Electrification of the auto supply chain requires new business case evaluation: Suppliers share strategies

The transition to electric vehicles (EVs) is accelerating. Across the leading original equipment manufacturers (OEMs), announced investment in vehicle assembly and battery plants is nearing $800 billion. Additional supplier investment supporting the transition will provide an economic multiplier well beyond this $800 billion. The OEMs have a range of EV aspirations, from GM’s 100% zero-emission sales by 2035 to Toyota’s complex mix of 70% zero- and low-emissions sales by 2030. Toyota’s mix includes battery electric (BEV), plug-in hybrids (PHEV), hybrids (HEV), and fuel cell (FCEV) componentry.

The transition to electric vehicles (EVs) is accelerating. Across the leading original equipment manufacturers (OEMs), announced investment in vehicle assembly and battery plants is nearing $800 billion. Additional supplier investment supporting the transition will provide an economic multiplier well beyond this $800 billion. The OEMs have a range of EV aspirations, from GM’s 100% zero-emission sales by 2035 to Toyota’s complex mix of 70% zero- and low-emissions sales by 2030. Toyota’s mix includes battery electric (BEV), plug-in hybrids (PHEV), hybrids (HEV), and fuel cell (FCEV) componentry.EV investment by OEMs and suppliers is incremental to the industry’s existing ICE capital investment. Through the EV transition, OEMs and suppliers should actively manage the reduction of ICE production contracts while ramping up EV-related production. This will help maximize profitability by supporting predictable revenue streams, reducing unintended costs, and minimizing stranded capital investment.

We undertook a survey in September 2022 to capture suppliers’ opinions and strategies with respect to customer-supplier relationships and the EV transition.

Sources of frication and risk are many, as are risk mitigation strategies

The survey prioritizes issues and commercial responses from a broad supplier base. This section identifies the primary sources of customer-supplier friction in the EV transition, the inherent risks, and mitigation methods suppliers are employing. Legacy OEMs must manage the transition well since their supply base must continue supporting their ICE programs effectively while investing in EV program growth. Startups not offering programs with major volumes must attract suppliers by being a customer of choice.

1. OEM request for quotation: Volume and production planning accuracy

This friction point drives poor pricing decisions, potentially excessive capital investment, and, ultimately, nonoptimized profit margins. Suppliers question both EV and ICE program assumptions as they try to understand which vehicle programs will be positive and which programs might cannibalize existing business. Ultimately, excessive volumes in RFQs lead to installed capacity that doesn’t match future demand.

Suppliers manage these risks by discounting projected volumes (some by a set percentage, some by an absolute unit amount), imposing strict payback periods and increasing their use of third-party forecasting tools to adjust OEM volumes. Suppliers also incorporate greater customer financial assessments and due diligence, particularly on new startup OEMs and direct suppliers, into their business case assessments.

2. Product cycle stability, accuracy, and compressed lead time

Uncertain product cycles play out in various ways, including unpredictable cash flow and capital investment lead-time planning. Suppliers are concerned with product development time compression if the start of production doesn’t adjust to program delays. Given that many EVs involve new engineering and manufacturing processes, compressed lead time increases the risk of field quality problems. Which, in turn, requires suppliers to adjust warranty and recall reserves accordingly.

In response, suppliers are carefully monitoring manufacturability requirements and demanding design and engineering specifications match current, proven standards. Suppliers are increasing their documentation of every specification discussion, testing activity, and required validation certification to protect future warranty claims. Finally, suppliers are ensuring RFQ responses leverage as many supplier designs and as much existing capital equipment as possible. Leveraging existing capacities and capabilities lowers the risk of having stranded capital and program losses if actual volumes don’t reach quoted volumes.

3. Managing the production transition to EV from ICE

As the customer and product mix changes to a more significant share of EV products and startups, suppliers recognize the need to manage their revenue mix carefully. Suppliers are aiming to ensure they maximize revenue and profits from their current customer base. In this regard, suppliers are no different than OEMs.

Toward this end, suppliers are creating corporate commercial committees to optimize multiple requests from existing and prospective OEM customers. These cross-functional committees provide checks and balances. This assures that commercial teams pursuing EV and ICE programs are aligned with a supplier’s engineering, purchasing, manufacturing, finance, legal, and human resources functions to optimize the transition of a supplier’s production mix from ICE to EV.

Cost models and price targets

Cost model and price target risk occurs when new EV components don’t fit the proven variable and coefficient assumptions built up over the years on mass volume and well-known manufacturing processes and part designs. Cost models now need to support new components, software, and integrated electronics with volatile production volumes or volumes that don’t follow a traditional ramp-up path.

Suppliers are increasingly winning cost recovery by separating upfront engineering, design, and tooling investment rather than amortizing these costs into the piece price. Suppliers also are negotiating program cancellation clauses and volume guarantees. Indeed, these provisions aren’t occurring across the board but with programs where suppliers have leverage. Suppliers must review their downstream contacts to ensure that risk is distributed equally among the customers and the sub-tier suppliers.

A successful transition relies on strong OEM and supplier relationships

Supplier respondents identified four supplier-OEM relationship tenets of the EV transition:

- Managing down ICE programs is as much a customer responsibility as sourcing new EV programs.

- Managing supplier risk is as much about integrating EV programs into a supplier’s existing business as it is the risk of the individual EV program.

- Program cycle stability is as much about product development compression as it is about timing volatility.

- New strategic supply chains to EV programs will be as much about onboarding nontraditional suppliers as shifting leverage away from current first-tier integrators.

OEMs must be mindful of managing down suppliers’ existing ICE business carefully. This is a complex undertaking. However, it can be addressed if OEMs consider their ICE productivity requests in conjunction with the recommendations from their EV commodity groups for capital investment. Similarly, OEMs should manage EV designs and engineering across their EV and ICE platforms to help suppliers gain economies of scale. If uncertainty is a given in program launch timing, OEMs can compensate by sourcing programs as early as possible to better allow suppliers to deal with compressed product development cycles. Finally, OEMs should be mindful of creating conflicts between suppliers that naturally arise from increased directed buys and ownership positions in material and sub-tier suppliers.

Emerging environmental, social, and governance requirements

This survey focused on supplier strategies to manage responses to formal EV program RFQs. Suppliers are also being asked to comply with broader environmental, social, and governance (ESG) requirements. These include carbon footprint monitoring, supply chain labor force compliance, and diversity, equity, and inclusion initiatives. While these topics drive serious public discussion and investment strategy decisions, 63% of respondents say they don’t have a customer with specific ESG metrics on their scorecard. This suggests that customers are rolling metrics and benchmarks out to test monitoring and reporting systems before including ESG measures in formal scorecard processes.

Key takeaways

A successful industry transition to EVs relies on strong OEM and supplier relationships and refining business cases for EV component sets, electronics, and software. Through the EV transition, OEMs and suppliers will need to actively manage declining ICE production contracts while ramping up EV-related production. Actively managing these two trends together will help maximize industry profitability.

Survey background

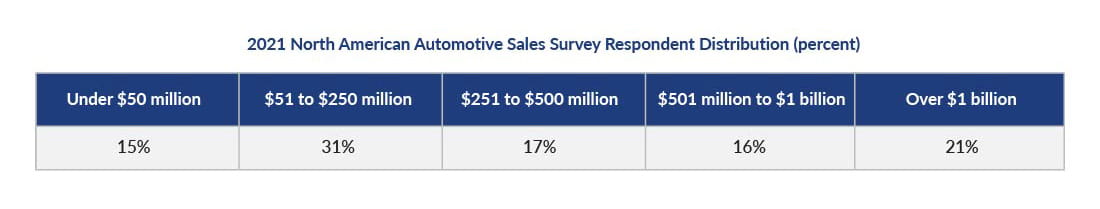

The Plante Moran Supplier EV Commercialization Issues Survey was conducted between Sept. 23 and 30, 2022. Respondents to the 2022 Plante Moran Working Relations Index® Study made up the sample base: 145 executives responded to the survey. Of these, 130 provided their 2021 North American automotive sales:

Our resources to assist suppliers through the EV transition

We support suppliers through the EV transition by assisting with a range of services, from strategic planning to cost modeling and production forecasting. Let’s start a conversation.

.jpg)