Throughout the last year, our nation’s senior housing and care providers have been challenged to continuously adapt to best protect their residents. Yet despite the industry’s best efforts, occupancy has steadily declined, hitting a new record low. Has the pandemic impacted desirability of senior living?

We’ll look at this question from two perspectives.

Long-term perspective: Demographics and population change

The senior housing and care industry has long been anticipating the retirement of the baby boomer generation, which many believe could herald an age of demand unheard of in the history of the industry. This isn’t just wishful thinking — demographic trends do indicate tailwinds are favorable, even as the preference to age in place remains strong.

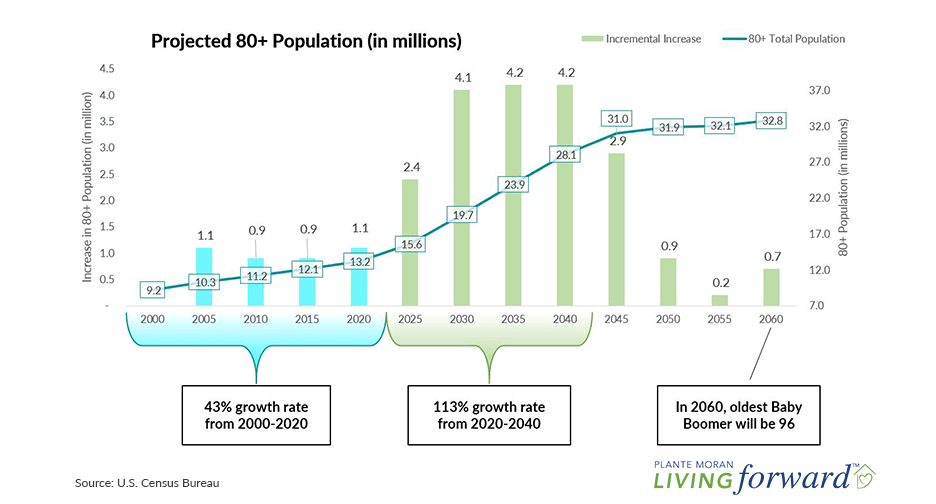

The first baby boomers turn 80 in 2026, which will be the catalyst for tremendous growth in the 80+ population. This growth will peak in the next 20 years but continue for at least the next 40. In fact, the 80+ population is expected to grow at more than double the growth rate from 2020 to 2040 than 2000 to 2020.

Not only is the 80+ population growing, but the caregiver support ratio is decreasing. The caregiver support ratio represents the population age 45 to 64 divided by the 80+ population. This means there will be less people to care for the 80+ population, causing more seniors to seek housing and care outside of their home.

In terms of sheer numbers, long-term desirability for senior living is expected to remain strong giving these changes in population demographics. But with the expected increase in the 80+ population of baby boomers still five years out, providers’ immediate concerns are related to public perception and consumer sentiment due to COVID-19.

Short-term perspective: Sentiments about senior living during the pandemic

When thinking of the immediate impact the pandemic has had on consumer sentiment, it’s important to understand the residents’ and prospective residents’ perspective to see if their opinions toward senior housing have changed dramatically.

In the summer of 2020, Plante Moran Living Forward launched a national COVID-19 Sentiment Report to poll residents and prospective residents of independent living communities about their opinions of senior living communities throughout the pandemic. (Prospective residents included both seniors on wait lists and those who had contacted the community because they were interested in possibly moving in.) Though maybe surprising to some, the sentiments toward senior living were overwhelmingly positive:

- 74% of prospective residents indicated their time frame for moving in was not changed due to the pandemic

- 86% of residents were glad they moved to their community

- 93% of residents felt their community took all precautions to keep them safe

- 61% of residents said they felt safer living in the community through the pandemic than in their home

While the survey did indicate 23% of prospective residents decelerated their timeline for entering senior living, there is an opportunity for communities to recapture their trust. Some prospect write-ins noted a significant amount of fear related to congregate living and how the community would suppress their freedom in choosing how to respond to risk. On the other hand, many other comments called out appreciation for videos of what life was like at the community during quarantine, sales staff explaining COVID-19 plans, and regular reports about infection rates. In sum, prospects felt that communities sharing as much detail as they could about their response to COVID-19 was informative and reassuring.

Conclusion: The overall feelings toward senior living

Due to challenges from COVID-19, the short-term outlook for senior living is not as rosy as the long-term — but it’s also not as bleak as one might think. It’s likely occupancy declines and operational challenges will improve with increased COVID-19 immunity in the majority of population. Providers could use this time as an opportunity to make smart investments for the future: reposition their assets, update and innovate their facilities, reshape their message and value proposition, and change the way they market their services to reengage and reassure their prospective residents. If you need help thinking through your strategy for the future, give us a call.

If you have not read our COVID-19 Sentiment Survey, the entire 100+ page report can be downloaded below. In it, you’ll learn how residents, prospects, and staff feel about senior living during COVID-19; discover strategies to pivot operations for happier residents and staff; and explore new senior living marketing and sales messaging that may improve prospects’ confidence in your community.