Commercial real estate can be an excellent diversifier to an existing investment portfolio. Investors with significant capital may consider investing in real estate through a joint venture.

Joint ventures are one of several methods of accessing private commercial real estate, and one way to access direct real estate without the need to establish a large team to manage the assets.

You can think of joint ventures as a miniature private fund. While funds would raise capital from many investors to invest in many different real estate deals, joint ventures consist of a minimum of two partners investing in a legal entity (such as a limited liability company or limited partnership) for the purposes of acquiring a single real estate asset.

Joint ventures serve multiple purposes, and the partners involved can split the responsibilities in various ways. For the purposes of this discussion, we will focus on joint ventures with only two members, the sponsor and investor member, investing in a single asset:

- The lead investor is the “sponsor” or “general partner,” responsible for the day-to-day activities of the joint venture and the operation of the real estate acquired by the partnership.

- The remaining investors, typically referred to as “investor members” or “limited partners,” usually have limited day-to-day responsibilities but often retain certain major decision-making rights.

As with any real estate investment, you should carefully evaluate the asset itself. But you shouldn’t stop there. You must also underwrite the sponsor and understand the deal structure before moving forward. Joint ventures come with certain risks and considerations other methods of investing in real estate do not. An appropriate alignment of interest between the sponsor and yourself as the investor is key to the partnership’s success.

Are you evaluating a prospective real estate joint venture? Here’s what you need to know.

Evaluating the sponsor and track record in a joint venture real estate deal

In a joint venture, evaluating the sponsor’s capability to execute the business plan is just as important as assessing the underlying real estate investment. A good sponsor will have a historical track record ready, and often provide it with the investment offering materials. Review relevant prior investments and return metrics like deal size, property type, geography, internal rate of return, cap rate, cash-on-cash return, and equity multiple. You’ll want confidence the sponsor not only has performed well (i.e., consistently generated strong returns), but also has invested in similar assets and strategies as the investment you’ve been presented.

Remember, real estate is very nuanced. Success in one property type or geography doesn’t necessarily translate into success in a different property type, strategy, or location. For example: If you’re evaluating a value-add apartment investment in Dallas, you’ll want to see a track record that reflects successful execution on other multifamily rehab projects in the same or similar geographies.

Background information on the sponsor, as well as the professional experience and qualifications of the sponsor’s key principals, should also be made available.

Understanding partnership contributions in a real estate joint venture

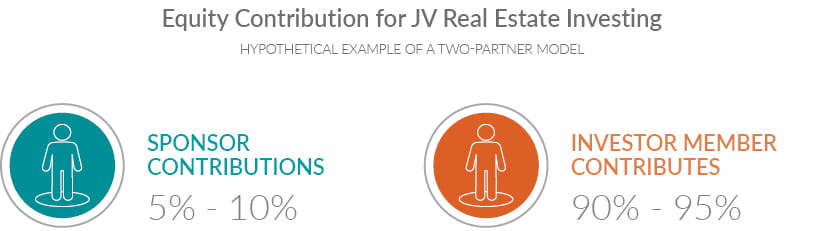

As an investor member, you want the sponsor to have meaningful “skin in the game.” To accomplish this, you will usually want the sponsor to contribute at least 5% to 10% of the total investment equity.

Any more than 10%, and the sponsor may require more control than the investor member would want. Any less than 5%, and the investment may not be meaningful enough for the sponsor to provide the appropriate level of time and attention to the deal — or it may create a misaligned incentive whereby the sponsor is incentivized to take undue risk due to their potential upside (discussed below) with disregard for their invested equity (as well as the investor member).

For example, if an investment is $30 million and $20 million will be financed, the investment will require $10 million of equity. Of that $10 million, the sponsor should contribute between $500,000 and $1 million; the investor member would contribute the rest.

However, this is only a rule of thumb. Depending on the deal size, those proportions might change. The purpose is for the sponsor to be appropriately aligned with the success of the investor member.

Rights and responsibilities of sponsors and investment members

As noted already, the sponsor will be responsible for the day-to-day management of the real estate owned by the joint venture. This includes hiring and overseeing property management, leasing, maintenance, setting a budget, and executing on the agreed-upon business plan. That said, the investor member should retain the final say over many major decisions. This is especially true in cases where the investor member comprises 90% to 95% of the total partnership equity. Such control rights may include, but are not limited to, the following:

- Approval of any major changes to the business plan

- Approval of major expenses

- Approval of annual budgets

- Ability to remove or replace the property manager

- Approval of major leases

- Ability to trigger or veto the sale or refinance of the property

The investor member’s rights could even include the ability to remove or replace the sponsor as the manager if they are performing poorly, acting negligently, or committing unlawful acts.

Fee sharing in a joint venture real estate deal

Fees are one area where inexperienced investors may unknowingly accept terms that are less than favorable for themselves. Fees related to the purchase, operation, financing, and sale of a real estate asset can quickly accumulate to a meaningful portion of the overall investment budget.

All fees should be clearly detailed upfront in the offering materials and the joint venture’s organizational documents. Typical fees you might see detailed include those for acquisition and disposition, debt procurement, construction management, asset management, and property management in addition to organizational expenses and leasing commissions.

Any conflicts of interest should be clearly disclosed, meaning if the sponsor is using an affiliate to provide any services where such fees may be earned, it should be clear.

Furthermore, fees should be levied “at market.” Whether an affiliate is used or not, the sponsor should obtain bids or quotes from multiple sources to confirm whether fees and costs are consistent with the local market for the asset size and type.

Fees should not be duplicative. Generally, a sponsor should not charge a fee for overseeing the services of a third-party fee-only service provider.

Assigning real estate due diligence costs in a joint venture

Like fees, due diligence costs associated with the initial identification, underwriting, and acquisition of a real estate asset can get costly. Again, the anticipated sharing of any costs should be detailed up front. The sponsor should bear initial underwriting and due diligence costs until an agreement is in place between the sponsor and investor member. Unlike fees, due diligence costs and expenses accrue prior to a transaction closing. As a result, an investor member should not commit to reimbursing or compensating the sponsor for these costs until the investor member has reached an agreement with the sponsor to invest in the deal.

While the sponsor may be compensated for certain intangible pursuit costs through an acquisition fee, more concrete due diligence costs (e.g., property inspection or environmental reports) might be shared pro rata by the partnership at closing.

Learn more about the important real estate due diligence tasks that can mitigate potential risks in a commercial real estate investment.

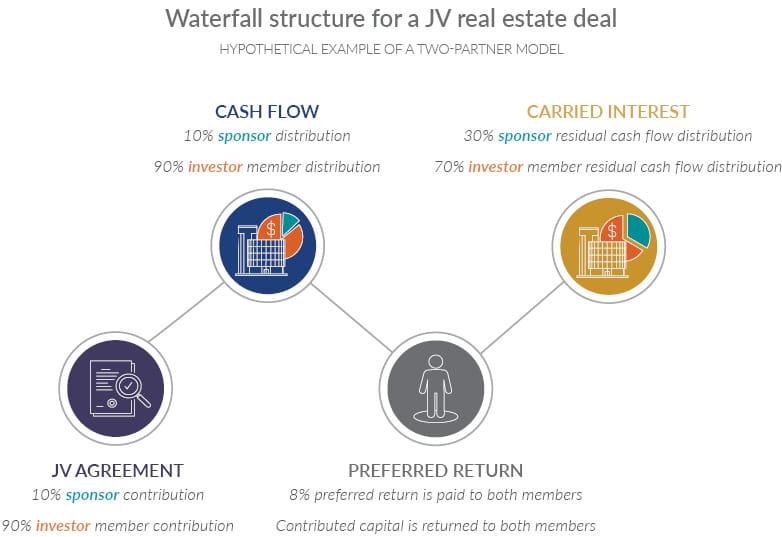

Including an economic incentive for the sponsor

Most sponsor/investor real estate joint ventures will have some sort of economic incentive for the sponsor to achieve strong results, subject to returns meeting a certain hurdle (called the “preferred return”). This incentive fee, often called “carried interest” or “sponsor promote,” is designed to reward the sponsor for outperformance. This reward is probably the strongest mechanism in a joint venture for aligning interests between the sponsor and investor member.

For example, consider a joint venture real estate investment where the investor member contributes 90% of the equity and the sponsor contributes 10%. The joint venture agreement might set the preferred return hurdle at 8%, accruing annually. As the property generates cash flow, payments might be made pro rata (i.e., 90% to the investor member and 10% to the sponsor) until the 8% accrued preferred return is fully paid and all contributed capital is returned. After this point, the sponsor would begin to earn carried interest. For this example, residual cash flows at this point might be split 30% to the sponsor and 70% to the investor member. If an investment performs well, you can see how quickly a sponsor could begin to earn multiples on their 10% contribution. This entire economic structure is known as the “waterfall.”

The key to an appropriate alignment of interest here requires a balancing act between the sponsor and investor member. Each deal is unique, and certain risks taken or avoided with respect to the other deal considerations will dictate the exact waterfall structure in each deal. While you want sufficient upside on the back end to incentivize the sponsor to outperform, it is important to remember the investor member has taken on a tremendous risk on the front end by contributing 90% of the equity and should retain adequate participation in any potential outperformance. The entirety of the financial arrangement between the sponsor and investor should be considered when balancing this alignment —from equity contributions and fees received to sizing of the hurdle rates and the amount of carried interest.

Use of debt in a joint venture real estate agreement

The use of leverage in real estate acquisitions provides many benefits. Chief among them is the ability to magnify returns. Conversely, debt can also magnify losses. For this reason, it is important to understand how the joint venture will utilize leverage in the acquisition of real estate. The amount and type of debt used (i.e., fixed or floating, short or long term) will vary depending on the property type and strategy (i.e., stabilized versus repositioning). In short, the type of debt used should align with the business plan.

Since the sponsor is responsible for the day-to-day execution of the business plan, the sponsor will typically drive decisions on the use of debt financing, subject to any approval rights the investor member may have retained. Certain loans, such as a construction loan, may require a guaranty. Typically, the sponsor should have the balance sheet and willingness to provide any guarantees a lender might seek.

There are a limited number of circumstances where an investor member would provide a guaranty in place of a sponsor for a loan to the joint venture. In those cases, careful consideration should be given to evaluate whether you are being adequately compensated for the additional risk associated with providing a debt guaranty. This may come in the form of a direct payment for the guaranty, participating in the carried interest, or reduced fees.

Documenting a strategy and exit for the real estate deal

The joint venture documents should clearly detail the stated investment strategy, horizon, and anticipated exit scenarios. In a case where the sponsor and investor member may not be perfectly aligned on exit timing, the joint venture documents should contemplate a mechanism for triggering the sale of the asset or the buyout of the other member’s interest after a certain lockout period. Common provisions include a put/call clause, right of first offer, or right of first refusal. Where the sale is between the sponsor and investor member, the methodology for determining the fair market value of the investment should be clearly detailed and include the involvement of independent third parties. Inclusion of a clearly defined business plan — including how to account for any contingencies — can be critical to avoid unnecessary disputes among the partners and reach an amicable conclusion to the investment.

Conclusion

Investors value real estate for its attractive characteristics: capital preservation, income generation, and inflation hedging. Real estate assets also tend to have a low or negative correlation with other traditional asset classes (e.g., stocks and bonds). But investing in real estate through a joint venture has many considerations that investing in wholly owned real estate or an investment fund do not. The partnership allows for nuances in contributions and control, investment strategy, and responsibilities for fee and cost sharing, debt procurement, and investment outcomes, all of which makes evaluating the sponsor just as important as evaluating the real estate asset itself.

All the components of the joint venture should be clearly detailed upfront in the company’s organizational documents. Those documents will be negotiated by the members and prepared in concert with the venture’s legal counsel to confirm the documents reflect the agreed-upon terms of the deal. A real estate investment expert can help confirm the business terms of the transaction are favorable for the investor and consistent with similar deals in the market. With carefully negotiated terms, many common pitfalls can be avoided.

All real estate investments carry a risk of loss, and on the surface, they can seem complicated. But as with any investment, careful consideration and help from the right real estate investment advisors can make it much easier. Whether it’s considering what to buy, where to buy it, or how to structure an investment, Plante Moran Realpoint Investment Advisors (PMRIA). If you’re interested in learning more about how to start investing in commercial real estate, contact us today to discuss your strategy options.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this content to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.