Choosing to sell your seniors housing or long-term care business is a big decision. Whether you’re ready to sell soon or simply curious about what the process might entail, understanding the disposition process is the best way to effectively maximize the value of your assets, eliminate surprises, and facilitate a smooth transition that will ensure future success of your facility.

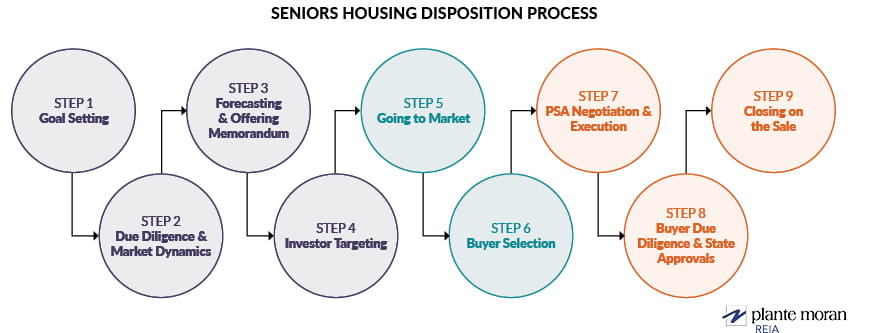

In this article, our real estate consultants will simplify the stages in the seniors housing disposition process and examine how each step contributes to the overall success of the sale.

Step 1: Set goals for the disposition

The first step in the seniors housing disposition process is goal setting. At this stage, start with some soul-searching: Why do I want to sell? What are my expectations for this sale? What am I hoping to gain?

Outlining your goals allows you to reflect, prioritize objectives, and be confident about your decision to sell. Those objectives could be to receive financial compensation, create a legacy, retire, provide new opportunities for your residents and staff, or any number of motivations. The important thing is to understand the unique value you place on each objective so you can determine the focus of the sale. As part of this, you should also research the tax implications and reinvestment options associated with the disposition of your business and plan accordingly.

Following these steps within the goal-setting stage will pave the way for your sale and act as a framework for the rest of the disposition process.

Step 2: Performing due diligence on your seniors housing business

Due diligence isn’t just for the buyers. Prior to bringing your community to market, there are several analyses and assessments you should conduct to mimic the due diligence process a buyer will go through when evaluating your community. These include the following:

Demographic and market analysis: This analysis helps contextualize your asset’s location in the eyes of the buyer, highlighting the strengths of your market for seniors housing. The demographics examined in seniors housing can be placed into three categories: population, income, and utilization. Often collected on a one-, three- and five-mile radius, these demographics observe age and income statistics to determine the demand for seniors housing.

Competitive landscape analysis: Identifying and analyzing competitor facility rates, service packages offered, facility/unit amenities, and more reveals what adjustments should be made to competitively position your community. Whether you execute on these adjustments or simply market the value-add potential, this can increase the value of your community in the eyes of investors.

Valuation methods: Cross-referencing multiple valuation methods supports and strengthens your value proposition to investors. The most common valuation methods include the following:

-

Sale comparisons: Estimates a price based on what similar assets are being traded at on a per unit basis. Proximity to your community, date of sale, acuity level, service package offerings, and building quality are among the many criteria to consider when identifying sales comparisons.

-

Income approach: Calculates the value by applying a capitalization rate to projected ongoing EBITDAR (earnings before interest, taxes, depreciation, amortization, and rent).

-

Discounted cash flow analysis: Determines the value of an investment based on projected cash flows that the asset will generate once the operation has been optimized.

Third-party reports: These are reports on the condition of the building and site, many of which are required to qualify for a sale. They include but are not limited to property condition assessments, surveys, and environmental studies. These reports are often specific to a location or product type, so you may consider bringing in a real estate investment banker with experience and market insight to ensure no steps are missed.

This due diligence process is intended to uncover opportunities to reposition your community in order to best achieve your sales goals and prepare for the sale process. Knowing which repositioning efforts will attain the highest ROI requires expertise in seniors housing dispositions that comes from experience. Additionally, the due diligence process lays the groundwork for pricing your community and creating marketing materials in the next stage.

Step 3: Pricing, financial forecasting, & offering memorandum

At this stage in the disposition process, your financial statements, market analysis, and industry benchmarks will be leveraged to create financial forecasts. A comprehensive understanding of the financials and operations provides optionality to seize opportunities or market them to potential buyers to drive-up value prior to the sale. In addition, these forecasts assist with establishing the current value expectation for your facility. That being said, in this type of sales process, we usually do not recommend setting an asking price. Instead, our marketing process allows investors to submit their maximum offer price for the facility, without knowing what other investors involved in the offering have offered. You may find this ultimately protects you from undervaluing your seniors housing business.

To market your asset and operations to potential buyers, you’ll need to create an offering memorandum. An offering memorandum is a comprehensive summary of the offering, which includes property descriptions, market overviews, financial information, and transactional guidelines. Investment bankers can utilize their experience, knowledge of industry standards, and resources to assist in compiling a thorough offering memorandum that will attract investors.

This stage, when done well, mitigates the risk of incorrectly valuing the property and prepares the business for a successful transition to the market.

Step 4: Targeting seniors housing investors

Whether it’s operational efficiency, quality of care, employee retention, or bottom line, every seniors housing owner has their own set of goals and values that dictate how their community is run. For this reason, when choosing which seniors housing investors to target, referring back to the goal-setting framework stage will help filter your list of potential investors to those who share a similar set of goals and values. Identifying and ranking these values will allow you to first create a buyer profile and then begin sourcing or scouting buyers that fit that profile long before the business goes to market.

Because there are local, regional and national buyers with varying investment criteria, choosing the right marketing strategy is vital. If you are unsure how to position your business in the buyer’s marketplace, investment bankers can help you evaluate the demand for your type of community, and utilizing their rolodex of contacts, connect you to buyers that align with your interests.

Step 5: Going to market with your seniors housing asset

After successfully targeting a group of investors, you will bring your asset to market by delivering the offering memorandum that you assembled in the third stage of the process. Serious buyers will then reach out to ask questions about the condition of the community, calcify their understanding of the financial information provided, and schedule property tours. An investment banker can act as a liaison, helping to field questions and frame all of the responses in a positive light to the potential buyers.

The goal during this stage is to obtain a Letter of Intent (LOI) from multiple qualified buyers, and create a competitive bidding environment. An LOI is a nonbinding agreement between a buyer and seller that outlines the proposed business terms of the transaction. Multiple LOIs provide you with more leverage for counter offers and negotiations. When reviewing the LOIs, it is important to be mindful of buyer accountability. Understanding the buyers’ motivation as well as their reputation will help you to establish their credibility. Have your investment banker research the buyers’ backgrounds to minimize the risk of selecting a buyer who initially submits a high offer but has a reputation for renegotiating its price during the sale process, or buyers who do not have a strong track record of closing.

The one element you cannot skip at this stage is a non-disclosure agreement (NDA), which is typically required for potential buyers to execute in order to receive the offering memorandum or detailed information about the facility or its financials. During this stage, news and information surrounding the sale may be sensitive, especially to staff, residents, and additional stakeholders. An NDA prevents rumors of a sale from sowing confusion and panic. All things considered, it’s in your best interest to begin crafting a communication plan to proactively address any concerns and control the narrative of the sale once you decide to move forward.

Step 6: Selecting the best buyer

By this point you have received several LOIs. It’s time for the fun part: selecting a buyer. More offers mean a stronger negotiating position and the freedom to select a buyer who aligns closely with your goals and values. The criteria for selection should be placed into three buckets: price, terms, and values.

Price is simply monetary value — but can be affected by the terms of sale. These terms can define the payment schedule, the amount and timing for payment of the earnest money deposit and can influence how the community will be run for years to come. The last criteria are the buyers’ values: How committed are they to improving the quality of life of your residents and staff? To determine this, your sell-side due diligence should include evaluating the purchaser’s operating philosophy, mission, and expertise to maintain quality of care. Consider referencing the Center for Medicare and Medicaid Services (CMS) rating, a standardized rating given to nursing homes based on health inspections, staffing ratios and quality of care.

Because of economies of scale, often larger operators may be better positioned to make the kinds of investments that will result in more consistent staffing, better care, and improved quality of life for residents, but this is not always the case. For that reason, another useful strategy for vetting buyers is to have them explain their valuation process as well as how they expect to increase revenue or reduce expenses. An investment banker can help evaluate the reasonability of these responses to determine the buyer’s level of sophistication.

Ranking each buyer and clarifying which deal terms are negotiable vs. non-negotiable will help you stay disciplined and intentional as you head into final negotiations.

Step 7: Negotiating the sale of your seniors housing assets

After executing an LOI with the selected buyer, a Purchase and Sale Agreement (PSA) is typically first drafted by the buyer’s counsel. The PSA includes all of the terms outlined in the LOI, as well as additional legal elements and detailed conditions.

When delving into negotiations, both parties will examine the LOI and PSA to identify key areas they would like amended. Each buyer and seller are unique in which item or items they choose to focus their attention on. Common points of contention include purchase price, due diligence period, closing period, contingencies, prorations, seller’s indemnification basket, and many more. Legal counsel will document these terms in the purchase and sale documents for their clients.

Should you choose to hire an investment banker, you can opt to have your representative involved in negotiations as well.

Although it can be frustrating and time-consuming, it’s in your best interest to remain patient throughout negotiations. Refer to the objectives you set in stage one of the process to ensure you are remaining aligned with your goals and values.

Step 8: Facilitating buyers due diligence & state approvals

Once buyer and seller have executed on the PSA, a few boxes still need to be checked. One of these includes coordinating the buyer’s due diligence. The buyer conducts its own due diligence process to verify the physical and financial aspects of the transaction. If you were thorough with your due diligence up front, it’s unlikely surprises will arise during this stage. If any do, you will have the proper reports and analysis to cross-reference with the buyer and determine what changes to the agreement, if any, need to be made.

In this stage, with the help of an investment banker you will also want to monitor and enforce deal terms and milestones closely. A significant milestone is when the buyer completes its due diligence, and the earnest money deposit becomes nonrefundable. As the buyer can no longer change any of the deal terms, this marks a shift of leverage from the buyer to the seller.

Another important milestone includes the several state approvals that must be completed before closing. As this stage is all about making sure that you and the buyer remain on the same page, clearly communicating when milestones are reached will mitigate surprises and facilitate a smooth transition to the closing stage.

Step 9: Closing on the disposition

After successfully following the steps outlined above, you will be ready to close on the disposition of your seniors housing assets. During this stage, you’ll implement the communication plan you drafted to alert all affected parties — including staff, residents, and other stakeholders — to the shift in ownership.

Lastly, a series of transaction documents will need to be completed to finalize the seniors housing disposition. These documents include an assignment and assumption agreement, bill of sale, delivery of tail insurance, and more. In coordination with your legal counsel, a trained investment banker can help you to prepare these documents to ensure a timely close.

On the day of closing, once all the transaction documents have been successfully completed, sale proceeds will be distributed to you in the agreed upon manner outlined on the settlement statement. With the transaction now complete, you can begin to look to the future and implement your planned reinvestment opportunities.

How long does it take to close on this type of transaction?

At this point, you may be wondering how long the aforementioned steps take to complete. It’s important to note that the timeline of a seniors housing disposition process can vary anywhere from a couple of months to a couple of years depending on several factors. Complexity of the deal, number of assets in your portfolio, the state approvals process, and current condition of your assets are just a few of the elements that can play a part in determining the time it will take to close. The length of the due diligence, closing, and exclusivity periods are additional key factors in determining the timeline. An investment banker can generally leverage their industry insights to negotiate shorter milestone periods and foster an expeditious process.

Who can help with the disposition process?

There is no question the seniors housing disposition process can be time-consuming and complicated. Knowing the steps involved in the process can reduce the element of surprise, mitigate risk, and give you the means to prepare accordingly.

Here at Plante Moran Realpoint (PMR), formerly Plante Moran REIA, we have a team of seniors housing transaction experts who can assist you at all stages of this process. Our extensive industry knowledge as well as our countless connections within the seniors housing space allow us to individually target buyers specific to your business. We focus on the intricate details of your sale, allowing you to focus on your big-picture goals. Reach out to our team for help with due diligence, valuation, restructuring, and process management.