Many think nursing home occupancy increases should inspire optimism, a harbinger of recovery. But as a single metric, it can be misleading. Underlying data and macro market trends indicate consumers and payors are seeking alternatives to the traditional nursing home model for long-term care.

Nursing home industry trends

While nursing home occupancy improved since bottoming out in 2021, senior living and care providers should be aware that this surface indication of recovery shouldn’t be taken at face value. Occupancy is increasing not only because demand is returning, but also because the number of beds is decreasing. What’s more telling of demand than occupancy is utilization — the number of total beds occupied compared to the population aged 65 and older.

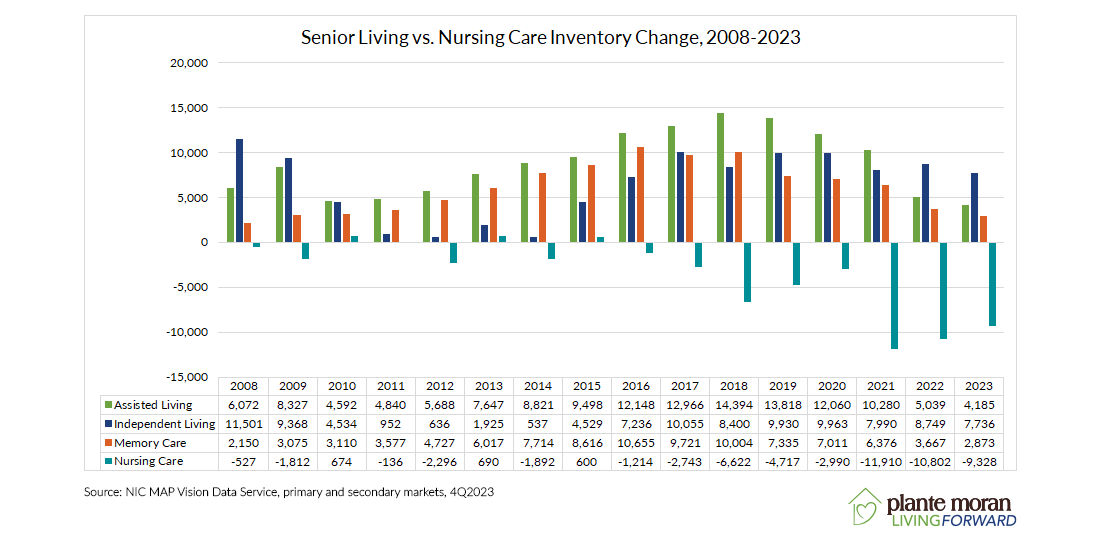

According to NIC MAP Data Vision, between 2008 and 2023, nursing homes saw a net loss of 55,025 beds (6% of beds) in the primary and secondary markets. The primary and secondary markets account for the top 99 markets in the country but are representative of the trends seen across the nation. The year-over-year losses were especially high during the height of the pandemic, peaking in 2021.

Number of residents followed the same pattern. The ratio of nursing home residents to the population of seniors aged 65 and older was decreasing before COVID-19 and bottomed out in 2021. Since the end of 2021, the utilization rate for nursing homes remained at 2%, with the rise in resident numbers matching the rise in population to maintain a steady rate since.

The decline in nursing home beds is tied to a number of factors, including increased consumer preference for home- and community-based services and alternative care options like assisted living, staffing shortages, decreasing hospitalization rates, and briefer lengths of stay in nursing homes.

Aside from consumers, third-party payors are also shifting away from nursing homes. Occupied nursing home beds as a percentage of the population aged 65+ across all payor types except managed care have decreased by over 30% from 2015 to 2030. This is based on an analysis of occupied nursing home beds by payor from 2015 to 2023 obtained from Kaiser Family Foundation’s analysis of Nursing Home Compare data. Financially, the decrease is exemplified by the shortfalls many providers are experiencing. According to the Plante Moran Skilled Nursing Benchmarking Report, the national net margin in nursing homes in 2022 was –2.86%. This will come as no surprise to many because Medicaid — the primary payor source to nursing homes in the United States — on average no longer covers the cost of resident care, according to data from MACPAC.

It’s unclear whether those utilization declines will continue or level off, but as long as the drivers remain, a reversal is unlikely.

Rise of senior housing

In contrast to the decline in nursing home beds, the senior housing market — encompassing independent living, assisted living, and memory care — has seen a boom in interest and new construction. Particularly between 2016 and 2019, when the primary and secondary markets added over 30,000 new senior housing units each year in this four-year period.

The fall of nursing homes and the rise of senior housing are highlighting a clear trend — consumers and payors are choosing alternative options to the traditional nursing home model, especially given they have the third option of receiving services in their homes. The residents of the future are all but assuredly going to continue this trend unless organizations rethink their healthcare model. One option supported by long-term market trends is repositioning skilled nursing beds to senior living units.

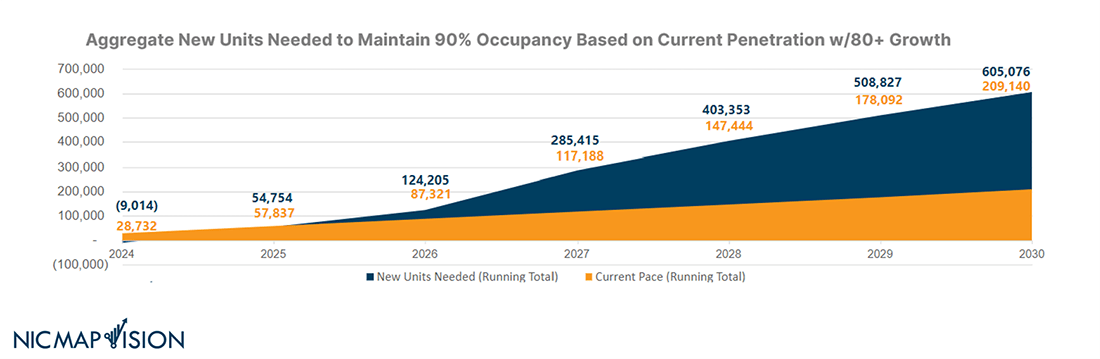

According to NIC MAP Vision Data Service, an estimated 605,000 new senior housing units will be needed by 2030 to maintain 90% occupancy at the current penetration rate. Given the growth in the senior population and decreasing number of caregivers over the next 10 to 20 years, NIC’s analysts note this is likely a conservative number. Despite this need, construction is not on pace to keep up with demand, creating a nearly 400,000-unit deficit in housing for this growing population of seniors.

Asking hard questions about the future of nursing homes

The trend away from skilled nursing, paired with the impending demand for senior housing, leaves life plan communities with important questions to ask about the future of their skilled nursing options:

- How do we currently compete in the market? Is it enough to offer all private rooms, all private showers, decentralized dining rooms, etc.?

- How many nursing beds would we need to serve our current independent living resident population? What percentage is right for our balance sheet and our mission?

- Can we provide these services in independent living or assisted living? What might that model look like? What regulations affect that decision?

- Can an older adult get better clinical outcomes in their current home? Could we offer that service?

- If we do downsize our skilled nursing, what do we do with those buildings?

Answering those questions will take strong leadership and strategic thinking based on a data-driven, holistic analysis of your organization’s operations, buildings, finances, and vision.

Operational life cycle analysis

An operational life cycle analysis will help you discover where there are opportunities to reinvest in your organization and change processes, staffing, and pricing to realign your operations to your strategy.

Market studies

Market studies and consumer research allow you to understand the demand for nursing home vs. senior housing in the local market and uncover opportunities for repositioning and growth.

Strategic planning

Strategic planning is an important process for leaders to align on the vision, goals, and objectives that will guide decision-making and hone priorities. Leaders should consider policies and regulations, economic trends, and broader senior living industry trends.

Repositioning planning

Led by the board and C-suite’s vision and supported by the data-based operational, financial, and market analyses, a master plan will map out the phases to accomplish your vision.

Financial modeling

Not all opportunities in the market are financially feasible. Running models on various unit mix scenarios can help right-size and appropriately phase your plans to allow for healthy growth.

The next level of senior living development

Skilled nursing remains a vital part of the senior care continuum, but consumers and payors have made their preferences for other forms of long-term care known. Many leaders will come out of these conversations realizing some hard truths: It may no longer be worth investing money in healthcare models that don’t work because the government controls the revenue and expenses to a net loss.

Ultimately, the transformation taking place will be around what consumers want for their lives, not how we want to box it up for them. You’ll still be caring for the same population through the end of their lives, just in a new environment not so much based on residents moving to services as much as services coming to residents when needed where they live.

Life plan community leaders’ ability to look holistically at their operational health and unit mix will be critical to developing and implementing plans for healthy growth that will meet with growing need for care over the next decade. This could look like aging-in-place apartments and cottages, along with a memory care area to handle elopement, end-of-life, and hospice issues. Or it could be affordable aging-in-place apartment models that will utilize nearby PACE and similar programs, which we will need at a higher density. What it looks like for your life plan community is ultimately up to the market and your own vision. However you choose to adapt, thriving in this new environment requires flexibility.

If you’d like help to determine the optimum unit mix and create a strategy to reposition your community, please reach out. Our experts help communities across the country reimagine their future.

If you liked this article, sign up for our email newsletter to get more like it sent right to your inbox.