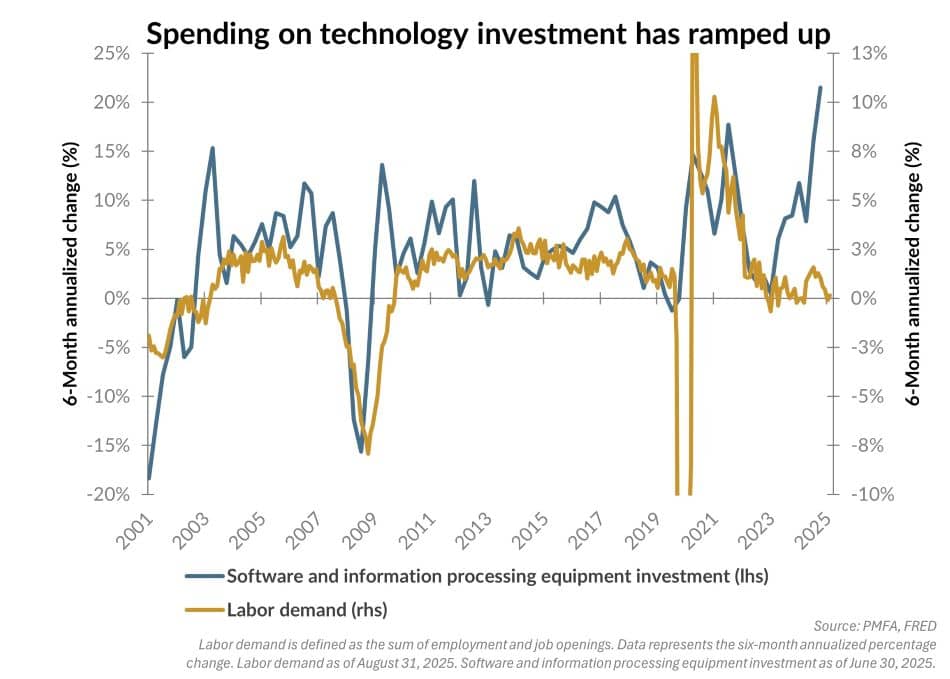

Recent trends underscore a significant development in the U.S. economy: capital expenditures on software and information processing equipment are contributing more to growth than at any point since the late 1990s. This surge is driven by rapid adoption and investment in artificial intelligence (AI) tools — a technological shift with profound implications for productivity and labor demand.

The massive ramp-up in investment in AI-related technology has been a key underpinning to growth this year. However, as shown in the chart above, this investment has coincided with a weakening labor market. Demand for labor has slowed notably, with total nonfarm payrolls and job openings roughly unchanged over the past six months. Hiring slowed considerably after the ”Liberation Day” tariff announcements as employers adopted a more cautious stance, but the shift may also signal a change in how businesses allocate resources. As firms seek productivity gains through technology, the need to hire for certain roles with tasks that can be automated may diminish. However, the degree to which AI will disrupt the labor market remains to be seen. The ultimate impact will depend on the pace of adoption and workforce adaptation.

What does this mean for the economy? While job creation has slowed and job openings have declined, layoffs have remained largely contained and unemployment has edged only fractionally higher over the past year. Looking ahead, continued investment and the potential for AI-driven productivity gains could help to sustain growth even in a tepid hiring environment.

For now, one conclusion is clear: The initial wave of AI investment is already having a meaningful impact on the economy. The intersection of technology and labor is emerging as a defining theme for the decade ahead.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.