Does your senior living organization have an experienced team or the time and energy to lead your campus’s upcoming expansion or multiphase repositioning? If not, you’ve likely been recommended to use a development advisory firm (also called a development consulting firm) to get the executive resources you need to help plan and manage the project.

As you compare firms, you may begin to wonder… How much should senior living development advisory services cost? What services should the development advisor include in its fee? If I have talent on my internal team, shouldn’t my fee be less? Ultimately, you are responsible to the board and residents as a good steward of the resources you have been entrusted with. So how do you get answers to these questions that you can trust?

Cost isn’t the only consideration for hiring a senior living development advisory firm, but it’s important to the feasibility of your project. Experience; specialization into your industry; business acumen; executive experience running and operating a similar organization; expertise in feasibility, design, and construction; and culture fit are also important.

Let’s peek behind the curtain of your project’s soft costs and development advisory services so you know which factors to consider as you look to wisely choose your trusted partner.

Budgeting for soft costs: How much is too much?

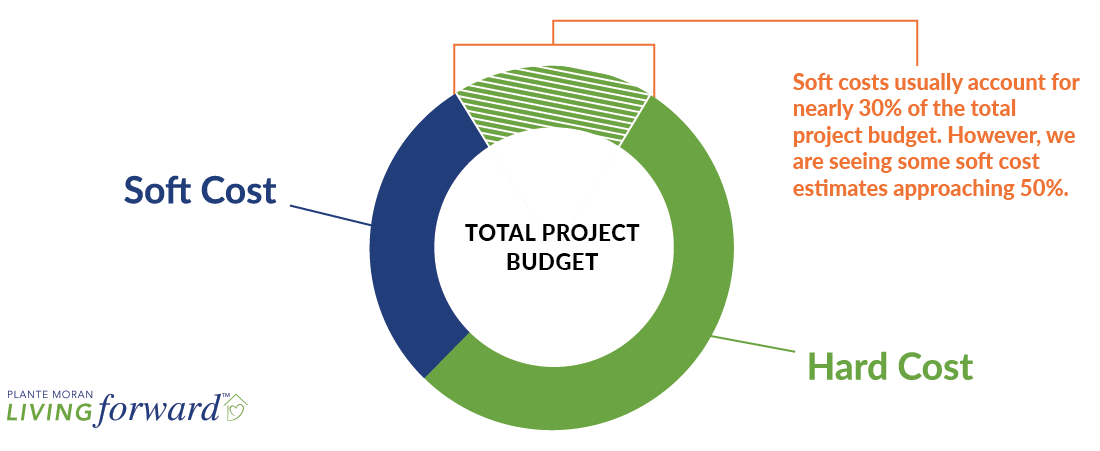

The total budget for any construction project, senior housing or otherwise, is split into two project budgets: hard costs and soft costs. Hard costs encompass the entire construction cost, including site work, to build the building. Soft costs are everything else: professional fees, due diligence, furniture, equipment, technology, financing, contingency, marketing, and other administrative expenses.

To illustrate, below is an estimated breakdown of a typical project’s costs. You want as much of your total project budget to be allocated to hard costs, since these represent the tangible, long-term assets your residents experience. Soft costs usually account for about 30% of the of the total. However, we are seeing some development advisors estimate soft costs approaching 50% of the total budget. This means the overall project budget will need to increase or the amount available to spend on hard costs will be reduced.

Soft cost budgets aren’t usually defined until the Sources and Uses of Funds statement is created during the project’s strategic planning phase. Many times, it’s the development advisor’s role to create this statement, define the hard and soft costs, and thus end up at the overall project budget. As the project moves through the different development phases of schematic design, design development, and construction documents, your development advisor should be updating the project budget with new construction estimates and clear budgets for each expense line item for the project, whether it’s for other consultants, furniture, or technology for the building.

Development advisory services land in the soft cost budget, and like other professional services, can be evaluated based on a percentage of the construction costs. At this early point in financial planning, many soft costs are lumped together in a single “Professional Services” line, accounting for a rather large percentage of the project: 9% to 12% of the construction cost. It may include development advisory, architect and engineering, owner’s representation, construction monitoring, legal, or other consultants’ fees — making it impossible to assess the cost per consultant or how conservative those consultants’ fee estimates may be.

An overly conservative approach to professional fee estimation is straining a lot of projects in the market right now. The development advisor you hire should provide a transparent budget that clearly defines the planned costs for all the consultants hired — including itself.

Questions to ask about development advisory services:

- Do you have a clear understanding of the soft cost line items per vendor, including the fees for senior living development advisory services?

- Has your development advisor reviewed soft costs and discussed ways to optimize these budgets?

- Have you reviewed these soft costs with another industry expert to get a second opinion on the appropriate range?

Cost of development advisory services: What exactly are you paying for?

Most development advisor fees cover project team procurement (such as managing the request for proposals and interview process), negotiating owner-consultant agreements, due diligence leadership, and pro forma creation. All should offer project team leadership that sets up clear communication for all parties and advises the owner on decision-making and problem-solving. We would call this the “typical” development advisor approach, one who’s role can be diminished as a project moves into construction.

Development advisors may also offer services that assist throughout construction — such as owner’s representation, construction monitoring, and move-in services — but much of the time, they recommend you hire these additional consultants (for an additional amount) because they lack that expertise on their team. However, having multiple consultants can create a communication issue between the different teams, and an unfortunate result is that your team of consultants can feel they are not being treated fairly or that they are being poised against each other.

Fortunately, hiring a development advisor that combines development advisory, owner’s representation, and construction monitoring into one bundled line of service can have significant benefits. Bundling these services gains efficiency, reduces overlap between advisors, and ensures you have a single point of contact to advise in all areas of your project. Those reasons also allow this “combined” approach to offer significant savings in soft costs.

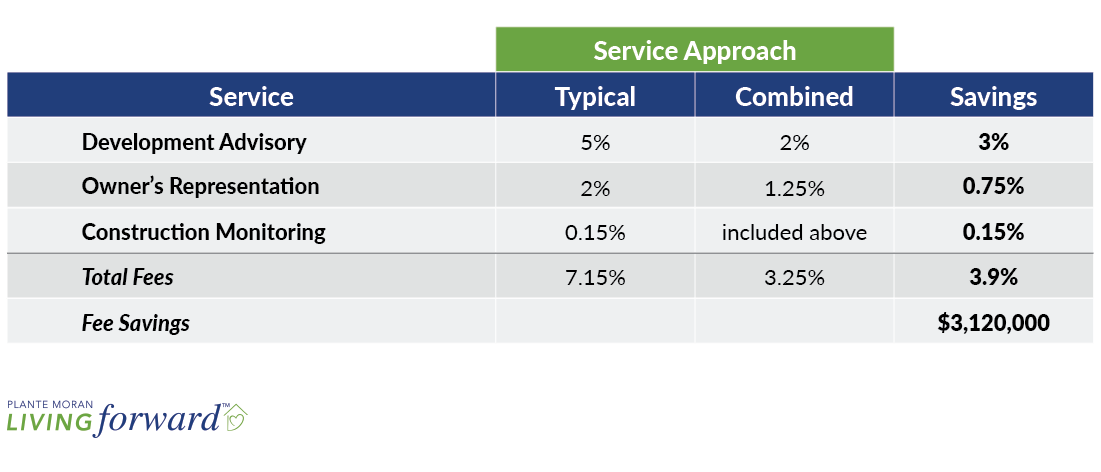

As an example, consider an $80 million construction budget for a 120-apartment independent living project when the senior living development advisory services follow a “combined approach” versus the “typical approach.”

As shown above, the combined service approach comes in at 3.25% and garners a 3.9% savings compared to the typical approach. On the $80 million project, that calculates to $3.12 million! With a typical approach, the project budget would need to increase $26,000 per independent living apartment to offset the increased soft costs. As we are seeing economic struggles and investment portfolios take a dip, saving $26,000 per apartment is a significant market advantage.

If your development advisor fee is 4% or more, and you’re paying separately for related consulting services, you should consider a combined approach instead. With the owner’s representation and construction monitoring services folded in, you’ll get cost savings and be able to rely on the expertise of the team you’ve trusted since the beginning of the project to see you through to the end.

Questions to ask about development advisory services:

- Does bundling more services with the development advisory services make sense for your project?

- Did you go through a competitive request for proposal (RFP) process for your development advisory firm?

- Do you know the overall fee for your development advisor for the project before the consultant lumped it into the project Sources and Uses?

Unpacking senior living marketing and sales soft costs: Should you unbundle?

Marketing and sales consulting services for senior living are another component of the Sources and Uses budget that we would like to shed light on. Some development advisors bundle these services within their scope, but as a separate fee. We recommend you unbundle these services from the development advisor because many development advisors overestimate the marketing and sales expense to a budget of 5% to 8% of the construction cost.

From our experience in working with multiple national senior living marketing firms, unbundling this service could produce additional cost savings on a project, bringing the budget into a range of 3% to 5% of the construction cost. As with all project estimates, this depends on many factors, which could include the following:

- Culture and brand of the organization

- Project alignment with current market perception

- Strength of the “waiting list”

- Strength of the housing market

- Strength of the sales team

- Integrated, omni-channel marketing strategies and tactics

- Length of time from presales to move-in

Working with a specialized marketing and sales firm with economies of scale could produce cost savings on a project, and importantly, it ensures there is no conflict of interest. The proposed resident fees, number of units, and sales schedule should be in balance with the market, not “massaged” to make the pro forma work. Many projects experience a slowdown in presales or fail when one or the other factors drive the project versus finding the balance with the market.

Questions to ask about senior living marketing and sales services:

- Are your marketing and sales expenses bundled with the development advisor’s professional fees?

- Marketing and sales professional fees can vary greatly based on market demand and marketing, sales, and occupancy goals; have these been taken into account?

- Have you received multiple proposals from marketing and sales consultants based on the same scope of services? Is the fee fixed or performance-based?

Do you have confidence in your senior living development advisory costs?

Many development advisors use a standard conservative percentage to ensure soft costs are more than adequately covered. This approach can lead to increased costs, so it should be carefully evaluated. After all, any excess cost will increase debt that translates directly to your new residents in entrance fees and monthly fees.

While cost should not be the only consideration for hiring a development advisory firm, as the executive in charge of any campus expansion or new campus project, you owe it to your stakeholders and future residents to prevent your project from being overburdened by exorbitant fees, and ultimately, more debt than is reasonable. By educating yourself about the cost factors that can influence your decision to hire one development advisor over another, you’ll be doing just that.

The goal of your senior living development advisor is to educate you about these cost issues and align a reasonable Sources and Uses statement to meet your needs and expectations. This firm should also ensure the rest of the consultants are held accountable to those budgets. Transparency in this process and alignment in expectations promotes a strong team that, instead of feeling there are winners and losers when budgets get strained, can look carefully at the total project budget to find a solution.

If you have a capital project in mind, contact us to evaluate your options for transparent, unbiased development advisory services.