The Tax Cuts and Jobs Act (TCJA), passed just a few days before the close of 2017, is a significant piece of tax legislation and affects nearly all contractors — no matter your size, specialty, market, or corporate structure. Most provisions apply to tax years ending after Dec. 31, 2017. Of note, many of the tax provisions related to individuals expire on Dec. 31, 2025, while most corporate tax provisions are permanent.

As with any tax change, what may seem simple on the surface tends to be much more complex as you get into the details. This complexity, while frustrating at times, can also provide a lot of opportunities for planning for construction companies.

Here is a summary of the key areas that could impact contractors:

Depreciation

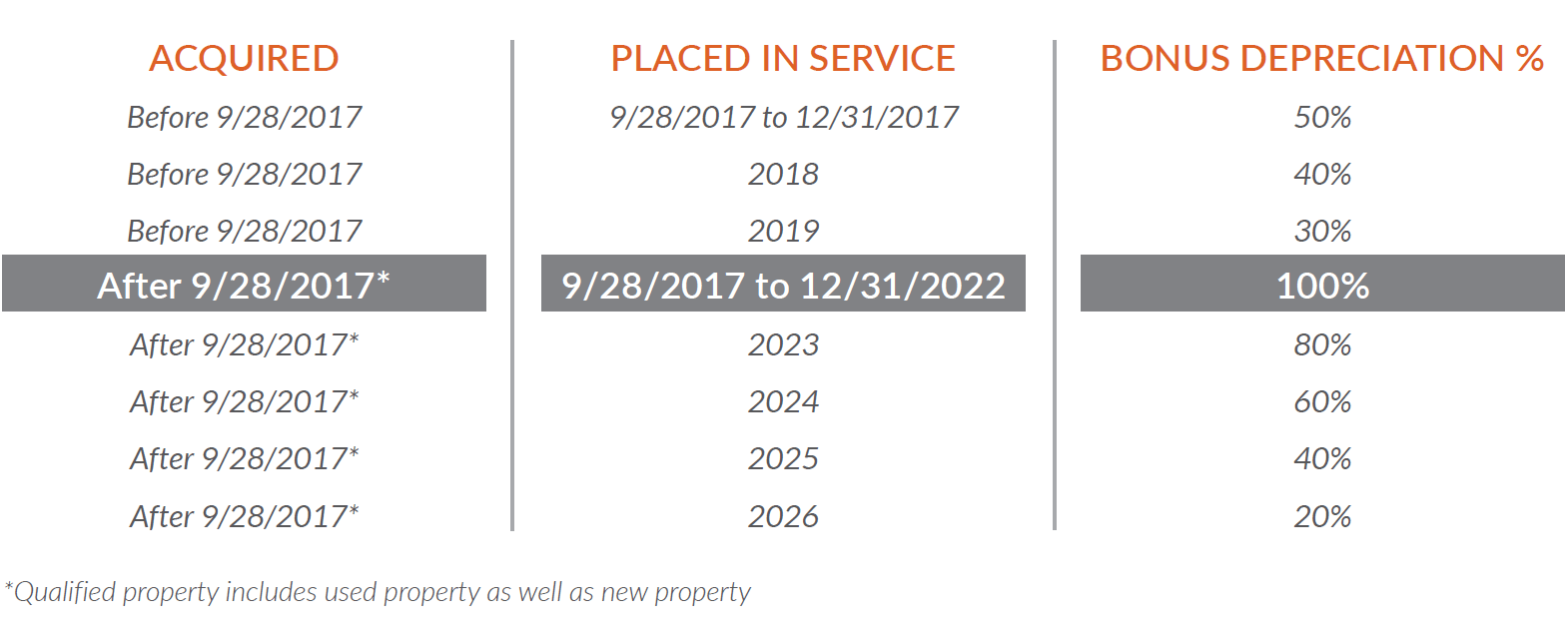

Significant changes are coming to depreciation rules, including an increase in bonus depreciation to 100 percent for qualified assets acquired after Sept. 27, 2017, through 2022, after which the bonus percentage decreases by 20 percent per year through 2026, until it reaches zero. Generally speaking, assets with a recovery period of fewer than 20 years will be subject to 100 percent bonus depreciation under the new law. See table on Section 179 expensing and bonus depreciation. Of special note is the fact that used equipment is now eligible for bonus deprecation, which was previously not the case.

Certain exterior real estate improvements now eligible for Section 179 expensing include roofs, HVAC systems, fire protection and alarm systems, and security systems.

For certain real estate businesses that elect out of interest expense limitations (see below), they will be required to use ADS depreciation, and do not get any bonus depreciation. ADS requires 40, 30, and 20-year depreciable lives as opposed to 39, 27.5, and 15 for nonresidential real property, residential rental property, and qualified improvement property, respectively. There are key planning opportunities to be considered to make sure maximum deductions can be enjoyed.

Like-kind exchanges

The major change to like-kind exchanges is the complete repeal of personal property exchanges. The code section now refers exclusively to real estate assets, “Exchange of real property held for productive use or investment.” Personal property assets that can no longer be exchanged include intangibles, such as broadband spectrums, fast food restaurant franchise licenses and patents, vehicles, machinery and equipment, artwork, and collectibles.

Entity tax changes

- Pass-through entities

The tax burden on owners, partners, and shareholders of S corporations, LLCs and partnerships — who pay their share of the business' taxes through their individual tax returns — will be lowered by a 20 percent deduction. The 20 percent deduction is prohibited for anyone in a professional service business — unless their taxable income is less than a certain threshold.

If the owner or partner in a pass-through also draws a salary from the business, those wages are subject to ordinary income tax rates. To prevent people from recharacterizing their wage income as business profits to get the benefit of the pass-through deduction, the tax law places limits on how much income would qualify for the deduction, as follows:

- W-2 wage limitation – The deduction cannot exceed the greater of:

- 50 percent of the amount of W-2 wages paid to employees by the business.

- 25 percent of such W-2 wages, plus 2.5 percent of the original acquisition cost of depreciable property.

- Both limitations phase-in for taxable income between $157,500–$207,500 for a single return and $315,000–$415,000 for a joint return.

Even with these limitations, there are plenty of planning opportunities to allow income to be taxed at more favorable rates.

- Corporations

The new law reduces the corporate rate to 21 percent from 35 percent, for tax years beginning after Dec. 31, 2017. The bill also repeals the alternative minimum tax on corporations. Fiscal-year corporations will use a prorated rate based on the number of days in the 34 percent and 21 percent tax years, respectively. While this lower rate may seem to be a driver for an entity change, corporations are still subject to double taxation, as well as state income taxes, while many pass-through entities are not subject to state taxation at the entity level. A careful analysis should be performed before changing the entity structure.

Business interest expense — A mathematical obstacle course!

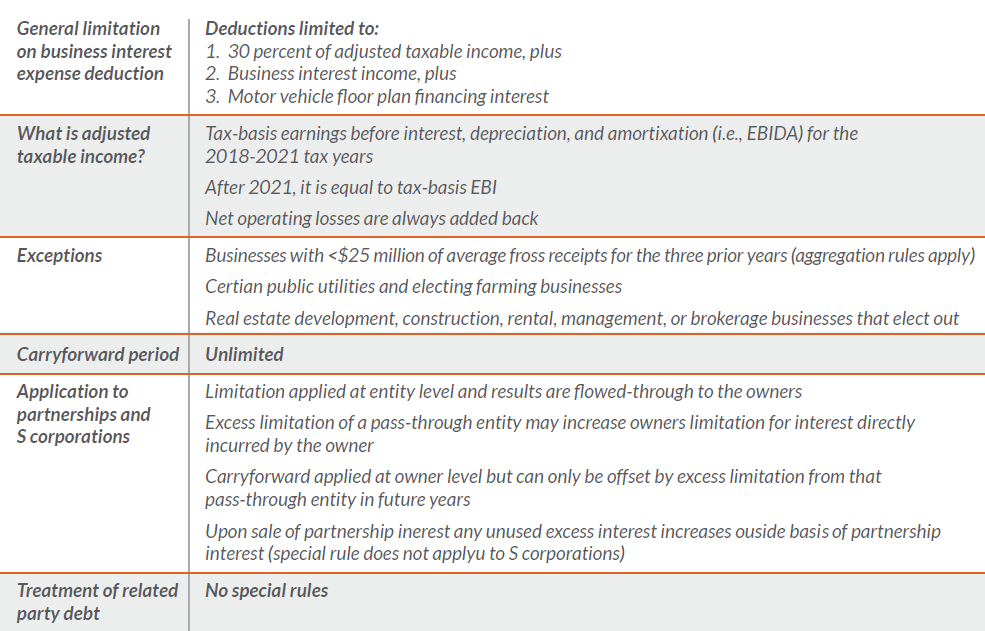

Under the TCJA, the deduction for business interest expense is limited to the sum of business interest income plus 30 percent of the “adjusted taxable income” beginning in 2018. Adjusted taxable income is defined roughly as a tax-basis EBIDA for the 2018 through 2021 tax years and tax-basis EBIT beginning in 2022 (meaning depreciation and amortization will no longer be added back in later years).

The limitation applies to both C corporations and pass-through entities. There will be exceptions for certain small businesses including real estate development and construction entities, such as those with less than $25 million in average annual gross receipts for the prior three years.

The table below summarizes some of the intricacies of the business interest expense analysis:

CAUTION: There is a trade off to be consider for real estate entities: Real estate entities can “opt out” of the business interest expense limitations, but they will have to forego the opportunity to take bonus depreciation and extend the useful life of their assets (slowing down depreciation expense). Careful computations will need to be performed to determine which approach is best — both today and looking forward to future years.

Small taxpayer method changes — Method of accounting

- Taxpayers with less than $25 million in average annual gross receipts over the prior three years can utilize the cash method of accounting.

- Also, taxpayers under the $25 million threshold above are exempted from long-term contract accounting, inventory accounting, and UNICAP/Section 263A.

Meals and entertainment

The tax law disallows the deduction of all entertainment expenses, which are currently allowed up to 50 percent for business-related entertainment. This also includes membership dues with respect to any club organized for business, pleasure, recreation, or social purposes. Meals provided to employees in facilities qualifying for de minimis fringe benefit treatment are now subject to a 50 percent limit as are meals associated with travel. This will require contractors to look at the money they spend on things like sporting event tickets and customer entertainment to verify (1) future deductibility and (2) if the cost is providing the business benefit.

Domestic production activities deduction

This has been eliminated for tax years ending after Dec. 31, 2017 for passthrough entities and Dec. 31, 2018 for C Corporations.

Net operating losses (NOLs)

While no one wants to have large losses, they do happen. Key changes under the new tax law will limit the ability to carryforward and use NOLs generated after Dec. 31, 2017, to 80 percent of taxable income. Therefore, the years of having large losses and not having to pay taxes for many years later are over — 20 percent of your income will still be taxed — at the rate applicable to the entity or individual.

Individuals

No tax discussion would be complete without commentary on the impact to individual taxpayers.

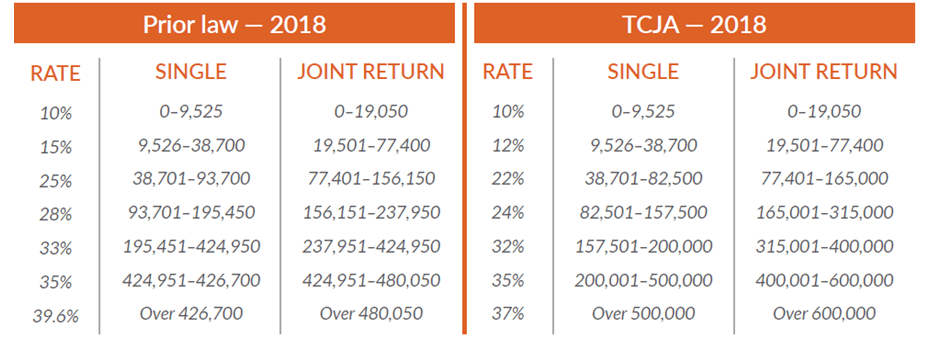

The individual tax brackets have been widened, and the top rate has been reduced from 39.6 to 37 percent. The “marriage penalty” was substantially reduced, but not eliminated in the 35 percent and 37 percent brackets. Like prior law, the TCJA includes phase-outs and catch-up provisions that would result in significantly higher effective tax rates at certain levels of income. The new tax brackets are shown below:

A summary of the key other changes are as follows:

- Eliminated personal exemptions

- Increased standard deduction from $6,500 to $12,000 for a single return, $13,000 to $24,000 for joint return

- $10,000 limitation on state and local tax deductions. This is the same for single and joint returns. This limit includes the combined real estate and state and local personal income or sales taxes paid.

- Mortgage interest deduction limitation changed from $1 million of mortgage debt to $750,000 for new debt incurred after Dec. 15, 2017

- Repeal of home equity interest deduction

- Elimination of miscellaneous itemized deductions

- Elimination of itemized deduction phase-out

- Increase in child tax credit from $1,000 to $2,000 and increase in phase-out thresholds to $200,000 and $400,000 for single and joint returns

- Alternative minimum tax (AMT) has been retained for individuals — but the exemption phase-out has been increased so that many taxpayers will now be able to claim an exemption that they could not under prior law

- Key item for business owners: Net business losses of individuals are only able to offset up to $500,000 of nonbusiness income ($250,000 for single filers). Excess is treated as a net operating loss carryforward, with no expiration

- Michigan – Keeping the personal exemption

- Michigan – 529 plans can be used in a new way to cover the cost of sending a child to a public, private, or religious elementary

While the new law is effective now, there are many corrections and clarifications expected over the coming months. Companies should work with the rules, as currently written, and consult with their advisors on the best way to take advantage of opportunities that exist and understand what the new tax law means to your organization and personal tax picture.