With careful planning and a well-executed strategy, commercial real estate can be an excellent diversifier to an existing investment portfolio.

Investors value real estate for its attractive characteristics, including capital preservation, income generation, and inflation hedging. Real estate assets also tend to have a low or negative correlation with other traditional asset classes (e.g., stocks and bonds), making commercial real estate investing a shrewd choice in times of economic uncertainty.

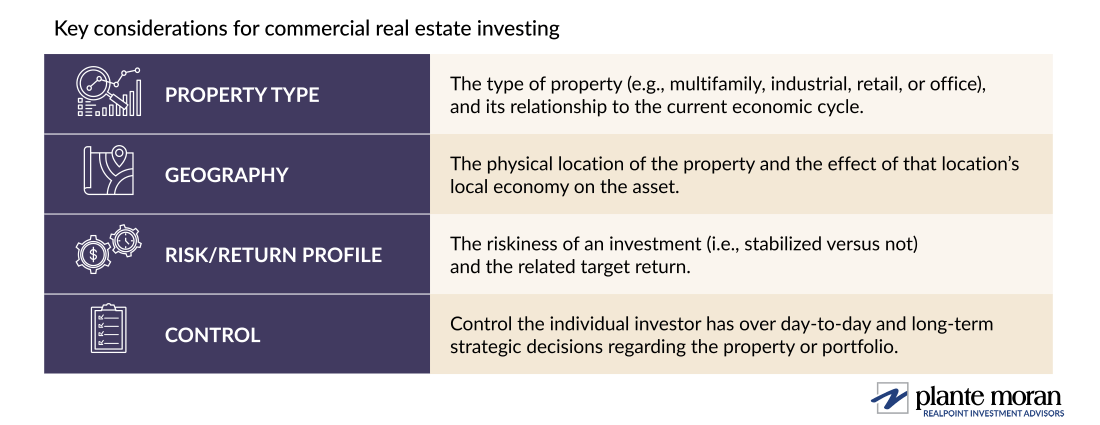

Making clear-sighted decisions about your real estate portfolio can be difficult for investors who are unfamiliar with the nuances of commercial real estate. As you think about building a commercial real estate investment portfolio, carefully consider which property types you invest in, the geographies you focus on, your risk/return tolerance, and the degree of control you want over your investments.

While we always recommend that investors engage professionals to aid in developing a real estate investment strategy, a reasonable start to building a diversified portfolio — with a risk-adjusted return profile that aligns with your investment goals and tolerances — is to follow these four guidelines:

1. Choose real estate property types carefully, paying close attention to economic trends.

“Property type” describes the use of the property and its relationship to the current economic cycle. The main commercial property types are multifamily, industrial, retail, and office; each type also includes several subtypes that have their own nuances.

Economic factors and cycles can have varying effects on the different property types. Investor sentiment and favorability as a result of these factors can drive further economic change within the property types. Diversification across property types can help reduce overall real estate portfolio risk and enhance returns.

Investing in multifamily real estate

Multifamily residential real estate refers to the many different types of apartment buildings available on the market. Multifamily has been known to be one of the more “defensive” property types. It can perform well across various points in the business cycle, given the necessary role housing plays in our economy. However, in certain markets, it is facing regulatory reform in the form of rent control and caps. Investors should be aware of possible changes to debt capital markets if government-backed residential lenders Fannie Mae and Freddie Mac are ever restructured.

Investing in industrial real estate

Industrial real estate encompasses warehouses, flex space, logistics, and fulfillment centers. According to the Urban Land Institute (ULI) in its 2025 Emerging Trends in Real Estate report, owners and investors are taking a “smarter” approach following the supply-chain disruption caused by the COVID-19 pandemic. “Logistics real estate is entering a new phase of growth after years of volatility, one focused on smart-growth decision-making to optimize supply chains, circumvent disruption, and stand the test of time.” Nonetheless, the need for more last-mile distribution facilities will remain high as consumers demand faster and cheaper delivery for groceries, prepared food, and other goods.

Investing in retail real estate

E-commerce continues to redefine how retail space is used and which investments will be attractive to investors. With industrial becoming the main beneficiary of online retail, as discussed above, retail investors are seeking “e-commerce resistant” opportunities. This includes automotive services, urgent cares, quick-serve restaurants, grocers, and similar businesses where the goods or services provided are considered “necessities” or may otherwise be difficult to replicate through online delivery. These investments are particularly attractive if the underlying tenant has investment-grade credit and is willing to enter into a long-term lease (10 or more years), which may sometimes have scheduled increases in rental rates.

In the wake of the COVID-19 pandemic, community shopping centers, urban street retail, entertainment centers, outlet and regional malls, and power centers are being reimagined. Many owners are willing to try out new concepts to draw in foot traffic or activate vacant spaces at a low cost to explore new uses. Retailers capable of successfully implementing omnichannel distribution have remained competitive with options such as ship-to-store, returning online orders to stores, and “showrooming” big-ticket items with the ability to easily ship from the warehouse to the consumer’s home.

Investing in office real estate

Corporate office real estate is another investment option. Investors are focused on assets that are spearheading the trends in amenities and sustainability, or that are part of larger mixed-use developments.

Like many facets of the economy, office real estate continues to evolve as a result of the COVID-19 pandemic. The adoption of work from home has proven to be stickier than many anticipated. Several notable employers have announced return-to-office mandates, while others have championed “flexible” or “hybrid” office programs. Following historical office trends, office tenants may continue to reduce their footprint. This has the risk of creating more vacancies in the near term as businesses need less square footage for the same number of staff (or more).

2. Understand market data related to geography and how it can affect the investment potential.

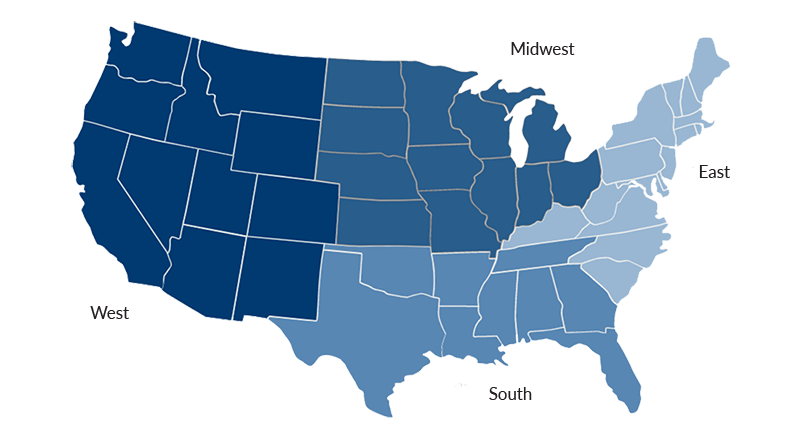

Changing economic cycles can impact individual markets in significantly differing ways and at varying times. Historically, commercial real estate investments perform best in high-demand geographies with strong population and job growth. Other non-economic risks that are idiosyncratic to certain regions (e.g., natural disasters, political, or regulatory) also exist.

In recent years, multifamily returns have been the most stable across Sunbelt markets, where high population growth, national migration, and job growth have driven renter demand and wage growth. On the other hand, Midwestern and Coastal markets continue to be attractive for industrial investors that are seeking to take advantage of favorable locations for domestic and international distribution channels.

Spreading investments across regions and markets can help reduce the portfolio’s overall risk.

3. Determine your risk vs. reward tolerance so you can align your real estate investments accordingly.

Like traditional investing, higher-risk commercial real estate investments reach for higher returns. This is often achieved through asset appreciation, but it also includes inherently riskier tactics like ground-up development, restructuring distressed partnerships, and financial engineering. Lower-risk investments target existing assets that generate lower returns derived primarily from regular income distributions.

There are four ways to categorize investment assets based on risk: core, core-plus, value-add, and opportunistic. Aligning your risk tolerance and return targets is critical to creating a portfolio that matches return expectations with long-term investment goals.

Investing in core assets

On the low end of the risk profile are core assets. This type of real estate is stabilized, well-located, and well-occupied. They generally target a 6% to 8% return rate, depending on a variety of factors.

Investing in core-plus assets

In the low to moderate range of risk are core-plus assets. This type of real estate is mostly stabilized but there are some elements of risk, such as the age of the building or moderate lease rollover. Because these assets have room for improvement that can help you boost their value over time, they generally target an 8% to 10% return rate.

Investing in value-add assets

As a moderate-to-high-risk investment, value-add properties exhibit some deficiencies that can be improved upon to realize larger gains. However, investors targeting the 10% to 14% returns associated with value-add investments need to make sure they have a strategy for unlocking the real estate asset’s value.

Investing in opportunistic assets

Opportunistic assets are those that require a high degree of enhancement to be profitable and may also include speculative development on vacant land. Assets in this category have major risks — such as structural issues, high vacancies, or financial distress — that need to be addressed. New development will require a specialized development advisory team with the skill set to determine the feasibility and manage the execution of the project. Opportunistic assets provide the greatest investment upside but also pose a significant risk of losing the principal.

4. Determine how much control you want over the management of your commercial real estate investment.

The types of real estate investing options includes wholly owned investments, joint-venture investments, private investment funds, publicly traded real estate investment funds (REITs), and non-traded REITs. The main difference between each real estate investment type is the amount of control you have over the asset. The investment vehicle and corresponding level of control you choose are a function of your desire to actively or passively invest in real estate.

No matter the structure, it is important to note that, when considering any passive investment (i.e., joint venture or fund), underwriting and understanding the sponsor’s strategy and track record are just as important as evaluating the underlying real estate investment.

Wholly owned real estate investments

Wholly owned investments provide the most control but come with additional risk and potentially more management responsibilities.

Investing through a joint venture

Joint venture investments can vary in their degree of control and risk depending on how much of the asset is owned by your partner or multiple partners. Joint ventures can be individual (one deal) or programmatic (multiple deals).

Investing in private real estate funds

Fund investments provide the least control but may offer more diversification (both by property type and geography) in a smaller minimum investment. These are considered a more accessible vehicle for gaining diversified exposure to investment real estate. They may be “closed-ended,” meaning they have a finite life and no liquidity until the underlying investments are sold. Alternatively, funds may be “open-ended,” with a perpetual life and structure to periodically create liquidity and redeem investors’ interests.

Investing in publicly traded REITs

Publicly traded REITs provide investors with the lowest barrier to entry of any real estate investment. REITs offer easy, instant access and diversification. They are also a good alternative for investors who cannot withstand the long periods of illiquidity associated with private real estate investments. In exchange for these benefits, REITs are subject to not only the least amount of investor control, but also the greatest volatility. With daily trading on the public market, the value of REIT shares can change dramatically in a short period of time. This contrasts with private funds, which have no secondary market and therefore lower price volatility, as they may be valued as infrequently as once per year.

Conclusion

Deciding the property types you invest in, the geographies you focus on, your risk/return tolerance, and the degree of control you want over the your investments are all great ways to start developing a real estate portfolio strategy that will help diversify your overall investment portfolio. The volatility of the past several years has underscored the importance of not only a well-diversified real estate portfolio, but also the benefits real estate can add to one’s overall portfolio.

With these four guidelines in place, the next steps are determining the appropriate allocation of real estate in your larger portfolio, setting investment objectives, and performing due diligence on the opportunities available to meet your goals. With careful planning and a well-executed strategy, your commercial real estate investments will have an improved likelihood of reaching your investment objectives.

Unsure what kind of real estate asset to invest in? Need help structuring an investment or joint venture deal? Want expert help maximizing the value of your property? Contact us for a consultation.

In the meantime, if you liked this article, sign up to have more just like it delivered to your inbox.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this presentation to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.