The global economy has been heavily impacted by volatile interest rates. As record-high inflation has taken its toll on businesses and consumers worldwide, central banks have rapidly tightened their monetary policy to combat these extreme conditions.

Real estate investors are carefully following the current interest rate market, but many are still left wondering how interest rates are, or can, affect the future of their deals. Here is our take on how interest rates are affecting commercial real estate deals, with tips to help real estate investors navigate this difficult market.

What’s currently happening in the interest rate market?

Since the start of 2022, the Federal Reserve has implemented seven rate hikes to combat high inflation in the U.S. economy and make lending more expensive for businesses and consumers. These rate hikes have ranged from 25 basis points up to 75 basis points at a time. Federal Reserve Chair Jerome Powell has stated that interest rates will continue to climb until inflation reverts to the annual 2% target.

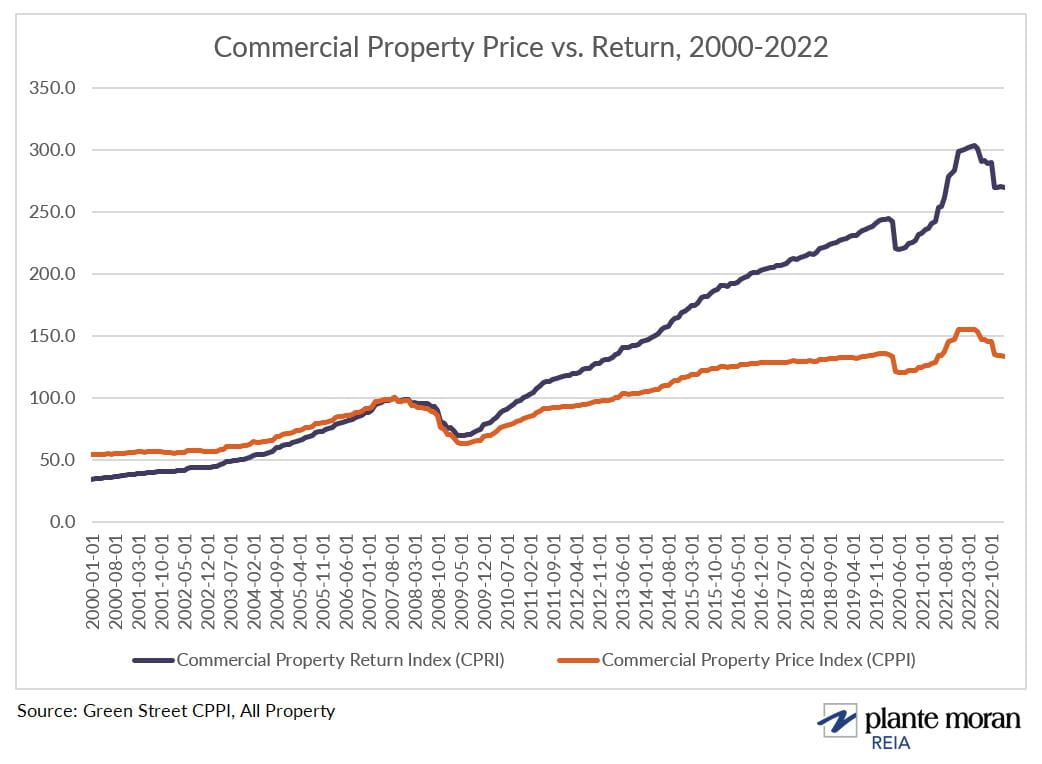

As a result of these rate increases, the cost of debt is up nearly 300 basis points over the past year. Higher cost of debt is putting increased pressure on new real estate development due to difficulty locating financing sources that fit within a project’s capital stack. It’s also causing compression in building valuations across commercial sectors. The Commercial Property Price Index® (CPPI®) from Greenstreet shows there was a 14% decline in valuation in 2022 for commercial properties based off future projected cash flows. What was once a market inflated by the COVID-19 pandemic in early 2020 has now turned the corner as property values have begun to decline. See below for a snapshot of the Greenstreet CPPI:

What’s next for the interest rate market?

The future is uncertain for the interest rate market, but there are signs of rate hikes slowing down. In January of 2022, the Federal Reserve slowed baseline rate hikes from 50 to 25 basis points, marking an inflection point in the battle with high inflation. Powell can be quoted saying that the Fed has “covered a lot of ground” but that the full effects of its plan to tighten monetary policy have yet to be fully felt and there is still “a ways to go.” Although the last rate hike slowed 25 basis points, the velocity of increases has been historical. Fed board members don’t expect to decrease in index rates until at least 2024.

To provide private market interpretation of government commentary, Chatham Financial periodically releases a forward curve that can be useful in projecting future index rates. The company’s one-month SOFR (Secured Overnight Financing Rate) Forward Curve predicts interest rates will peak in August 2023, drop below 4% in December 2024, and flatten out to just above 3% by end of 2025 or early 2026 (projections as of March 1, 2023). It is important to remember Chatham Financial’s forward curve projects future rates based on Fed commentary and historical trends. All indicators seem to point to one expectation: investors can anticipate the cost of debt to increase over the next year.

How do investors and developers navigate this market for a real estate deal?

With experts expecting interest rates and cost of debt to increase into 2024, how can you prepare your assets and developments for another round of potential increases? Our real estate consultants at Plante Moran Realpoint Investment Advisors (PMRIA), formerly Plante Moran REIA suggest several actions to our clients:

Tips to reduce pressure on real estate development projects

- Consider alternative public financing funds as they become available to developers, for example, government-funded programs like Low Income Housing Tax Credits powered by HUD’s HOME Investment Partnership Program.

- Research economic development tools available within the local, regional, and state government. In addition to incentives programs that directly facilitate returns, there may also be a willingness, subject to the development’s benefits, to mitigate costs and incentivize development in other ways: streamline entitlements; augment density; be flexible with zoning requirements or bulk regulations; or negotiate permit, tap, or other fees.

- Re-underwrite current developments — both those in the pipeline and under construction — to stress test for higher debt service costs.

- Consider utilizing lower-leverage floating rate debt for new developments and assume a fixed-rate refinance once interest rates have normalized, if it fits within your overall asset or portfolio strategy.

- Consider mezzanine financing as an alternative to raising increasingly expensive traditional equity. Providing a limited preferred return for a portion of required equity and a lessor carried interest for certain projects may reduce the long-term overall cost of capital.

Tips for implementing strategic real estate transactions

- Consider disposing of assets that may no longer make sense in your portfolio or are underperforming. Explore alternative uses for your assets if the market suggests there is no longer a use for what you currently own.

- Confirm your level of risk tolerance given the status of the market.

- Consider acquiring properties with assumable low-interest, long-term debt in place.

Tips for asset management of owned properties

- Consider how you budget your property-level operational expenses. Plan ahead and be prepared for unforeseen increases.

- Prepare for lower property valuations, as many markets are seeing value compression. Rerun property cash flow models using projected market conditions and decide the best time to dispose of an asset for optimal returns.

Conclusion

So, what is the bottom line? As we progress into 2023, the future of the interest rate market remains uncertain as the Fed continues to deploy various defensive tactics. But real estate investors have several methods available for consideration that help protect their investments. Learning more about the rising interest rate environment and its impact on real estate development, transactions, and asset management is the first step in being prepared for uncertain markets. Reach out to our team for help proactively addressing your real estate needs.

In the meantime, if you liked this article, consider signing up for our newsletter to get more like it delivered right to your inbox.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this content to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.