In an era of high interest rates and rampant construction cost inflation, Michigan communities are seeking new ways to encourage real estate development, specifically through project-based tax increment financing (TIF) programs.

Project-based TIF programs have become a vital tool for both municipalities and developers. They are intended to help municipalities and developers achieve shared goals: revitalizing underused sites, expanding housing, and stimulating economic growth. Despite widespread use, misconceptions persist about how TIF works in Michigan, who benefits, and how it impacts local budgets. This article provides a high-level overview of how municipalities and developers are using TIF for new real estate developments and redevelopment projects.

What is tax increment financing?

The State of Michigan’s Brownfield Redevelopment Financing Act (Act 381 of 1996) enables real estate developers to use the new property taxes generated from their investments to reimburse themselves for qualifying costs related to cleaning brownfield (i.e., environmentally contaminated) sites.

In contrast with “appropriation-style” incentives (such as grants from local, state, and federal governments) and TIF districts (in which property taxes from neighboring properties are captured to encourage localized investment), the Act 381 programs are wholly “performance-based.” This means that the real estate developers’ investment must occur first, creating new taxes on the property, before any incentive benefit is provided.

Recent amendments to Act 381 expanded the use of TIF. Eligible activities now include housing developments and infrastructure improvements. The amendments also introduced transformational brownfield plans, with new revenue-capture mechanisms such as income, sales, and withholding taxes. These changes in the state law have made TIF more accessible for housing and large-scale mixed-use projects. Real estate developers statewide are using these economic development tools in cities seeking to encourage long-term value creation in exchange for short-term deferral of new tax revenues.

It’s important to note that TIF is not a tax increase — it’s a reinvestment strategy. By deferring incremental tax revenue, Michigan communities unlock immediate development that drives long-term economic and social returns.

How does TIF work over the long term?

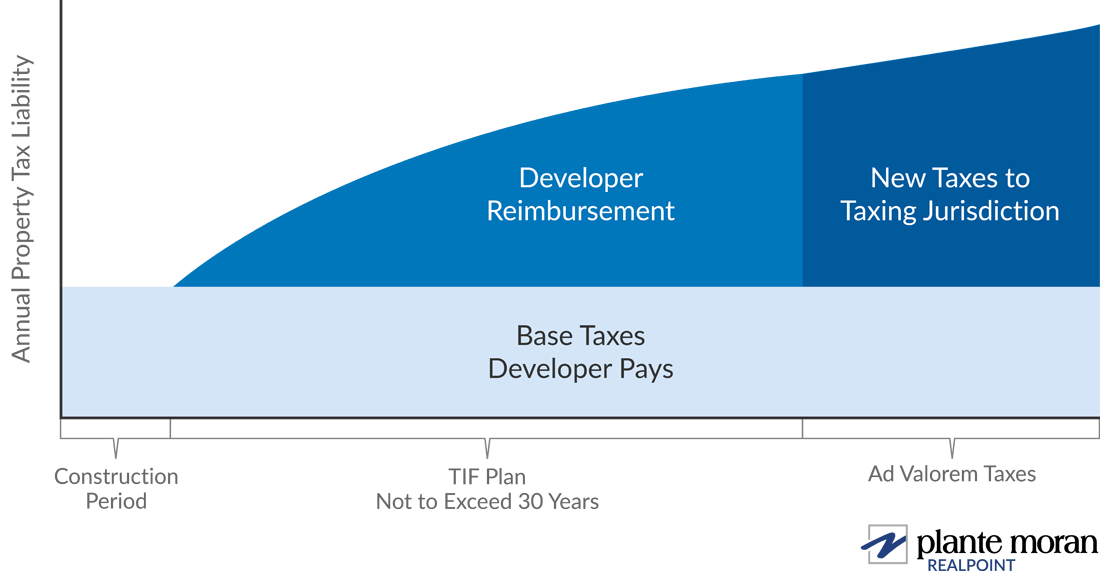

TIF is an incentive structure used in 49 of 50 U.S. states. The structure allows a developer to capture incremental tax revenue generated by a development to reimburse eligible costs, such as site clean-up, infrastructure, and construction. The developer pays standard property taxes and is reimbursed for an applicable portion of taxes the following year as improvements are made to the site. Under Act 381, the developer is eligible to capture these new taxes created for up to 30 years as reimbursement for certain eligible costs.

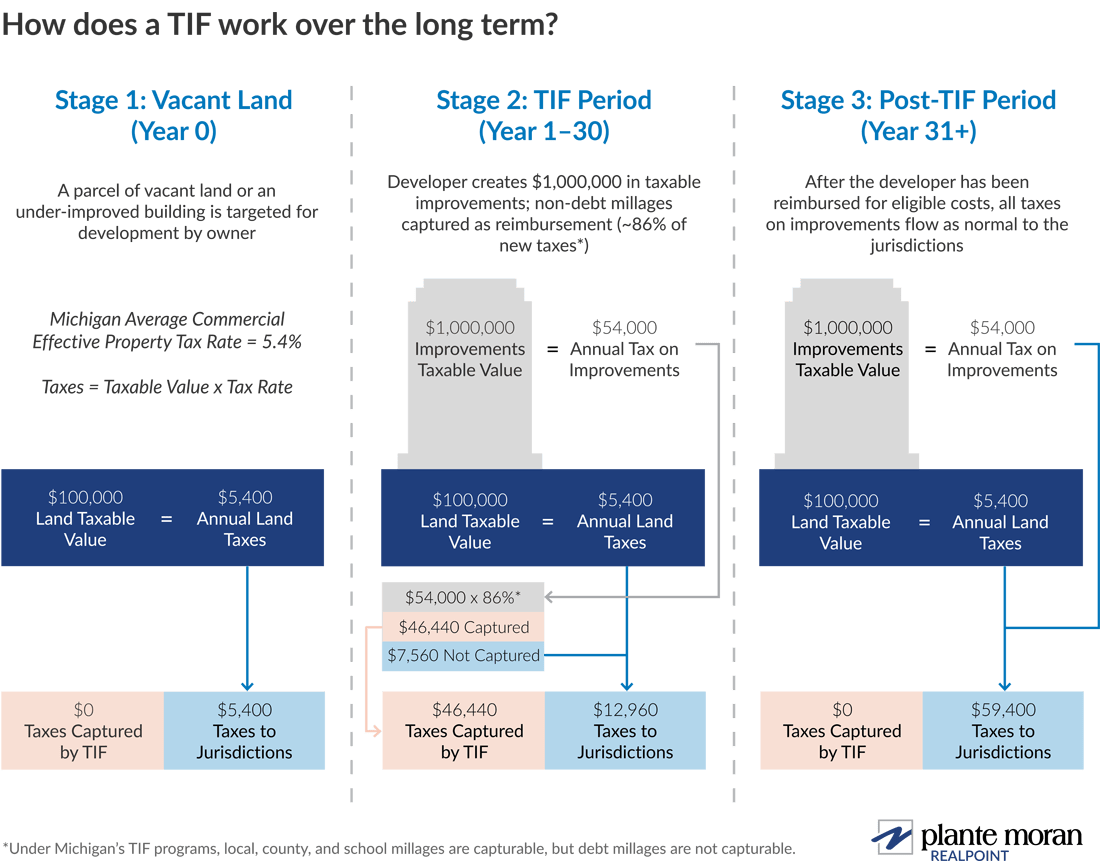

Consider an example where a developer buys vacant land or an under-improved building with a taxable value of $100,000.

At Michigan’s average effective commercial tax rate of 5.4%, the annual land taxes due are $5,400. The developer then makes investments that create $1,000,000 in taxable improvements on the land. Under Michigan’s project-specific TIF programs, the developer is eligible to capture a share of the incremental taxes — the difference between the current assessment and the base — as reimbursement. Statutorily, the developer is not able to capture any debt-encumbered millages, and the amount of state, county, and local millages the developer is able to capture is subject to approvals from the respective authorities with jurisdiction over those millages.

For this example, it is assumed the developer captures 86% of the new incremental taxes, totaling $46,440. That means the various jurisdictions receive the $5,400 in original land taxes plus the remaining 14%, for a total of $12,960. The incremental tax increase may be recaptured over no more than 30 years and only until the identified and approved eligible costs are reimbursed, at which time the various jurisdictions receive all taxes on improvements as normal.

See the graphic below for an illustration of this example.

What types of TIF programs exist in Michigan?

The State of Michigan has district-style programs (Act 57 of 2018) and project-specific programs (Act 381 of 1996). This article focuses on project-specific programs under Act 381. There are three project-specific TIF programs in Michigan: Brownfield TIF, Michigan State Housing Development Authority (MSHDA) Housing TIF, and Transformational Brownfield TIF.

Brownfield TIF program

The Brownfield TIF program supports the clean-up of contaminated sites, the development of transit-oriented properties, or the redevelopment of blighted, functionally obsolete, or historic properties. Eligible costs include environmental testing and cleanup, demolition, lead and asbestos abatement, site preparation, and public infrastructure. Approvals are through the local city council; the local or regional brownfield authority; relevant county authorities; the Michigan Department of Environment, Great Lakes, and Energy (EGLE); and the Michigan Strategic Fund.

MSHDA Housing TIF program

Since 2023, the MSHDA Housing TIF program has supported more than $800 million and 3,000 units in new housing. It focuses on new and preserved housing, infrastructure, and safety improvements. Eligible costs include infrastructure and safety improvements, parking, site preparation, demolition and renovation costs, and financing losses associated with affordable housing. Approvals are through the local city council, local or regional brownfield authority, relevant county authorities, and MSHDA.

Transformational Brownfield TIF

Since 2017, the Transformational Brownfield TIF program has supported billions in real estate development statewide. It supports large-scale, mixed-use developments on sites that qualify under the Brownfield TIF program and also have a transformational impact on a city’s population, commercial activity, or employment. Transformational plans require a minimum capital investment ranging from $15 million in small communities to $500 million in large municipalities. All construction activities are eligible for reimbursement.

In addition to capturing property taxes, Transformational Brownfield TIF also allows developers to capture state income and sales taxes for up to 20 years. Approvals are through the local city council, the local or regional brownfield authority, relevant county authorities, and the Michigan Strategic Fund.

Why are cities using TIF?

State and local government leaders continue to grapple with the scourge of record-high housing unaffordability and commercial office vacancy rates.

The state is short an estimated 190,000 housing units. From 2014 to 2023, Michigan built just one new home for every 14 new jobs — leaving thousands of workers struggling to find housing. Meanwhile, changing work patterns associated with remote work and commercial office vacancy rates are beginning to impact property values — a mere 1% increase in vacancy can reduce property values by a staggering 2 to 3%.

Cities across Michigan are using project-specific TIF programs to address these problems, including the redevelopment of environmentally contaminated land, investments in workforce housing, and large-scale transformational investments that will draw new residents and jobs. These leaders are making the conscious decision to forgo short-term property tax gains in exchange for enhanced spending in the local economy today.

Why are developers asking for TIF?

Michigan ranks among the top states for property tax burden, making TIF a critical tool for offsetting high upfront costs and continued high operating costs. TIF programs help bridge funding gaps, making projects with broad community impact that might otherwise stall due to financial constraints viable. These programs are proving decisive for the viability of real estate projects in Michigan, as developers face significant national and local headwinds that are widening financing gaps.

State & local headwinds

- High Property Taxes — Michigan ranks 14th highest in the country for effective property tax rates, with Oakland County ranking in the top 20% and the City of Detroit having the highest effective property tax rate amongst large cities in the country.

- Increasing Construction Costs Outpacing Inflation — Construction costs have increased 41.6% since the pandemic, significantly outpacing the 21.9% inflation rate.

National headwinds

- Tariffs’ Impact on Construction Costs — Recently enacted tariffs by the federal government are estimated to further increase commercial real estate construction materials costs by 9.0%.

- Persistently Higher Interest Rates — Ten-year treasury yields, the benchmark financing rate for most long-term real estate debt, have increased from 0.79% in October 2020 to 4.14% in October 2025. In actual dollars, this means the operating income that once could finance $1,000,000 in construction debt can now only support about $650,000, a 35% reduction.

- Reduction in Federal Funding for State & Local Projects — The Fiscal Year 2026 Federal Budget proposes eliminating much of the federal funding for local economic development and residential housing gap financing.

Addressing municipal concerns: “No new taxes?”

Real estate development projects that are supported through TIF are typically done so in the interest of stimulating the local economy through further commercial development, redeveloping sites that otherwise wouldn’t be redeveloped, encouraging housing development, or attracting large-scale transformational investments. By deferring tax revenue capture, municipalities strategically invest in long-term growth, address housing shortages, and revitalize contaminated sites.

Cities that support TIFs are agreeing to forgo the potential new property taxes created by a project for some period of time — meaning that they are left to fund the increased cost burden on local services associated with the new development through other mechanisms. Common solutions include the following:

- Municipal Services Agreement — An agreement between the developer and the local municipality to fund a specific amount for operations (e.g., police, fire, and parks and rec) for some agreed-upon duration.

- Community Benefits Agreement — An agreement between the developer and a local community group outlining contributions to be made by the developer to the community in response to concerns the community has related to the project.

- Application Fees — Fees charged by the local municipality to offset the cost of project reviews.

- Brownfield Redevelopment Authority — An authority established by the Local municipality or the county that can charge fees on the captured TIF to be used for various administrative costs.

- Local Brownfield Revolving Fund — A fund established by the local municipality or the county that can charge fees on the captured TIF to be used for various land development costs.

Takeaways for local leaders

Municipalities use TIF as an economic development tool to unlock the potential of neglected or underutilized areas. By supporting TIF projects, cities catalyze the revitalization of underutilized assets and foster community development. The deferred tax income is a strategic choice — spurring immediate growth to yield greater long-term tax revenues.

Project-specific TIF initiatives must be carefully planned and managed to make certain that public benefits outweigh private gains. Understanding how project-specific TIF programs work — and the motivations of both cities and developers using them — is essential for encouraging real estate development under current market conditions.

Plante Moran Realpoint is a full-service real estate advisory firm with experience in supporting both public and private clients in navigating the complexities of economic development incentive programs, such as project-specific TIF. Contact our team with questions.