The Federal Reserve cut interest rates by 25 basis points, signaling a more accommodative stance as it navigates a complex — and somewhat conflicted — economic backdrop. While the move was expected, the tone in Fed Chair Jerome Powell’s press conference was notably dovish, indicating that additional rate cuts are likely in the months ahead.

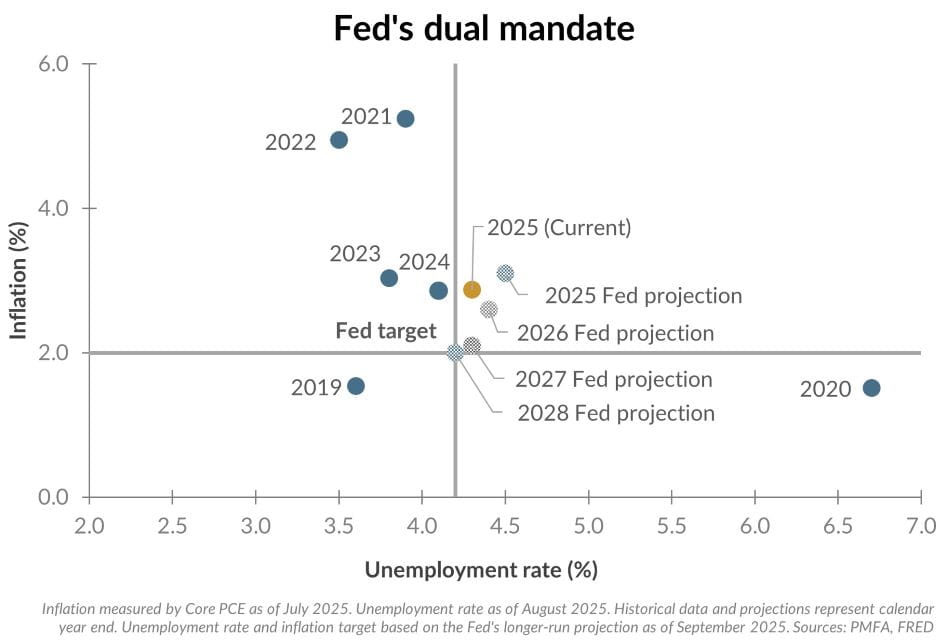

The Fed’s dual mandate — to maintain full employment and price stability — remains the guiding framework, but yesterday’s action provided an important signal about the Fed’s greater near-term concern. Inflation is running higher than the Fed’s 2% target, but the unemployment rate has climbed back above the Fed’s long-run full employment projection as shown above. Inflation remains a concern, but it’s the latter that has increasingly moved the Fed to ease policy. Job growth has slowed to a crawl since May, particularly in cyclical sectors, and a rising unemployment rate signals increasing slack in the labor market.

The decision to ease shouldn’t be interpreted as inflation no longer being a concern for policymakers. As outlined in our accompanying article, consensus expects inflation to rise over the next six months due to tariff-related pressures, then ease back toward 2% next year. The Fed’s updated projections acknowledge that potential but also signal a greater willingness to let inflation run higher for longer than previous forecasts indicated — opting to act preemptively to support a cooling labor market rather than waiting for inflation to reach its 2% target.

The bottom line? The Fed is walking a fine line — offering support while keeping policy at relatively restrictive levels for now as it attempts to balance the relative risk associated with its two objectives. Lower rates may help cushion near-term labor market softness and could also serve as a tailwind to capital markets, especially if the economy stabilizes and a recession is avoided. Did the Fed act quickly enough to provide that support? That remains to be seen, but most observers still view the near-term probability of a recession as quite low. If that’s the case, lower interest rates should provide a boost to growth and reassurance for equity investors.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.