Public-private partnerships (P3s) offer municipalities a powerful tool to spur economic development and create vibrant communities. Collaborations with the private sector can unlock resources, expertise, and innovation to achieve shared development goals.

In this article, our real estate development advisors will explain the fundamentals, advantages, and challenges of P3s. We'll explore different P3 models, highlight the benefits of these agreements, and provide tips for successfully working with private partners.

If you have any questions or wish to discuss your municipality’s unique development needs, our advisors are happy to have a conversation. Learn more about our services.

What is a public-private partnership?

A public-private partnership (abbreviated as P3 or PPP) is an agreement, usually creating a lasting relationship, between a private party and public entity to share the risk and rewards of delivering or enhancing an essential public service. Often the project is one whose economics or feasibility is dependent upon, or greatly enhanced through, collaboration.

Types of public-private partnerships

Public-private partnerships should be considered when a government entity is pursuing economic development or planning improvements relating to its core function of promoting health, safety, and welfare. Often, these objectives are intertwined.

Economic development

Broadly speaking, economic development projects include:

- Public asset redevelopment — Leveraging public assets to optimize public benefits or unlocking monetary value found in many public assets through sale, ground lease, joint venture, or other mechanism

- Private redevelopment — Induced by publicly provided “gap” funding realized through financial incentives, expedited entitlements, enhanced zoning, or other community assistance to make a real estate development project feasible

Critical public infrastructure

- Critical public infrastructure — Public sector seeks to enhance the timing and mitigate costs of delivery, lower life cycle costs, and/or to “risk transfer” through private sector collaboration for some or all phases of development, design, construction, financing, and operation of its core functions

The types of real estate assets developed as part of a P3 could include redevelopment of an industrial property, a community revitalization project, brownfield development, or construction of new hospitals, bridges, or highways. Public asset redevelopment P3s usually aim to monetize a public sector asset such as vacant land, surplus buildings, parking lots and garages, and utility systems.

How do public-private partnerships work?

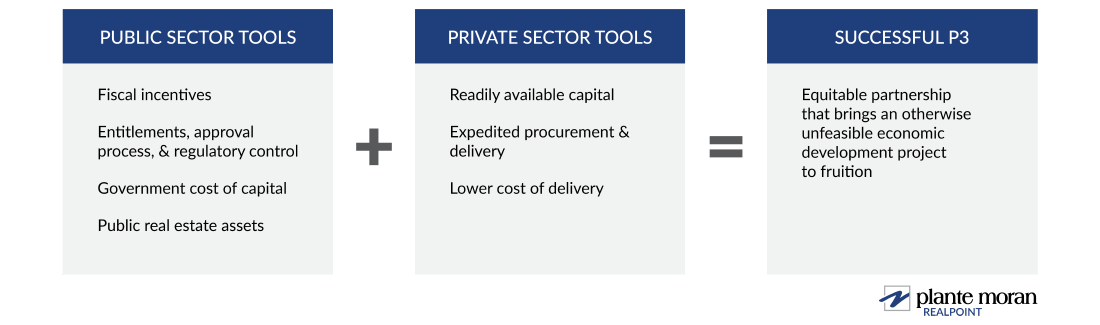

A public-private partnership model for development works by bringing together the strengths of the public and private sectors to reach a common goal.

Successful public-private partnerships have several key points in common:

- The public entity has clearly identified and quantified the project’s fiscal and community impacts (including opportunity costs) and has community and political support.

- The public entity has assembled a team that can help the municipality make decisions regarding assessing project feasibility, identifying financial options to secure an equitable agreement, managing predevelopment work, and overseeing design, construction, closeout, and occupancy.

- The public-private partnership objective, a shared goal between the public and private entity, is well defined and agreed upon in the deal agreement.

Tips for structuring a public-private partnership

Public-private partnerships may not be right for every development project, but many communities have found success by following these tips:

Tip #1: Get an experienced advisory team on board right away

From a public perspective, there are unique considerations that should be analyzed in order to set a project up for success, including deal structure and revenue opportunities. Additionally, there are other qualitative factors that make a public project successful when partnering with a private partner, such as transference of risk, access to capital, speed of delivery, and development expertise. A development advisor can help municipalities think through all these considerations and confirm their goals and objectives are feasible based upon underlying factors.

Tip #2: Understand the risks vs. rewards

While a public-private partnership allows the municipality to transfer project risk to the private partner, leverage innovative design and construction techniques, free up capital for other purposes, and keep project debt off the books, there are some challenges or risks as well. Public-private partnerships sometimes have higher financing costs, the procurement process can be complex, and the deal agreement may limit flexibility. A development advisor will be able to help the municipality identify the advantages and disadvantages of a potential public-private partnership.

Tip #3: Understand the private-sector perspective

Municipalities should look at any project through both a private and public lens to ensure that it is beneficial, fair, and viable for both sides of the deal. Typically, private entities are focused on the financial benchmarks and returns, such as return on cost, return on equity, and internal rate of return. In addition to these metrics, the private partner will want to assess construction budgets, operating expenses, revenue projections, and debt service capacity to determine a project’s feasibility. Understanding the importance of these considerations to the private partner helps municipal stakeholders understand the private partner’s motivations and risk tolerances.

Should you consider a public-private partnership for your real estate development?

Our development advisory team’s broad experience serving both public and private interests means we provide government clients with unique advocacy in managing their real estate needs. Let us help you figure out whether a P3 is a viable solution for your project.