Insight into the local market area is important for any real estate investment, but particularly so for senior housing. Market studies provide insight regarding the current economic climate of a given area, and particularly the supply and demand metrics that indicate the surrounding community’s need for the senior living products and services offered. Ultimately, market studies can help guide a prospective investor to make a more informed, data-driven decision.

However, some metrics in a market study can be difficult to interpret. As we work with private investors who are interested in the positive long-term outlook for senior housing investments, we notice that even the savviest need help deciphering which metrics are most noteworthy, which may be deceptively positive, and which are concerning enough to warrant a deeper look.

Before you move forward with a senior housing investment, make sure you understand how to interpret these five market metrics in the senior living market study.

#1 Demographics data

One significant category of market metrics is demographics. Market studies for senior housing generally focus on three population cohorts in the defined market area (an area from which a particular service can expect its greatest demand): the population of seniors, the population of adult children, and the availability of labor.

Senior population

As a needs-based product whose success is dependent on a select population, continued demand for a community’s housing and services from seniors in the market area is crucial.

The term “seniors,” in this context, has different qualifications depending on the product and care services offered at the community. Typically, in lower acuity senior housing facilities such as active adult properties, the term “seniors” refers to people ages 65 to 75. In the context of independent or assisted living, we identify “seniors” as people ages 75 to 85. In the most acute forms of care, such as skilled nursing, “seniors” are identified as people ages 85 and above.

The way a market study calculates potential demand for a senior living community is by first measuring the current senior population in the market area and then filtering that population for age and disability qualification of the product offered (i.e., acuity level) and income qualification for the proposed pricing of the product. When you’re considering senior population as a driver for demand, what’s possibly more important than the current overall senior population growth is an analysis of the projected growth of the age- and income-qualified senior population in the market area.

Adult children population

To complement the senior population data, a market study should also analyze the adult children population, who are typically identified as people ages 45 to 64 in the market area.

Adult children can have a significant influence on when and where their senior parents move. Many adult children prefer their parents to live in a community near them to make family visits more convenient or to interact more directly with the staff providing care. In fact, in many cases, the adult children choose the community for their parents. Provided other market area factors are also favorable, large numbers of adult children in a market area could indicate an elevated demand for senior housing.

Availability of labor

Lastly, a market study should consider the workforce available to staff the senior housing facility and provide care and services, especially in communities serving higher-acuity residents such as nursing homes, assisted living facilities, and home care agencies.

Staffing constraints continue to be one of the largest challenges facing senior housing facilities, so a strong labor base will usually contribute to the long-term success of your senior housing investment. In cases of labor shortages, operators turn to contracted labor, which is significantly more costly and will ultimately hurt the business’s bottom line.

#2 Occupancy trends

Across real estate asset classes, occupancy is a common indicator of demand. Senior housing investments are no different.

As an investor, you should make note of current occupancy, but more importantly, analyze it in conjunction with multiyear trends in occupancy and significant changes within the market area. Although a high market occupancy may look positive, upon further review, you may learn that the market area had struggled with occupancy for years before peaking in the present or that it could have been trending downward for some time already.

Occupancy can be quite volatile in the senior housing industry. Lease terms in senior housing are short — vastly month-to-month in independent and assisted living, and day-to-day in skilled nursing. Therefore, occupancy is analyzed from a projected stabilization point, rather than a single point in time, to uncover the annual trends historically. You may wish to inquire about what is causing occupancy to trend one way or another: Is one large outlier skewing occupancy, or is occupancy consistent across the market area?

Another factor to consider related to occupancy is how the market area has historically responded to difficult economic trends (e.g., COVID-19) or new competition being introduced in the area. How the market area has historically responded to these negative supply shocks can be a good indicator for how the market area will respond to future such events, like new communities opening.

#3 Construction vs. inventory

When assessing an investment, supply is just as important of a factor as demand. The most common metric for measuring changes in supply is the ratio of new construction to the existing inventory.

Although on the surface it may seem that a high volume of new development is a positive indicator for a strong market area, that is not always the case. Overbuilding could lead to slower fill-ups for both those new communities and the subject community. Therefore, you may benefit from investing in a more opportunistic market area, where supply is not currently growing but demand is still projected to grow.

Keep in mind, too, that construction vs. inventory information may be skewed by the source of information. Check that the market study does more than rely only on the usual data subscription resources. A thorough market study will also include interviews with nearby planning and zoning departments to inquire about projects in the early development phase that wouldn’t be captured by these construction monitoring resources.

#4 Penetration rates

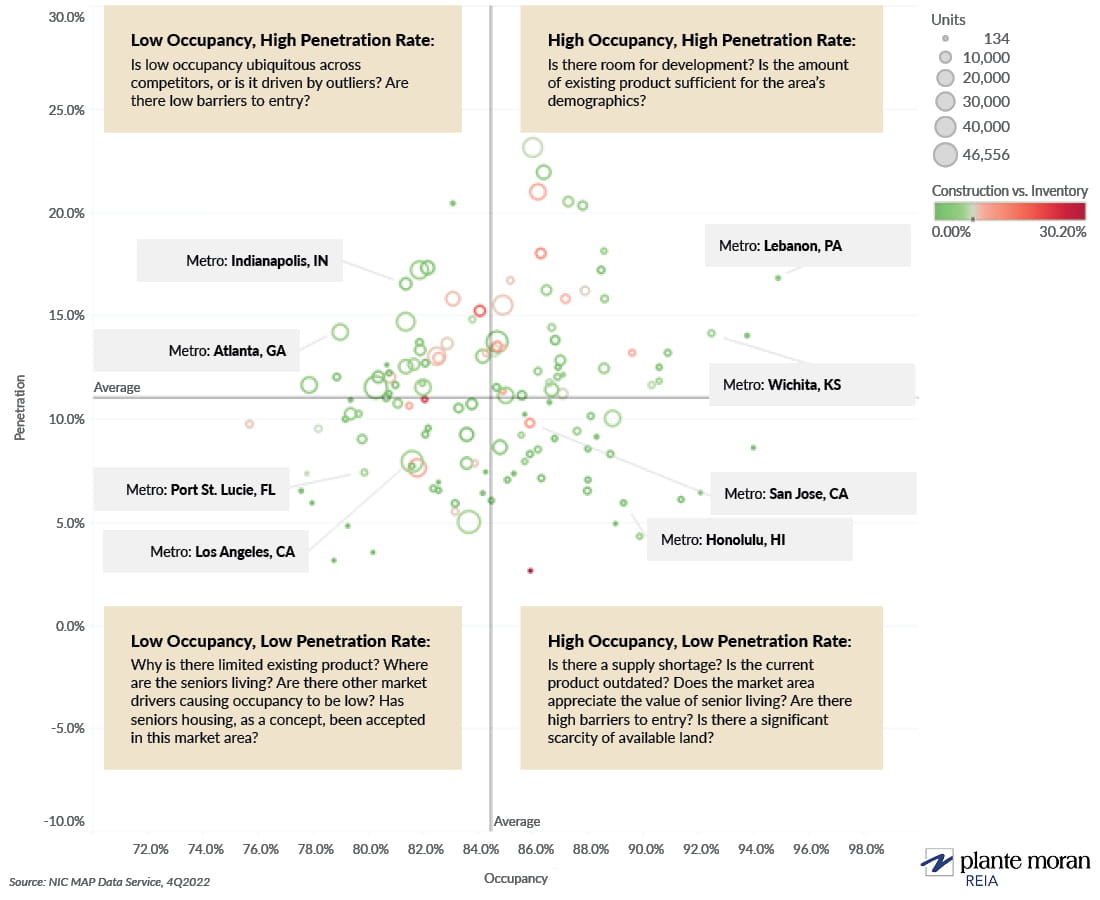

In order to gain a firmer grasp on how senior housing is being utilized in a certain region, the market study will explore Gross Market Penetration (GMP) rate. The GMP rate measures the ratio of all occupied units in a market area relative to the number of age- and income-qualified households. GMP can get very nuanced and is best understood when analyzed in conjunction with occupancy and other quantitative and qualitative market metrics.

In layman’s terms, GMP rate is a high-level metric measuring the rate at which the population of a certain market area uses senior housing. High penetration often means a more competitive market, since there is more occupied supply relative to seniors in the market. Low penetration refers to fewer seniors living in senior housing. The figure below offers examples of different market areas with different GMP and occupancy relationships, along with potential drivers of those metrics.

Occupancy vs. penetration rates

Essentially, you should analyze how new projects have an impact on penetration in the market area between current year and the year the project is expected to reach stabilized occupancy. If the GMP is expected to increase, you may conclude that the target demographics are not growing as quickly as the supply. If the GMP is expected to decrease, it means the demographics are growing faster than the supply, which is a favorable indicator of future demand.

#5 Unit potential

The final of the five market metrics to focus on is unit potential. Unit potential is the ultimate calculation of net demand of a market area. Seemingly straightforward, this metric has a few nuances to keep in mind.

All things held constant, a market with higher unit potential is more favorable than one with lower. Yet, as always, demand should always be understood in relation to supply, particularly occupancy. High occupancy and high unit potential could mean there is room for more development, but low occupancy and high unit potential could indicate a problem area for fill-up.

Before you evaluate the meaning behind unit potential, you have to remember that unit potential is a calculation relying on many inputs from the market study, particularly planned projects. However, there is no industry standard for which planned projects are included and which removed for the purposes of calculating unit potential. When interpreting this metric, you should gain a comprehensive understanding of how planned projects are factored into results and question why some may be left out.

Senior living market metrics affecting investment potential

If you’re evaluating an investment opportunity or offering memorandum for a senior housing business, remember that market metrics are important factors that can impact long-term investment potential. In general, be wary of taking results at face value. Try to gain a complete understanding of the larger context the results are calculated under whenever possible, as sometimes the context is more important than the results themselves.

As you can expect, these five market metrics are not the only ones you should consider. Each should be weighed not only in conjunction with each other and other market metrics, but also with project assumptions and the return metrics presented with the investment opportunity. If you’re considering the purchase of a senior housing business, contact our professionals. We have a deep bench of experts with unparalleled senior living industry, market study, and transaction experience to help you find and assess senior living investment opportunities.

In the meantime, if you liked this article, subscribe to our email newsletter for more real estate investment advice.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this content to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.