COVID-19 has undoubtedly had sweeping implications across all aspects of our lives so far in 2020. Not exempt from this has been the commercial real estate industry. The chief financial concern among property owners over the past several months has been tenant financial strength and related rent collections. Many investors are using the new information gained through this point in the pandemic to reset their real estate targets going forward and revise near-term underwriting assumptions when looking for new opportunities.

Updates on rent collection

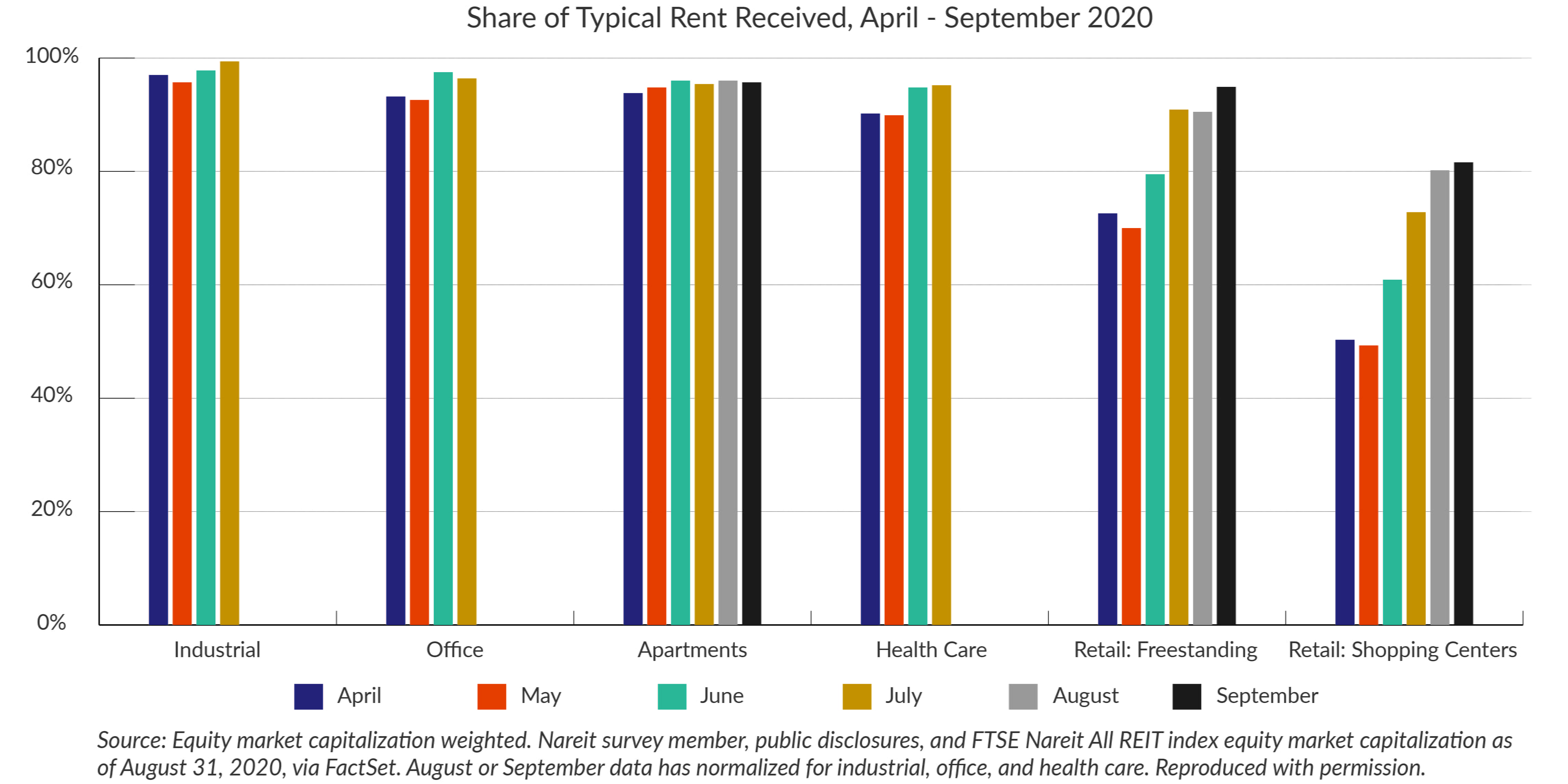

Not all property types have been impacted in the same way as a result of the pandemic-related shutdowns and social distancing measures. The chart below reflects Nareit reported rent collection data by property type over the six months ended September 2020. The percentages reflect rent collections as a share of typical rent collections. Nareit’s survey includes listed equity REITs that, combined, own and operate between 10% and 20% of commercial real estate in the United States. Beginning in August, Nareit stopped reporting data for the industrial, office, and health care sectors, due to rent collections stabilizing at high levels.

Industrial has been the strongest performer each month from April through July, with office, apartments, and health care proving resilient as well, exemplified by consistent rent collections each month in excess of 90%. Industrial properties have been a bright spot due to increased use of e-commerce as part of the collective effort to socially distance. Notably, the industrial space has been a solid performer for a number of years due to consumers shifting preferences towards e-commerce, a trend that has been rapidly accelerated in the COVID-19 environment. This strength in industrial comes at the expense of retail, which is discussed further below.

A high degree of rent collection in the multifamily sector has underscored the conventional wisdom that housing remains indispensable, even in times of economic turmoil and uncertainty. Residential real estate has arguably become even more indispensable as more people work remotely, and homes increasingly double as an office — a trend that is likely to stick to some degree even after the pandemic has waned. There is a case to be made, however, that multifamily performance has been buoyed by the enhanced unemployment benefits and stimulus checks provided as part of the CARES Act.

Acceleration of retail trends

Retail has seen an acceleration of trends that were present prior to the COVID-19 pandemic. Continued growth in e-commerce and mounting retail bankruptcies, which stands at 27 so far as of September 14, 2020, compared to 17 in all of 2019, are signs of the challenges faced by the sector. Winners and losers in the retail industry have been largely dictated by who was deemed essential (and therefore remained open) and who was not, resulting in the virtual disappearance of brick-and-mortar retail foot traffic due to social distancing and stay-at-home orders. How much of this will result in permanent behavioral change toward e-commerce is yet to be known, though clearly comfort level with online shopping has drastically increased through the pandemic. According to Digital Commerce 360’s analysis of the U.S. Department of Commerce data, online spending rose 44.4% to $201 billon during Q2 of 2020 over the same quarter last year — representing $1 of every $5 spent during that period.

Challenges facing travel and hospitality

Not reflected in Nareit’s survey is hospitality and lodging performance. STR, a leading source for hotel data, has reported stark declines across all hotel performance metrics. As of September, year-over-year average occupancy was down 28% overall to 48% occupancy, the average daily rate was down 25% to $99.12, and revenue per available room was down 46% to $47.87. Surprisingly, these figures represent a significant improvement over the prior months. They also reflect national averages, as geographies driven by leisure travel (i.e., Hawaii) have been hit much harder than others. Conversely, limited-service hotels catering to business and other necessity travel, in some cases providing housing for essential workers, have fared slightly better.

Significant challenges in hospitality and lodging are anticipated to last in 2021, with recovery to 2019 levels likely several years away. Unfortunately, no one could have reasonably anticipated a scenario where travel would come to a near total halt. The Transportation Security Administration has been tracking passenger throughput at checkpoints since the beginning of the pandemic. This has served as a good proxy for the travel industry overall. Traffic dropped off by nearly 97% at its lowest in mid-April and is still down 60% to 70% on average year-over-year through October.

Capital markets update

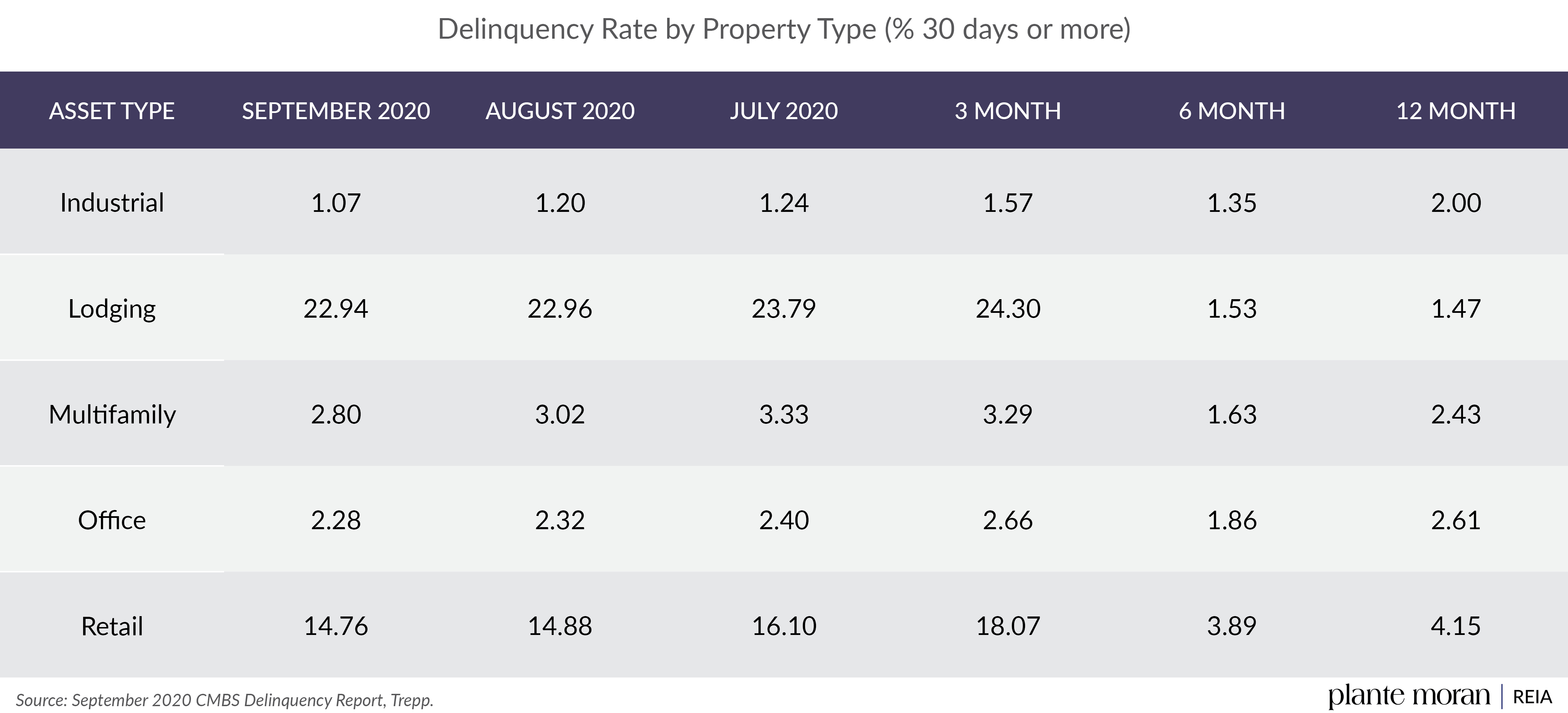

Thanks to the more than $3 trillion the Federal Reserve has provided to the market since the beginning of the pandemic, real estate capital markets have remained relatively liquid compared to prior periods of economic disruption. However, banks are still tightening their underwriting standards in certain instances. According to Trepp, increased CMBS delinquencies mirror the issues described above. The percentage of delinquent CMBS loans for industrial, multifamily, and office are nearly unchanged from trailing 12-month averages through September, while lodging and retail delinquencies are several multiples higher at 23% and 15%, respectively. Consequently, lenders are avoiding property types and geographies disproportionately hit by the pandemic and implementing safety measures such as increased reserves and lower loan-to-value ratios for others.

These figures are notable, as problems with real estate investments most frequently arise due to the property’s inability to service its debt. In the absence of such, there will be little supply of foreclosures, “fire sales,” or other bargain-hunter favorites.

Opportunities in today’s market

First movers attempting to take advantage of so-called “distressed” investments may still be too early. This is due, in part, to just how much remains to be resolved — whether there will be additional stimulus, when and how the pandemic wanes, and what the economic recovery looks like heading into 2021. Added clarity around these issues will have a broad impact on valuations across all property types. At this point in the cycle, distressed investors run the risk of finding themselves in a value trap versus a genuine prospect to extract value. Certainly, idiosyncratic opportunities exist, but in our opinion, truly systemic dislocation in the real estate market is still in the distance. Nonetheless, we are continuing to monitor the potential to take advantage of distressed situations as the economic outlook evolves.

However, skilled investors can still take advantage of today’s market. Market disruptions undoubtedly expose and enhance risks. At the same time, dislocation can also create new opportunities or strengthen pre-existing tailwinds. Successful strategies in the near term will need to be focused on avoiding attempts to “catch a falling knife,” while leaning into property types with favorable economic drivers, such as industrial, multifamily, and certain niche sectors.

Conclusion

The events of the COVID-19 pandemic have undoubtedly impacted commercial real estate sectors, in some cases accelerating trends that were already present, but for others, creating new unforeseen challenges. Through the spring and summer, various government-mandated shutdowns had a varying degree of impact on rent collections by property type. As a result, we have seen a sharp acceleration of pre-existing trends in certain sectors like industrial or multifamily. On the other hand, hospitality has suffered greatly in a scenario no one could have imagined. Banks and other lenders remain relatively liquid but are still tightening their underwriting standards for new deals across all industries. It’s likely these new trends will continue until there is some clarity on the public health, political, and macroeconomic factors driving them. That said, opportunities exist to take advantage of the current dislocation, but at this point, we believe they are more idiosyncratic as opposed to systemic or market wide.

If you are interested in discussing a potential allocation to real estate or reviewing your current real estate investments in light of the current environment, please reach out to your client service team.