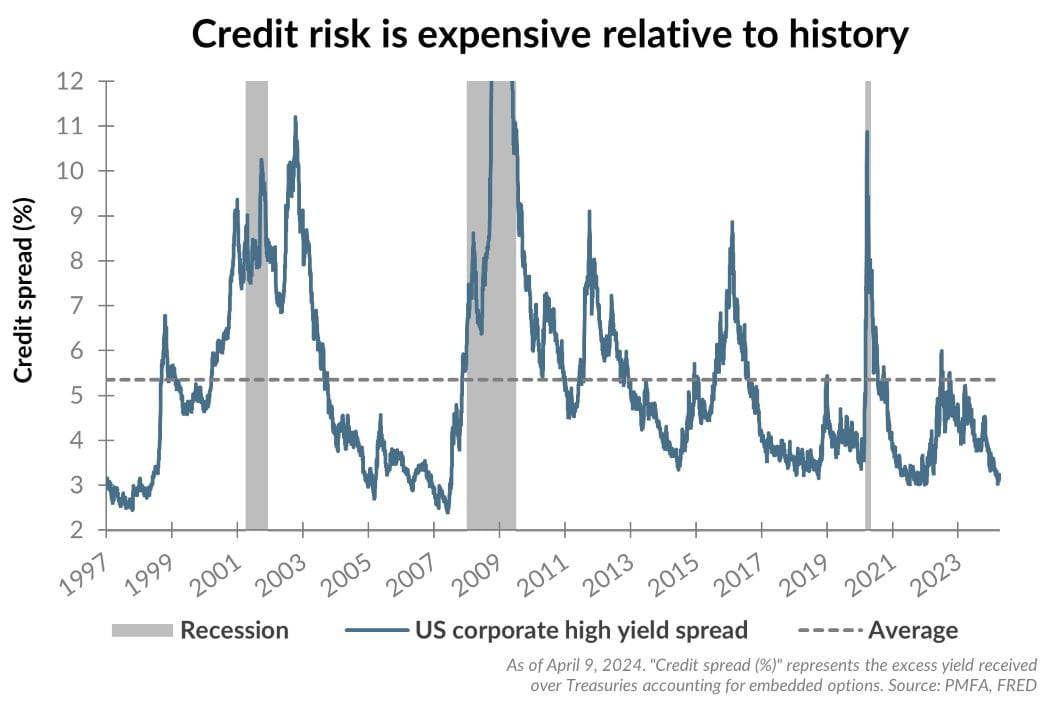

As with any investment, high-yield bonds carry risks. Due to their lower credit quality, high-yield bonds typically have a higher risk of default relative to their investment grade peers. Thus, investors require additional yield (often called “spread”) to compensate for that additional risk, although the amount of that spreads can vary widely over time. Today, the yield difference between high-yield bonds and Treasury bonds is quite narrow — near its lowest point in over 15 years, as illustrated by the chart. That incremental compensation is only about 3% now, well below the long-run average of about 5.4%.

If Treasury yields remain stable or decline and spreads don’t blow out quickly as part of a “risk-off” event, that incremental yield could be beneficial. The reverse is also true.

Adding risk to a portfolio isn’t necessarily a bad thing, within the context of a long-term time horizon and one’s risk tolerance. However, when choosing to take on additional risk, it’s essential to evaluate whether you are being adequately compensated to do so. While the risk-reward tradeoff for high-yield bonds may not appear compelling today, the good news is that high-quality bonds are offering attractive yields — the highest the market has seen since the Global Financial Crisis.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.