You may think a commercial real estate lease has a below-market rental rate — until you realize how much of the space you’ll be paying for is not actually yours to utilize.

A loss factor by any other name

When comparing lease options, office tenants are often so focused on the rental rates that they overlook the loss factor. Big mistake.

The loss factor reflects the amount of common or shared space factored into your rental rate. There could be as much as a 40 percent loss factor, depending on the space’s layout and the method used to determine the factor. You may find that common area costs make up as much as 30 percent of the rent you pay!

The loss factor goes by a variety of names, often with subtle differences in meaning. You may also hear it called:

- Common area factor

- Load factor

- Gross-up factor

- Core factor

Be wary of rental rates that seem “too good to be true.” They probably are.

Mathematics to the rescue

Tenants make this mistake when they misunderstand how landlords calculate the square footage for rent. The loss factor, in short, is the difference between your rentable square footage and your useable square footage.

Useable square footage is the space you physically occupy inside of your walls.

Rentable square footage — the space used to calculate the lease rate — includes useable space plus a portion of the areas shared by other tenants in the building or the floor. Landlords may factor common areas such as restrooms, building conference rooms, lobbies, public hallways, mechanical and electrical rooms, and custodial closets into this number.

Executives need to understand this difference when comparing office lease options with similar rates or especially good rates. We recommend having a space planner verify how much of the stated rentable square footage is useable space.

After you’ve confirmed your numbers, the math to determine your loss factor is easy. First, subtract the useable square footage from the rentable square footage. Next, divide by the rentable square footage. Finally, multiply your answer by 100 to get a percentage.

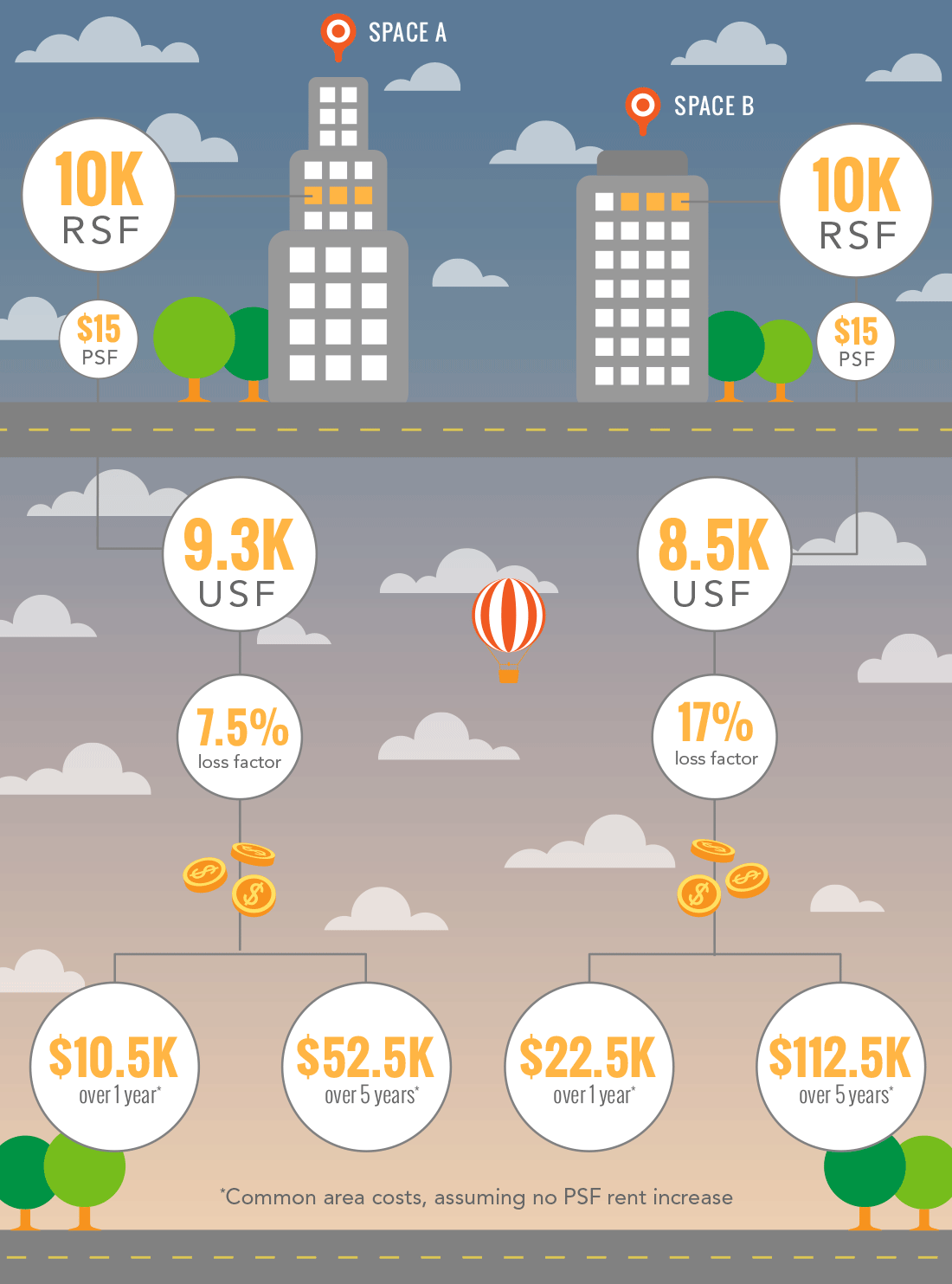

Let’s say you’re the CFO of a professional services firm comparing office space for lease in two similar buildings. Both landlords market the space at 10,000 (rentable) square feet. You determine that the useable square footage for Space A is 9,300 and Space B is 8,500. Here’s how the two spaces compare:

According to the numbers, your loss factor in Space A is 7.5 percent. That means you’ll spend more than $52,500 on common areas over a five-year lease. Your loss factor in Space B is 17 percent. You’ll spend more than $112,500 on common areas over a five-year lease.

Given the cost, why wouldn’t you review the loss factor when evaluating your lease options?

One caveat: The loss factor is only one consideration

Just as a great rental rate isn’t everything, we also don’t want to give the impression that the loss factor should be the deciding factor in your commercial real estate deal.

While there may be less useable space because of a large loss factor, size isn’t everything. A smaller, well-designed space may offer efficiencies or be more flexible. Before eliminating an option because of size or loss factor, talk to your tenant representative about how to leverage efficient layouts.