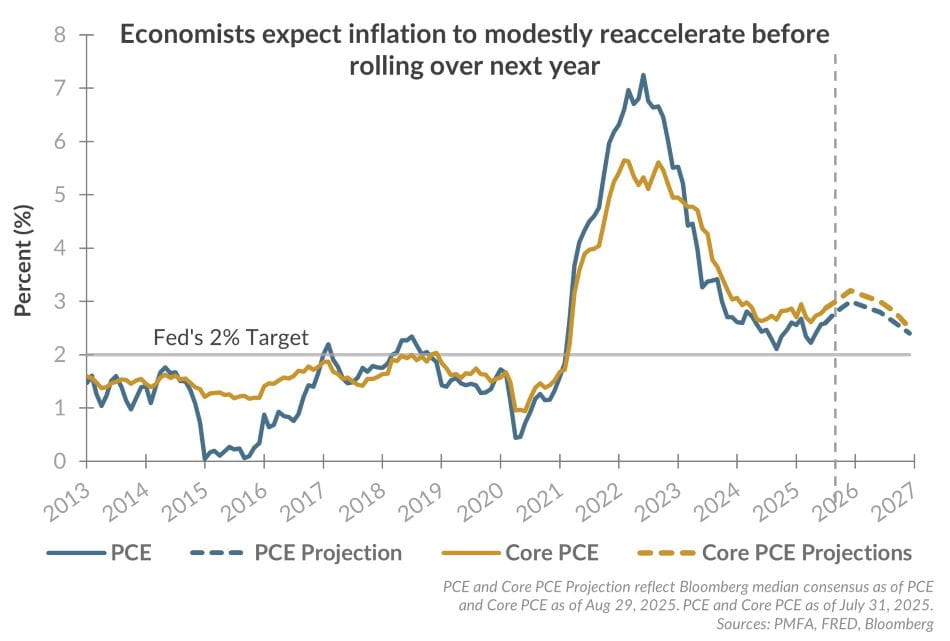

Inflation eased considerably since its 2022 peak, but it’s not “mission accomplished” for the Fed. Current figures remain above the central bank’s 2% target, and consensus estimates suggest a temporary reacceleration to the 3% range by late 2025 or early 2026 before receding back toward 2%. This uptick is expected to stem in part from tariff-related price adjustments — a reminder that inflation isn’t just about monetary policy, but also global trade dynamics as well as other sectors like healthcare and housing exhibiting persistent price increases.

The Fed continues to closely monitor inflation expectations since they can influence behavior, from wage negotiations to pricing decisions for businesses and purchasing decisions for consumers, and ultimately actual inflation. While survey data on expectations has been mixed, long-term market-based indicators like breakeven rates have remained relatively anchored. This suggests that investors still believe that, despite its persistence in recent years, the Fed will ultimately succeed in its inflation fight, reducing the potential for a self-fulfilling cycle of elevated inflation over the longer term. It also appears to give the Fed some flexibility to lower interest rates in the near term without triggering instability in financial markets.

For everyday Americans, the cumulative rise in prices since 2021 has impacted essentials like groceries, housing, and transportation. A return to the Fed’s 2% inflation target would relieve some of the pressure on household budgets and support long-term economic stability and healthier capital markets. While progress has been made, the final stretch may be the most difficult. The Fed must carefully balance its tools to avoid reigniting inflation without stifling growth. With yesterday’s announcement, policymakers confirmed that although they remain committed to their 2% goal, the path to get there continues to lengthen. For now, they appear ready to accept that. For both investors and consumers, staying informed and maintaining a long-term perspective remains essential.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.