Are you a business owner looking for an increase in liquid capital without incurring more debt? Do you want to capitalize on the value of your company’s owned real estate assets? Perhaps you want to build in long-term flexibility (both size and location) to your real estate strategy? Or do you simply have no desire to carry the burden of owning a commercial property?

If any of these scenarios resonate with your situation, a sale-leaseback transaction could be an excellent solution for you and your company.

What is a commercial real estate sale-leaseback?

A sale-leaseback is a real estate transaction where an operating company sells its owned real estate to a third-party investor and simultaneously executes a lease for the property to retain possession. A sale-leaseback can be a powerful tool for CEOs, CFOs, and other business operators looking to capitalize on the hidden value within their owned real estate asset, which they can deploy in other parts of their business.

Why should you consider a sale-leaseback?

There are four main reasons to consider a sale-leaseback of your commercial property.

#1 Unlocking capital

Sale-leasebacks allow you, as the seller, to unlock capital by converting an illiquid real estate asset into capital that can be deployed for a variety of uses. For example, the money from your sale-leaseback transaction can be reinvested into internal company growth initiatives, the company’s balance sheet, high-ROI business segments, stock buybacks, or M&A acquisition financing, among many options.

#2 Current market conditions

Given the current real estate market, a sale-leaseback can oftentimes decrease the blended cost of capital, especially in the middle-market sector. With commercial real estate capitalization rates (also called cap rates) dipping to decade lows over the past year, some companies that own real estate have seen their property values skyrocket. Cap rates for industrial properties, for example, are trending in the sub-6% range, with rates regularly dipping into the sub-5% range in core markets.

A sale-leaseback can be an alternative form of financing, with the cap rate being the cost of capital for that source. Given the average cost of capital for many middle-market companies regularly averages above 8% to 12%, a sale-leaseback could be a cheaper form of capital than traditional debt, especially considering rising interest rates in today’s debt market. Moreover, sale-leaseback transactions can provide financing for 100% of the asset’s value, while traditional debt oftentimes may be limited to 70% loan-to-value levels and come with restrictive debt covenants, interest rate risk, and balloon payments. For these reasons, a sale-leaseback can help your company lower its weighted average cost of capital (WACC).

#3 Capture value arbitrage

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a widely used, general measure of a business’s profitability. A company’s EBITDA multiple is a metric that compares a company’s enterprise value to its EBITDA.

Sale-leasebacks can help you capture value arbitrage between your company’s EBITDA multiple and real estate multiple. If you are contemplating the sale of your business, and your business owns the real estate in which it operates, a sale-leaseback strategy can increase the implied EBITDA multiple and the overall value of your business. If a sale-leaseback is structured effectively, a savvy business owner can possibly fetch a price for its owned real estate equivalent to an EBITDA multiple of 12x to 20x given the yield that sale-leaseback investors will accept for real estate supported by a commercially bondable lease and a business with a strong balance sheet. This multiple is usually much higher than the business’s existing EBITDA multiple. As a result, when business owners trade EBITDA for rent, and execute a sale-leaseback, it creates an arbitrage opportunity for a company to increase the company’s value without any operational changes.

#4 Mitigate risk

Sale-leasebacks can help mitigate risks to your company.

One risk that sale-leasebacks mitigate is operational risk for companies that own real estate. Company needs may change in the future: the business may require a different type of building, more space, or a change in geographic location.

Additionally, sale-leasebacks help shield a company from a decline in value in its owned real estate. As a real estate owner, your company assumes the uncertainty of the future value of its real estate. Although it has been attractive to be an owner of real estate recently, the future is uncertain. Property values ebb and flow with the markets, and many owners might not want to face the prospect of losing value in their investment in an economic downturn.

Furthermore, owning property requires human and financial capital. Even desirable properties in a desirable market are complex and require constant attention and intensive asset management initiatives to retain value. More often than not, owners of specialized middle-market companies are not expert real estate owners and do not have the time, experience, or desire to actively manage such large pieces of real estate. A sale-leaseback presents an opportunity for business owners and operators to transfer the risk of owning property to the buyer while also relieving themselves of the stress involved in constant asset and property management.

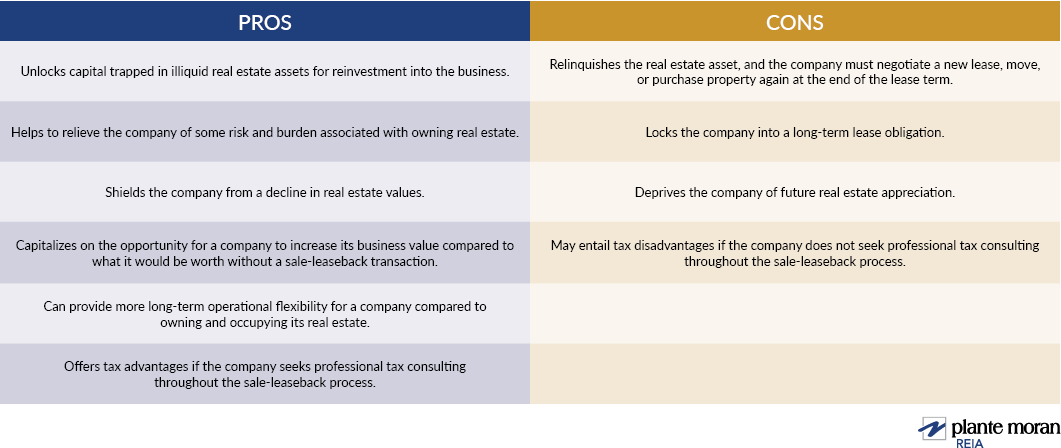

What are the pros and cons of a sale-leaseback?

The benefits of a sale-leaseback are many, but owners should consider the possible downsides of a lease, opportunity loss if the asset continues to appreciate after the sale, and possible tax disadvantages if the transaction is executed without the oversight of trusted tax consultant. A sale-leaseback is not for every company, but a trusted real estate consultant can help you determine the best option for your business.

The image below compares the pros and cons of a sale-leaseback.

Sale-leaseback pros and cons

What is an example of a successful sale-leaseback?

International pet toy manufacturer, The KONG Company, was in the process of refinancing its property acquisition loan when two national investors expressed interest in acquiring the building. KONG worked with our team at Plante Moran Realpoint (PMR), formerly Plante Moran REIA, to explore the option of a sale-leaseback and decided to take the property to market. The industrial property gained attention on the market, and KONG ultimately executed a sale-leaseback instead of a refinance. This gave KONG an injection of cash, relieved the company of its original acquisition loan, and allowed operations to stay in place as a tenant in the building. Read more about KONG’s sale-leaseback story.

For another sale-leaseback example, read about how Plante Moran Realpoint and PMCF helped Allied Plastics execute a sale-leaseback that far exceeding the client’s expectation of value.

What are some important value drivers of a sale-leaseback?

Sale-leaseback investors seek to achieve attractive returns while mitigating risk. While the quality of the underlying real estate is important in a sale-leaseback transaction, the lease structure and the lease’s financial terms determine the investor’s returns and risk level. As a result, sale-leaseback investors are keenly interested in structuring a commercially bondable lease with favorable terms.

As a property owner looking to execute a sale-leaseback, you must consider a handful of important factors related to the lease that will help position your real estate in an attractive way to investors while accomplishing the goals you and your company have identified in taking your property to market. Lease term, rental rate, lease structure, and tenant creditworthiness are the four most important value drivers in these transactions.

Lease term

Sale-leaseback investors are looking for a stable investment that generates perpetual cash flows. One of the main factors in determining the stability of a commercial real estate investment is the lease term, or the investor’s ability to release the space if your business leaves at the end of the term. If your real estate is located in an established market with high levels of demand from other users, you may not have to commit to a long lease term. However, if your owned real estate is located in a secondary or tertiary market, you may need to consider a lease term of 15 years or more to entice investors.

Rental rate

Sale-leaseback investors are also looking to generate steady cash flows with annual rent increases that meet or exceed inflation. Therefore, they’ll be looking for a lease with a market rental. If the rental rate is below market, you had the opportunity to convert more of your EBITDA to rent, and you may be forgoing value in the sale-leaseback transaction. If the rental rate is above market, the sale-leaseback investor may have a concern about replacing the rent if your business vacates the space at the end of the lease term, which creates significant risk for the investor and may decrease the value of your property. You should work with experienced commercial real estate professionals to determine a market rental rate that is both attractive to investors and fair to you as the future tenant.

Lease structure

Single-net, double-net, and triple-net leases all vary in the sense that they determine which party — landlord or tenant — is responsible for operating costs such as real estate taxes, insurance, and common area maintenance, as well as capital repair costs such as roof, parking lot, and building structure. We recommend you work with experienced commercial real estate professionals to determine what lease structure will generate the most value in your specific scenario.

Tenant creditworthiness

As mentioned, stability is a key value indicator for investors. In addition to lease term, tenant creditworthiness is a large factor in determining investor risk. If the tenant that supports the lease has a poor credit rating or unfavorable balance sheet, investors will be turned away by the implied increased risk of default or inability to consistently pay rent. This can be mitigated by adding a lease guarantor (presumably a more well capitalized parent or affiliate company) that will provide additional security for the payment of the lease.

These value indicators are some of the key metrics that investors assess when considering your property for a sale-leaseback. Working with experienced commercial real estate professionals will help to ensure you’re creating top-notch value throughout the sale-leaseback process.

Conclusion

A sale-leaseback can be a valuable tool to relieve your company of real estate ownership burdens, provide cheaper cost of capital without debt covenants, and inject valuable liquidity to help your business grow and reach its goals. However, a successful transaction will require an understanding of your local real estate market and the value drivers both for you as the seller and for the potential buyer.

Now may offer a truly unique opportunity to capitalize on the gold mine of real estate you own and transform the future of your company. Plante Moran Realpoint's real estate professionals have helped clients across the country unlock value in their real estate through sale-leasebacks and other real estate transactions. Contact our team today for help thinking through your options.

In the meantime, if you liked this article, consider signing up for our newsletter to get more like it delivered right to your inbox.