Taxable and tax-exempt fixed income performance has diverged meaningfully year to date. Through August 31, the Bloomberg U.S. Aggregate Index returned 5% while the Bloomberg Municipal 1-15 Year Index lagged at 2.2%. Multiple factors help to explain that gap, including their respective investor bases, supply dynamics, and rate sensitivity.

Municipal bonds tend to follow a predictable seasonal rhythm, with performance often weaker in the spring and fall months as the pace of bond issuance outstrips reinvestment demand. Year-to-date municipal issuance has been heavier than usual and is currently on pace for a record year. This supply-side pressure weighed on performance, particularly for longer-term bonds as yields edged higher.

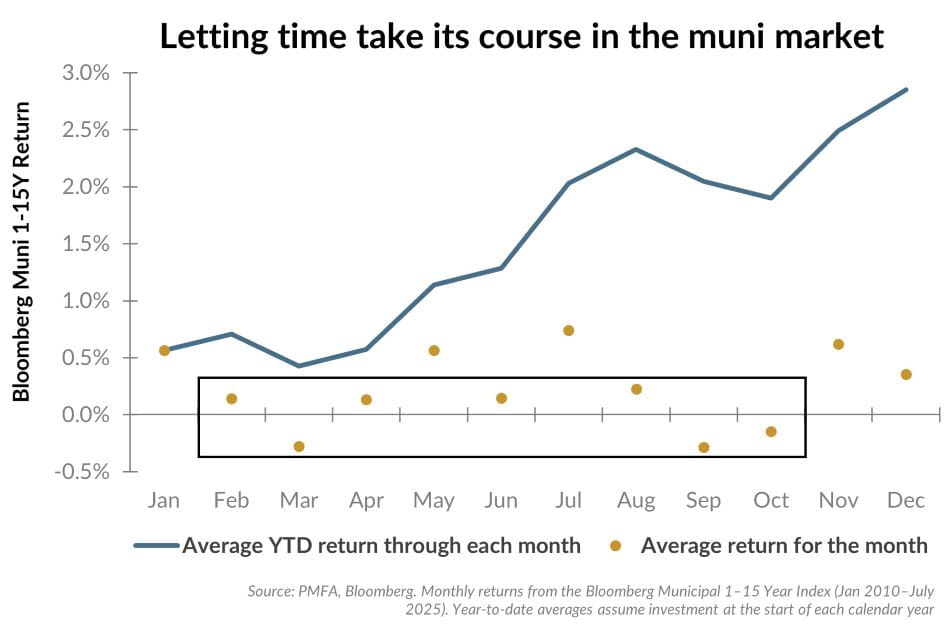

That dynamic has been evident in monthly muni market return patterns over time. The chart above illustrates the average monthly returns since 1990 for the Bloomberg Municipal 1-15 year index. Historically, the range of average monthly returns has been notable, with a few months — particularly in the latter half of the year — faring better than the typically softer returns early in the year. Calendar-year muni index performance masks that seasonality and the variability in returns month to month.

The result is that the municipal bond market often appears to start the year on a soft note, particularly if rates are edging even modestly higher. The critical income component is comparatively limited early in the year, becoming a more important driver of performance as the monthly flow of coupon payments accumulates over the course of the year.

A single year may not seem like the “long term” in traditional investment terms, but the compounding effect of interest over even a year’s time is significant. Over the longer term, coupon payments are the key driver of fixed income performance.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.