Clients often ask us how to “give smarter.” Keep these top five tips in mind as you consider making year-end charitable gifts.

1. Set a budget. Charitable contributions are irrevocable gifts — once you’ve given them directly to a charity or to another giving vehicle like a donor-advised fund or private foundation, you can’t get that money back. That’s why you should define your annual giving budget in two ways: first, how much you’re comfortable setting aside for charity relative to your total annual budget and, second, how much of your budget will go to a particular cause or organization.

2. Define your core values and areas of interest. It used to be that year-end was the time when nonprofit organizations made their requests for contributions. Nowadays, organizations have been asking us to give all year long. It can be particularly hard to say no if you haven’t clearly defined what’s most important to you.

For example, let’s say you’re focused on supporting human services and early childhood education, and you’re intentional about funding and collaborating on projects in these areas. Your friend approaches you about a worthy organization dedicated to animal welfare. Historically, you’d feel compelled to fund this project, even if it wasn’t quite so close to your heart. This is where having a plan (and a budget) comes into play. It gives you permission to acknowledge the importance of your friend’s interests while saying no and staying true to your passions, perhaps with less guilt and more conviction.

3. Do your homework. With over one million nonprofit organizations in the United States, it can be overwhelming and confusing to understand how and where to give your dollars or other assets. We recommend considering both quantitative and qualitative factors. Quantitative questions might include: How much is spent on programs versus administrative expense? What is the size and age of the organization? How might that impact its ability to use your gift? Old and large isn’t always a better option. Context can be helpful to interpret organizational data — that’s where qualitative questions come into play. Questions to ask yourself might include: What’s the reputation of the organization in your community? Do you trust the leadership and its vision for the future of the organization? How does this organization’s values align with mine?

4. Reflect on current and past gifts. If you’ve successfully tackled the first three actions above, consider going a step further. A number of clients are expressing interest in developing strategic giving plans, and part of this process includes defining your “giving personality.”

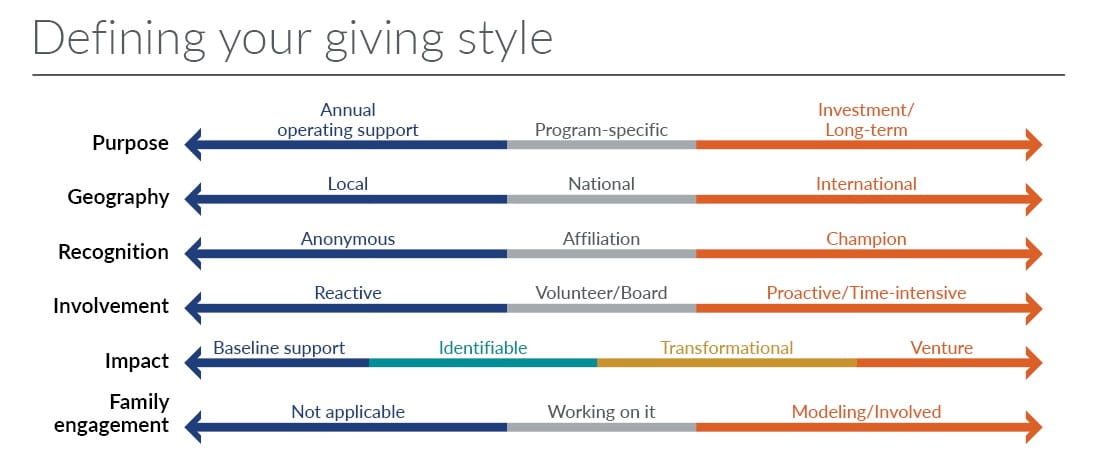

Put simply, one’s giving personality represents a set of criteria that defines and helps guide charitable giving in multiple areas: purpose, geography, recognition, involvement, impact, and family engagement. The chart below highlights six key considerations and can be used to be more strategic with your philanthropy.

Questions we might ask as you review the chart above include:

- Do you tend to give to organizations without specifying a purpose, or do you direct funds to specific programs or long-term investments?

- Are most of your charitable gifts given locally, or is geography irrelevant to you if the organization is doing good work (as defined by you)?

- Do you prefer to remain anonymous when making gifts or perhaps you recognize the impact of leading a campaign with a major gift or matching grant?

- Is it important for you to be proactively involved with the organizations you support?

- What impact are you looking to make — maybe you’re willing to give to a new unproven venture with more risk and less of a track record.

- How do you engage others in your philanthropy, and is this important to you?

There’s no right or wrong answer to any of these questions, but each of us generally has an opinion, especially when giving significant dollars.

5. Engage others in the process. Philanthropy is one of the easiest ways to model what’s important to your family and engage the next generation in stewarding those values. For some, giving alone might be easier, but it’s a missed opportunity to address so many of the objectives and concerns that parents and grandparents have about their family’s legacy. Instead, get your loved ones involved early and use your philanthropy as a tool to foster greater family communication and understanding.

Parting thoughts

These suggestions are important to consider whenever you’re making a charitable gift, not just at year-end. Investing a little extra time to connect your values to your giving and to do your homework before executing results in your dollars going where you want, when you want, and to whom you want, which helps extend the impact of your generosity.

And don’t forget that philanthropy doesn’t occur in a vacuum. Particularly if the dollars are significant to your overall financial and estate plan, engage your Plante Moran relationship manager to ensure the good you’re doing in the community also complements your personal financial goals and objectives.