Cap rate, or capitalization rate, is one of the most commonly referenced return metrics used when evaluating the performance of a current or prospective real estate investment.

What cap rate means in real estate investing

The “cap rate” in real estate investing is the unlevered rate of return on an asset based on its annual net operating income (NOI).

Cap rates, which are expressed as a percentage and represent returns for a single point in time, are used to evaluate an individual investment property or compare properties without complicating the assessment by taking into account the effect of debt or other financing on the project (therefore, cap rate is an “unlevered” return metric).

Cap rates are often compared to the coupon on a bond, since both can be used to express payment as a percentage of the value of the asset.

Cap rate formula: How do you calculate cap rate?

The formula for a cap rate is simple: cap rate is the annual NOI divided by the market value of the property. For example, a property worth $10 million generating $500,000 of NOI would have a cap rate of 5%.

It’s important to note, however, that value and price paid are not necessarily the same thing. Value usually refers to the “fair market value,” which is a hypothetical number arrived at through one of the commonly accepted appraisal methodologies. While the value should reflect the price a reasonable buyer would pay a seller in an arm’s-length transaction, it can change over time and is often inclusive of different considerations depending on the investment. On the other hand, the price an investor pays (or their “basis”) includes additional costs or considerations such as transactional fees or capital expenditures that are not necessarily reflective of the asset’s intrinsic value.

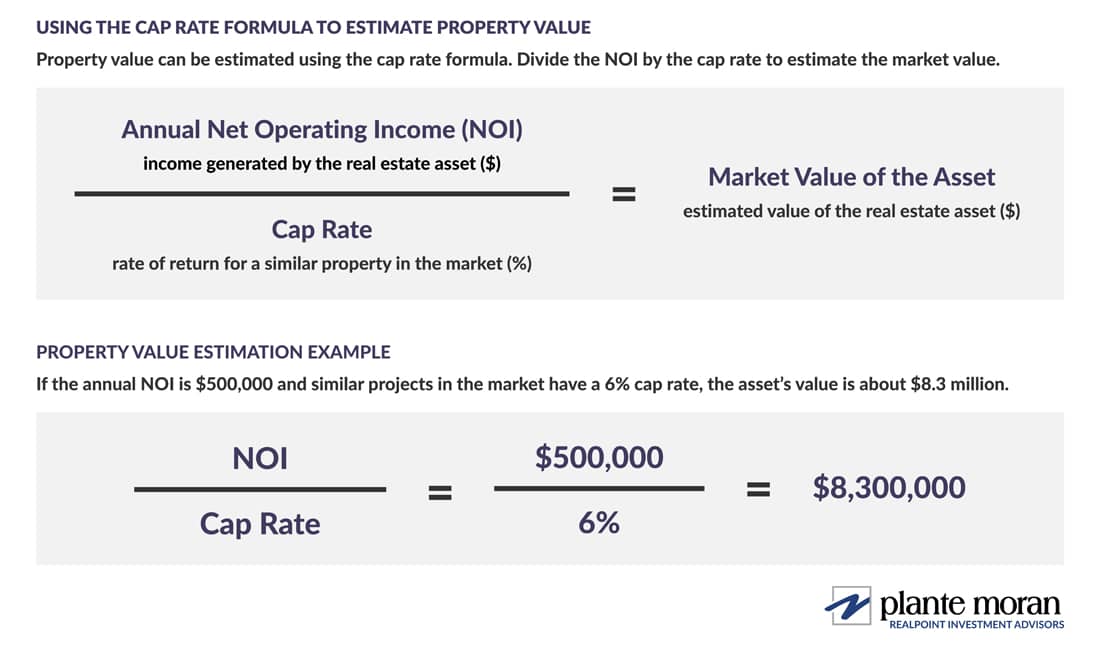

Using this same cap rate formula, you can estimate the value of a building based on its NOI. In the example above, if you know the property is generating $500,000 of NOI and the appropriate cap rate (i.e., unlevered return) for a similar project in the market is 5%, you can divide $500,000 by 5% to arrive at a $10 million value. If an appropriate market cap rate is 6%, the same project may only be worth $8.3 million. This also illustrates how shifting return expectations in the marketplace (in this case, the cap rate) can cause implied real estate values to fluctuate, as detailed further below.

What is a good cap rate for an investment property?

Cap rates can serve as a proxy for determining which investment is “better” or riskier. A lower cap rate is generally associated with a safer or less-risky investment, while a higher cap rate will be associated with more risk.

Many advisors will tell you that a high cap rate is better, or that a good cap rate is between 5% and 10%. Part of that is true: All things being equal, an investor should invest in the property with the higher cap rate because a higher cap rate forecasts a higher yield. But cap rates aren’t everything: the decision to buy a property should factor in investor risk appetite, the property location, property condition, ability to grow NOI, and numerous other investment-specific factors. For certain risk-averse investors, investment opportunities with low cap rates might be worth exploring.

In addition, cap rates are not static. They move up or down depending on changes in the value of the building or NOI. Market conditions and investor improvements to the property can also make this return value change:

- An increase in the value of a property generally results in a lower cap rate, while a decrease results in a higher cap rate.

- On the other side of the equation, an increase in NOI results in a higher cap rate, while a decrease in NOI results in a lower cap rate.

Cap rates also don’t account for debt. Other return metrics — such as cash-on-cash returns and internal rate of return (IRR) — should also be calculated, as they paint a broader picture of the opportunity.

Cap rate vs. cash-on-cash return

Just like with cap rate, cash-on-cash return is expressed as a percentage and represents a return for a singular period in time. Unlike cap rate, however, cash-on-cash accounts for the effect (positive or negative) of leverage. It’s used during underwriting because it shows the potential cash flow return in comparison to the upfront equity contributed to the project. Learn more about cash-on-cash returns in commercial real estate.

Cap rate vs. IRR

Unlike the cap rate or cash-on-cash, which are metrics to evaluate investment performance at a particular point in time, IRR is an annualized rate of return. It is designed to take into account the time value of money, measuring performance across multiple time periods over the life of an investment. What IRR cannot tell you is the total profit earned on an investment, which is why it’s often taken into consideration with another calculation to do just that, the multiple of invested capital (MOIC).

Conclusion: How to start investing in real estate

The real estate industry is full of technical formulas for return metrics that can help you evaluate the performance of current or prospective real estate investments. However, these numbers shouldn’t be viewed in a silo, and often need to be scrutinized to determine whether they accurately reflect the investment potential.

The real estate investment advisors at PMRIA can work with you to evaluate potential acquisitions and pair that analysis with broader market insights and planning to determine whether those opportunities align with your personal investment goals. Please reach out with questions — we’d be happy to help.

In the meantime, if you liked this article, consider signing up to have others just like it sent to your inbox.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this content to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.