Timing is everything: Converting a partnership to maximize Section 1202 QSBS exemption benefits

Taxpayers that invest in qualified C corporations are able to realize tremendous benefits from a gain exclusion under Section 1202. Investors in businesses structured as partnerships typically will miss out on this benefit. However, partnerships may have an opportunity restructure into C corporations, sometimes gaining even more significant benefits than operating as a C corporation from day one. This strategy poses an essential question: When is the best time to restructure my business to a C corporation?

Taxpayers that invest in qualified C corporations are able to realize tremendous benefits from a gain exclusion under Section 1202. Investors in businesses structured as partnerships typically will miss out on this benefit. However, partnerships may have an opportunity restructure into C corporations, sometimes gaining even more significant benefits than operating as a C corporation from day one. This strategy poses an essential question: When is the best time to restructure my business to a C corporation?This strategy poses an essential question: When is the best time to restructure my business to a C corporation?

To have & to hold (for at least five years)

Sec. 1202 was enacted in 1993 to encourage investment in small businesses. It allows certain shareholders of C corporations to exclude up to 100% of the taxable gain recognized on the sale of qualified small business stock (QSBS). Qualifying stock must be held by the shareholder for more than five years before exit. In the case of a partnership conversion to a C corporation, the five-year clock starts at the time of conversion. Consequently, the conversion strategy works best when the horizon for exit is at least five years, so the stock can qualify for Sec. 1202. However, if the shareholder unexpectedly exits early, all is not lost — they may have opportunities for gain deferral, such as Sec. 1045.

Qualifying as a small business for Section 1202

To qualify as a “small” business for Sec. 1202, the corporation must not have had more than $50 million of gross assets at any time before or immediately after the issuance of the stock. Generally, this requirement measures assets using tax basis, which is often less than fair market value. However, if a partnership converts to a C corporation, the assets are instead measured by their fair market value at the time of conversion, including value in intangible assets such as goodwill. As such, delaying conversion for too long may cause the company to lose out on this opportunity, since the fair market value of the partnership’s assets must be less than $50 million at the time of conversion.

One detail that’s often overlooked is that the $50 million requirement is based on the corporation’s assets, not equity or enterprise value. Therefore, if a partnership is worth $40 million, but also has $25 million of liabilities, its gross asset value is $65 million. Without additional planning, this company wouldn’t meet the $50 million small business requirement.

Balancing act: Maximizing the QSBS exclusion while limiting tax on existing gain

Because of the complexities of the Sec. 1202 exclusion calculations, growing the value of the company before converting to a C corporation can boost the amount of gain exclusion available to investors. The amount of gain eligible for exclusion is the greater of (a) $10 million or (b) 10 times the basis of the taxpayer’s qualifying stock. When a partnership converts to a C corporation, the shareholder’s basis for determining their Sec. 1202 exclusion is the fair market value at the time of the conversion. By waiting for the fair market value of the company to grow before transitioning to a C corporation, the basis is often much higher than the cash initially contributed into the business.

However, this strategy has a trade-off. The amount of the existing gain in the stock at the time of conversion (the difference between fair market value and tax basis) will not be eligible for gain exclusion and will be taxable upon exit. Therefore, taxpayers must consider the projected growth of the company between the conversion and their anticipated exit to determine when a C corporation transition makes sense.

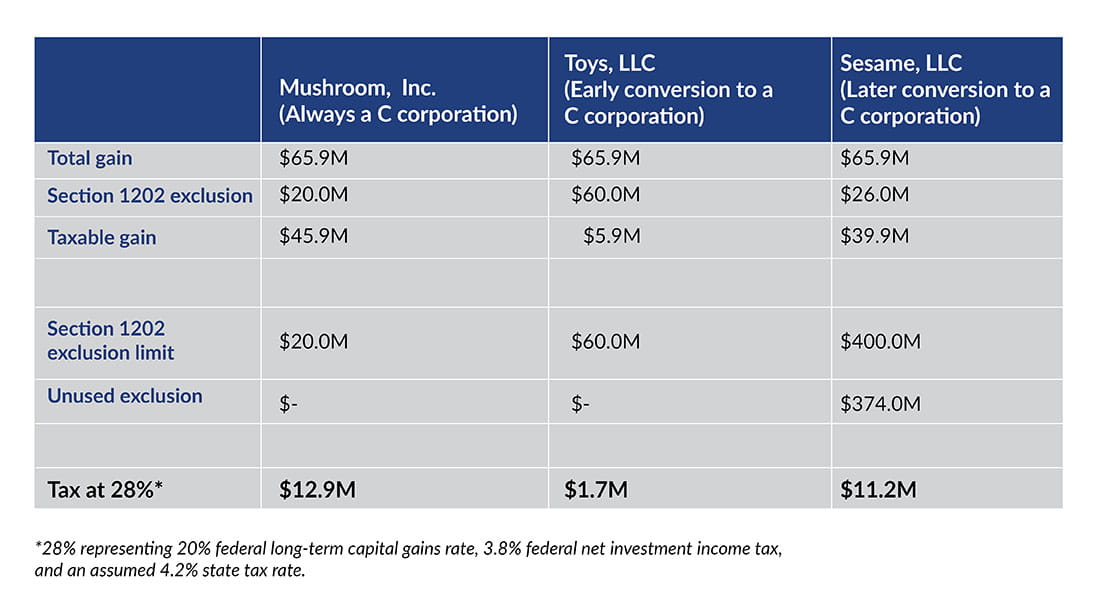

Since the benefits of this strategy rely on math, it’s helpful to compare a few scenarios.

Mushroom, Inc. (Always a C corporation)

In 2015, Mario and Luigi form Mushroom, Inc., a C corporation, by contributing $100,000 in total for a 50% interest each. In 2022, they sell all their C corporation stock for $66 million. Assuming the requirements of Sec. 1202 are met, Mario and Luigi will each exclude the greater of $10 million or 10 times their Sec. 1202 basis ($20 million in this case, since each would have a $10 million exclusion). However, the remaining $46 million of proceeds, reduced by the $100,000 basis, will be taxable to Mario and Luigi.

Toys, LLC (Early conversion to a C corporation)

Toys, LLC was formed by Buzz and Woody in 2013 as a partnership by contributing $100,000 in total for a 50% interest each. In 2015, Toys had a fair market value of $6 million and elected to be taxed as a corporation for tax purposes. In 2022, Buzz and Woody sold their stock of Toys for $66 million. Assuming the requirements of Sec. 1202 are met, Buzz and Woody will exclude the greater of $10 million or 10 times their Sec. 1202 basis (10 times $3 million for each, or $60 million in total). However, the value prior to conversion of $6 million will be subject to long-term capital gains tax.

Sesame, LLC (Later conversion to a C corporation)

Sesame, LLC was formed as a partnership in 1995 by Bert and Ernie with $100,000 in total for a 50% interest each. In 2015, when fair market value was $40 million, Sesame converted to a C corporation. In 2022, Bert and Ernie sold their stock in Sesame for $66 million. Assuming the requirements of Sec. 1202 are met, Bert and Ernie can exclude up to $400 million of gain on the transaction. However, Sesame’s $40 million pre-conversion value is subject to long-term capital gains tax. Therefore, while Bert and Ernie could exclude up to $400 million (10 times $20 million for each), they also will have to pay tax on the $40 million value at conversion.

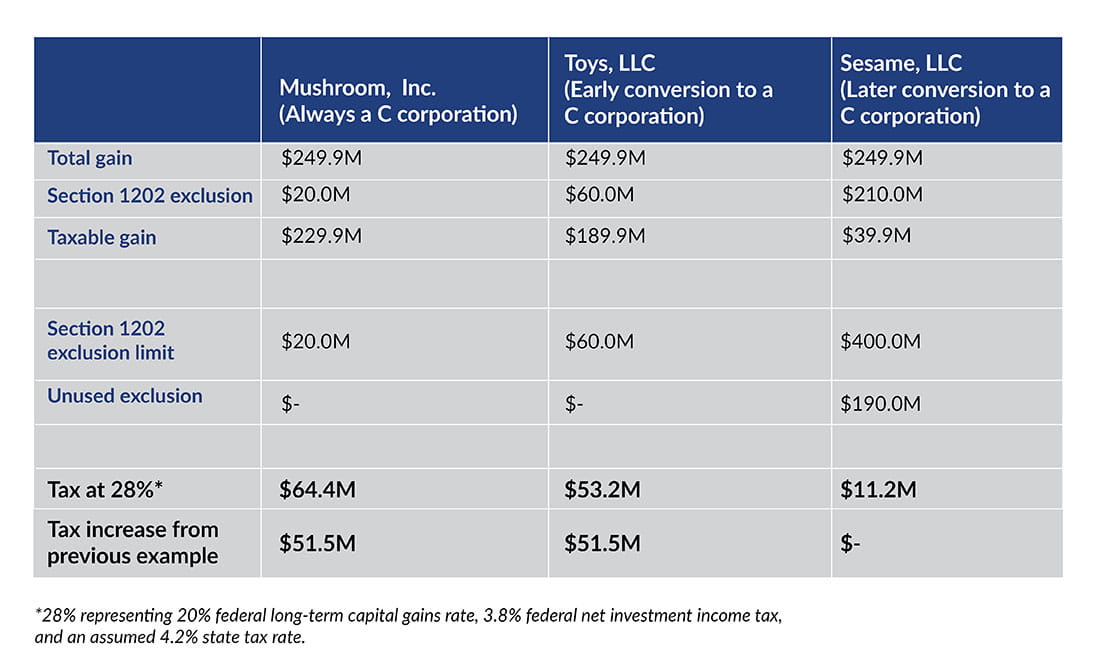

What if the companies sold for $250 million instead?

In the scenario above with a modest growth projection, Bert and Ernie would have ideally converted when Sesame had a fair market value of $6 million in order to minimize the taxable built-in gain. However, if Sesame had ended up selling for substantially more, their gamble of delaying the conversion could have paid off significantly. The table below compares the results for Mushroom, Toys, and Sesame if the value of the companies exploded and instead sold for $250 million.

In the exit, Bert and Ernie have saved $51.5 million in taxes compared to Mushroom’s and Toy’s investors.

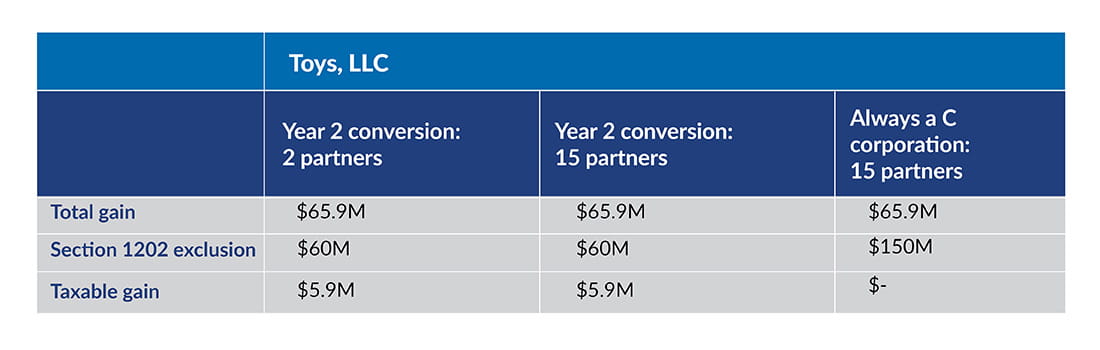

Timing the partnership to C Corporation conversion: Investor multiplication

When considering the best timing of conversion, it’s also important to consider the number of total owners that will be sharing in the gain exclusion because each gets their own $10 million or 10 times basis limitation. For example, if Toys had 15 equal partners at inception, it would have been better off to start as a C corporation because the minimum gain exclusion at the ultimate taxpayer level is $150 million ($10 million each times 15 partners), avoiding tax on $6 million of gain.

However, when the ownership isn’t pro rata between each owner, the math gets substantially more complicated. Those with smaller ownership percentages may desire to be a C corporation earlier, since they will almost certainly rely on their $10 million exclusion under any realistic exit scenario and would rather start the five-year clock sooner. However, those with larger ownership percentages may prefer to start as a partnership to get a larger benefit

How to convert a partnership to a C corporation

A business taxed as a partnership, including an LLC, can convert to a C corporation using a number of different methods. For example, it might convert to a corporation under state law, merge into a newly formed corporation, contribute its assets to a newly formed corporation, or simply make an election to be taxed as a corporation for income tax purposes. The best path for a business will depend on a number of factors, but tax law provides a lot of flexibility when making this decision.

The best path for a business will depend on a number of factors, but tax law provides a lot of flexibility when making this decision.

But what about S corporations and Section 1202?

Existing S corporations can also restructure into C corporations to take advantage of Sec. 1202. The benefits and trade-offs identified above apply in those situations as well. However, planning for S corporations often requires different tactics than partnerships. An existing S corporation can’t qualify for Sec. 1202 simply by revoking its S election. Instead, an existing S corporation generally would create a new corporate subsidiary and contribute its business into that new corporation. The stock of that new corporation is the stock intended to be qualified for Sec. 1202.

The value of valuations when considering converting to a C corporation

Companies considering conversion to a C corporation must carefully consider the current value of the business. The valuation impacts the amount of the gain exclusion, the built-in that will always remain taxable, and it supports qualification under the $50 million requirement. Hiring a valuation firm to document the valuation creates more certainty that the planning the business has done will be realized by the shareholders when compared to an internally developed valuation.

Navigating Section 1202 and C corporation conversions with the right team

There can be significant tax savings when companies choose the right time to be taxed as a C corporation. However, there isn’t a one-size-fits-all answer. Restructuring into a C corporation has broader implications to both the business and investors, including legal, tax, and other considerations. There are numerous traps for the unwary when executing this strategy, so you need an experienced team of advisors to help you navigate these tax rules to determine if your business may be eligible for Sec. 1202 and optimize your taxes on a future exit.