Cash-on-cash return, IRR, equity multiple, cap rate … Real estate investors rely on a plethora of return metrics to assess the profitability of a real estate investment. In this article, our real estate investment advisors explain what cash-on-cash return is, how to calculate it, and how it compares to other return metrics. You can learn more about other return metrics in this article on cap rates.

What is cash-on-cash return?

Cash-on-cash return is one of the most commonly used return metrics when analyzing the performance of a current or prospective real estate investment. Cash-on-cash return is the leveraged net cash flow generated by a real estate property divided by the total amount of equity invested in the property, calculated on a pre-tax basis.

Cash-on-cash return is used during underwriting to show the potential cash-flow return relative to the upfront equity contributed to the project. In other words, the metric provides a picture of cash flow in your pocket as a percentage of equity invested in the deal. It also provides you with an easy-to-understand analysis of the potential cash distributions throughout the life of the investment. It is particularly important if you’re evaluating financing options and want to know how much cash to invest in a down payment, or you want to know how much of an investment’s capital stack should be debt. Other common terms for cash-on-cash return include “cash yield” and “equity dividend rate.”

Cash-on-cash return applies to every property type, albeit in different ways, and it allows you to perform a quick analysis to evaluate the long-term potential of different property types. (The metric also applies to other types of non-real estate investments and can be used to compare investment options.) A few considerations for various property types are listed below.

- Multifamily: Multifamily real estate investments may have a lower initial cash-on-cash yield, but they tend to have a perpetually increasing cash-on-cash yield due to increasing rental rates and short-term leases. The initial cash-on-cash yield may not be as high as an industrial investment, for example, but the industrial investment’s cash-on-cash return may remain flatter over time.

- Retail: Generally, investors look for higher cash-on-cash yields in retail to account for more risk. The risk inherent in retail investments is tied to tenant creditworthiness, lease term, number of tenants, and other investment characteristics specific to the retail property type.

- Office: As with industrial properties, office investments typically have a more stable long-term cash-on-cash yield because of the longer term of office leases. Office investments, however, typically have much higher ongoing capital requirements because the cost to re-tenant the spaces as tenants’ leases expire is much higher than for industrial properties. So, it is important to note that capital costs are typically not included in net cash flow (the numerator of the cash-on-cash definition), but they should be considered for office investments.

Some notable shortcomings of the cash-on-cash return metric include a failure to take appreciation or depreciation into account, while ignoring an investment’s specific tax situation. Also, the metric can illustrate an investment’s performance right now, but it cannot predict the future. Lastly, it does not consider the possible cash flow from a future sale.

Does cash-on-cash return include debt service?

Yes, cash-on-cash return includes debt service in its calculation, accounting for debt service payments. This is different than other real estate investment return metrics, such as cap rates, which ignore debt service. More on the differences below.

Cash-on-cash formula: How to calculate cash-on-cash return

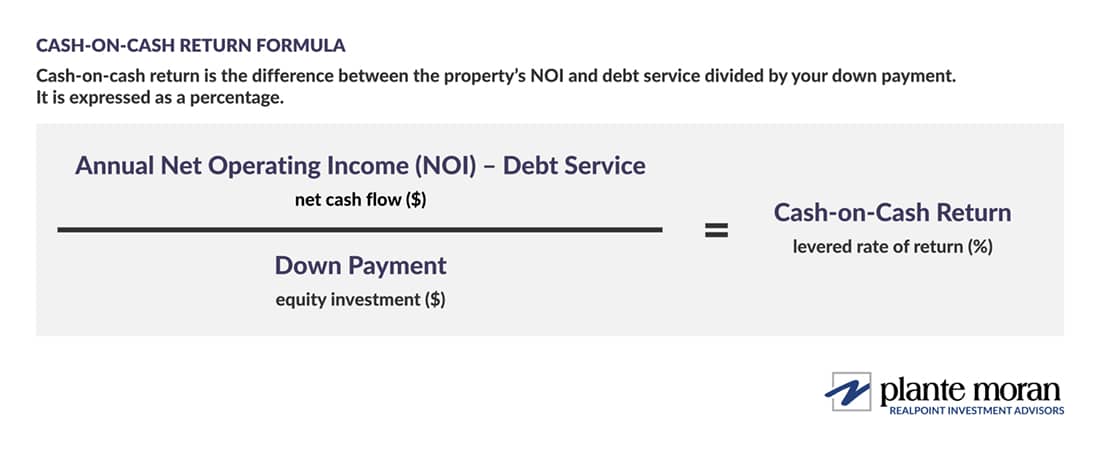

The formula for cash-on-cash is the difference between the property’s net operating income (NOI) and debt service divided by your down payment or equity investment, as shown in the graphic below.

NOI is calculated by subtracting operating expenses from revenue. Operating expenses may include items like maintenance, labor, and real estate taxes. The equity investment is the portion of the total capitalization of the investment minus debt proceeds. Cash-on-cash is expressed as a percentage and represents a return for a singular time period, typically one year.

Cash-on-cash return example

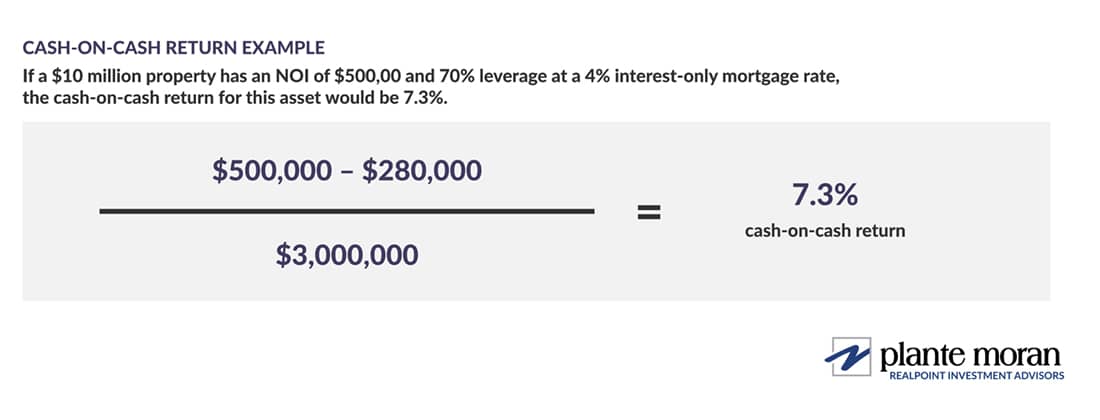

Let’s consider a theoretical investment, where a property generating $500,000 in annual NOI is valued at $10 million and financed with a $3 million equity investment and $7 million loan (70% loan-to-value, or LTV) at 4% simple interest, with no amortization.

In the above example, the annual debt service would be $280,000 per year ($7 million x 4%). The annual pre-tax cash flow would be $220,000 ($500,000 NOI – $280,000 debt service). The cash-on-cash yield is 7.3% ($220,000 / $3,000,000).

If the above investment was completed without debt, i.e., “all cash,” the cash-on-cash return is 5.0% ($500,000 NOI / $10,000,000 investment). The “additional” 2.3% of return in our example is the effect of leverage.

Cash-on-cash return vs. cap rate

The capitalization rate, or cap rate, is simply the unleveraged cash-on-cash return at the time of acquisition. An investment’s cap rate is calculated by dividing the annual net operating income by the market value of the property. Like cash-on-cash return, an investment’s cap rate represents a return for a singular period of time and is expressed as a percentage. However, mortgage loan costs are excluded from the cap rate calculation. Learn more about cap rates in commercial real estate.

Cash-on-cash return vs. IRR

While comparing cash-on-cash return and IRR, or internal rate of return, is complicated, the main difference between them is time. IRR is a real estate return metric that considers the time value of money and is an annualized rate of return, measuring across multiple time periods.

IRR can be significantly impacted by the passage of time, and it only indicates an investment’s return relative to the project timeline. Additionally, IRR heavily weights the investment’s residual value. For example, investors interested in long-term passive cash flow generation often emphasize cash-on-cash over IRR. This is mainly the profile of intergenerational family office investors, and broadly speaking, these investors seek above-average cash-on-cash yields in their investments.

Cash-on-cash return vs. ROI

While cash-on-cash return and return on investment (ROI) are sometimes used interchangeably, they are distinct metrics, especially when debt is used in a real estate investment or transaction. ROI calculates the total return on the total investment, which may include loans used to finance the purchase of the property. Cash-on-cash return only measures the return on the actual cash invested out of pocket. Cash-on-cash return is a snapshot of annual cash flow, whereas ROI is cumulative and typically measures returns including the eventual sale price.

What’s a good cash-on-cash return for a real estate investment?

The idea of a “good” or “strong” cash-on-cash return is subjective, and the answer to this question is most likely “it depends.” Obviously, the higher the cash-on-cash return, the better. However, that may not be the whole answer. While increasing the amount of debt will increase the cash-on-cash return, increasing debt beyond a sustainable level may make the investment too risky. Also, a single-period cash-on-cash return is not as informative as what will happen to the cash-on-cash return over time.

Another factor to consider is that different property types have different levels of risk associated with them, so a higher cash-on-cash return does not always mean a better investment. The attractiveness of a real estate investment generally scales with the underlying risk-free rate. If an investor can purchase government bonds for a 2% return, a 5% cash-on-cash return for a low-risk real estate investment may look enticing.

Conclusion: How to start investing in real estate

The commercial real estate industry is laden with technical analysis, which includes a laundry list of complicated metrics that are used to evaluate investments. Cash-on-cash is an important consideration that looks at return on cash invested, inclusive of debt, but we recommend real estate investors compare various metrics to accurately assess the overall investment potential and risk before committing.

Our real estate investment advisors can work with you to evaluate potential investments and pair that analysis with broader market insights and planning to align those opportunities with your personal investment goals. Please reach out with questions — we’d be happy to help.

In the meantime, if you liked this article, sign up to receive more like it directly to your inbox.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this content to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.