With the cost of capital rising, alternative funding options for capital improvements or real estate developments will be an increasingly important option for business owners and investors. One financing program gaining interest from environmentally conscious property owners as gap financing or prefinancing is Commercial Property Assessed Clean Energy (C-PACE).

More than 35 states and Washington, D.C., have enacted PACE legislation, giving property owners the opportunity to finance up to 100% of qualified capital improvement costs. What’s more, the annual savings generated from the improvements may be greater than the annual debt service requirement. This can be a win-win for property owners, as these programs can provide the potential to commit no funds upfront while simultaneously increasing annual cash flow.

What is PACE financing?

C-PACE is a financing tool property owners can use to make various improvements focused on energy efficiency, renewable energy, energy storage, and other environmental- or safety-conscience measures. C-PACE programs allow a property owner to finance up to 100% of the improvement costs via a long-term loan. Funds financed through C-PACE programs are placed on the property’s tax bill and are assessed over a long-term period (typically 20 to 30 years). The C-PACE assessment attaches to the property rather than the individual, allowing for a subsequent sale to a new owner.

While C-PACE programs are overseen by the U.S. Department of Energy, C-PACE is not a federal program. C-PACE programs are authorized through state legislation and this structure varies from state to state. (More on that below.)

Eligibility requirements for financing energy-efficient upgrades

While the specific requirements vary from state to state, or program to program, PACE programs are generally geared toward the following:

- Energy Efficiency – HVAC and mechanical upgrades, energy-efficient lighting systems, insulation, etc.

- Renewable Energy – Solar panels, fuel cells, EV stations, etc.

- Resiliency – Stormwater management; fire, seismic, and hurricane measures; etc.

These improvement options are broad in scope, aiming to promote a variety of avenues to gain energy savings, reduce operating costs, or reduce the carbon footprint. Many states and programs require a demonstration of savings above the upfront cost of improvements in the application and review process, known as the Savings to Investment Ratio (SIR). To qualify for C-PACE financing, a specific SIR may be required by that state or program.

C-PACE is available for virtually all commercial property types, multifamily residences, and certain public buildings. It is also available for many stages of development, including the retrofitting of existing buildings and facilitating new construction. In certain circumstances, C-PACE financing can also be used to reimburse capital from prior investments already made.

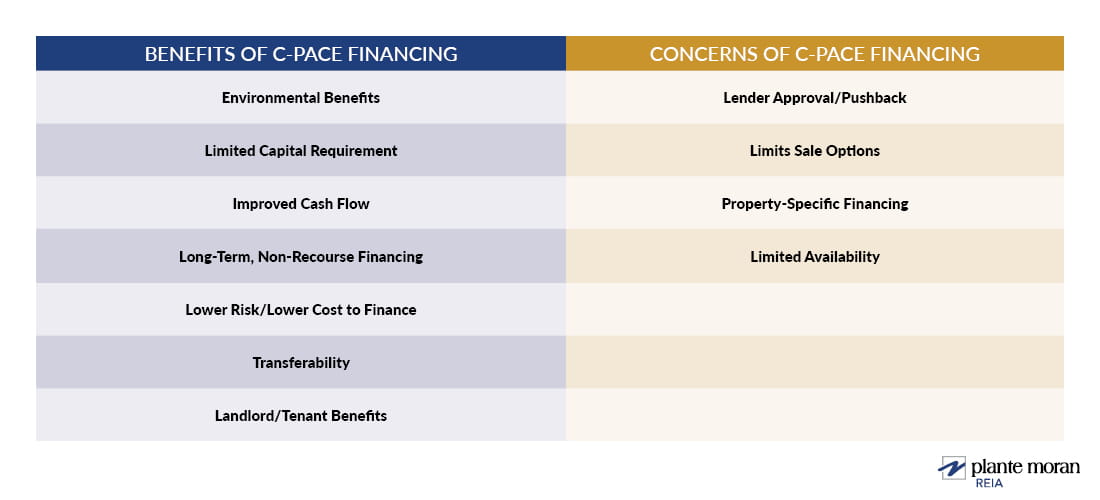

Benefits of C-PACE financing

- Environmental Benefits – C-PACE financing can provide cost-savings to property owners while allowing their companies and local municipalities to further their environmental, social, and corporate governance (ESG) initiatives.

- Limited Capital Requirement – C-PACE funding can finance up to 100% of the improvement cost, requiring no down payment from the property owner.

- Improved Cash Flow – Savings generated from improvements can be greater than the annual repayment, leading to an increase in annual cash flow to the property owner. Oftentimes, this is a requirement as part of the approval process.

- Long-Term, Non-Recourse Financing – C-PACE assessments are generally long-term in nature and can range from 10 to 30 years. Further, there is no acceleration of the full loan balance if a year’s assessment is unpaid. Delinquencies of C-PACE loans are treated as any other delinquencies in property taxes. The risk to the property owner is limited to the loss of property.

- Lower Risk/Lower Cost to Finance – Loan repayments are attached to the property as an additional assessment and are secured by the property with a more senior lien than many other creditors. This additional security can allow lenders to offer lower interest rates than what can be obtained through other unsecured options.

- Transferability – C-PACE assessments “run with the property” and are automatically transferred to the new owner upon sale unless they are prepaid.

- Landlord/Tenant Benefits – C-PACE can benefit both the landlord and tenant, as both the tax assessment and cost-savings can be shared with tenants through most lease structures.

Concerns about C-PACE financing

- Lender Approval/Pushback – Because unpaid C-PACE assessments can create a senior lien on the property, C-PACE financing often requires lender consent for any property with a mortgage. This can add time and cost to the financing process. C-PACE assessments can also limit refinance options due to these senior liens. The Federal Housing Finance Agency (FHFA) has directed Fannie Mae and Freddie Mac not to purchase or refinance mortgages with C-PACE liens.

- Limits Sale Options – Properties that have C-PACE assessments attached to them can be more difficult to sell, as the new owner has to agree to pay the additional assessments.

- Property-Specific Financing – C-PACE loans are structured uniquely for individual properties and require cost/savings analysis specific to that property, making it difficult to utilize for a portfolio strategy.

- Limited Availability – While C-PACE financing is becoming more prevalent, this financing can only be utilized in locations with PACE-enabling legislation. This includes statewide enactment as well as the participation of the local municipality.

C-PACE pros and cons summary table

How does a C-PACE loan work?

As indicated, the C-PACE structure varies from state to state and includes the following:

- Statewide – The state has one C-PACE program administered at the state level. Local municipalities will need to opt into the statewide program. Examples include Colorado, Connecticut, Utah, and Wisconsin.

- State and Local – A statewide C-PACE program exists. Local municipalities have the option to opt into the statewide program, join existing programs, or create their own. Examples include Kentucky, Michigan, and New York.

- Local – C-PACE is enabled at the state level, but there is no statewide program. Local municipalities join existing programs or create their own. Some states provide standards and guidelines for local municipalities while other states leave the entire responsibility to the local municipalities. Examples include California, Illinois, and Ohio.

Once the program guidelines are established, an administrator (which can be the public entity or a third party) is selected to launch and run the program. Local governments can join the program, or in some cases, start their own.

With a program established, an administrator selected, and a local municipality opted in, a property owner in that municipality can apply for funding by working with a contractor to identify specific improvements, determine the upfront cost, and estimate the savings generated from the improvements. The program administrator reviews and approves the project based on the costs and estimated savings. A tax assessment is placed on the property and a financier funds the PACE-eligible improvements. The property owner pays for the completed work through a property tax assessment, and the local municipality remits the repayment back to the lender.

Lenders can finance C-PACE improvements through private loans that remain on their balance sheets. In addition, local municipalities or joint authorities can securitize the assessments and issue bonds to the capital provider. Both financing structures are commonly used.

Is a PACE loan the right option for you?

C-PACE is an alternative financing option that can be utilized by property owners to fund long-needed environmentally friendly capital improvements with limited upfront cost. It can also be utilized to fund gaps in the capital stack for new construction or development projects with sustainability goals.

As municipalities, lenders, and other participants push greener initiatives, environmentally friendly improvements may become requirements — as opposed to recommendations — in order to obtain entitlements, approvals, or desired financing structures.

While the benefits are many, property owners should conduct due diligence into their local or state program to understand which improvements apply and how the process varies from state to state or local municipality to local municipality.

A trusted advisor can help you navigate these waters to better evaluate the costs vs. benefits of utilizing various capital structures. If you have questions about alternative financing options for your capital projects or development project, contact us to learn how we can help.

In the meantime, if you liked this article, consider signing up to get similar ones delivered right to your inbox.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this content to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.