Transfer prices are a critical component managing multinational enterprises (MNEs). In all countries of operation, incorrect transfer pricing can lead to tax consequences that include suboptimal global effective tax rates, unexpected cash flow emergencies, costly and time-consuming tax audits, and tax adjustments, interest, and penalties. However, transfer prices don’t give “real” business information in any meaningful sense. The “transfer price” between related parties is an artificial value that’s driven almost entirely by tax considerations. Treating the transfer price as if it were an actual cost can lead to inappropriate management decisions by creating incentives for management and personnel behavior that aren’t based on actual economics.

Transfer pricing is a “plug” value

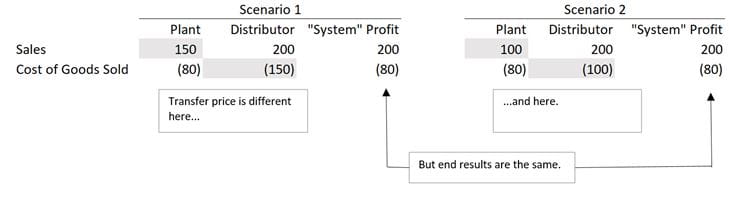

Consider a manufacturer selling to a related-party distributor in another country (below).

Here we have a manufacturing entity that purchases raw materials from third parties at market prices, transforms them into finished goods, and sells them to a related distributor in a foreign country at an internal transfer price for final resale to a third-party buyer at market prices. The plant’s cost of goods sold (COGS) — 80 — is a true third-party price, representing the market value of the resources purchased. In other words, this value is a true cost to the global company. The final resale price — 200 — is also a third-party price, representing the market value to the global company of the finished product; this is what a third party is willing to pay for the finished goods.

The transfer price between the entities (in gray) is a “plug” that’s selected purely for tax purposes and which disappears upon consolidation. The “system” P&L represents all market values, both cost and revenue, with the artificial intercompany transfer price being eliminated. Even when the transfer price is radically changed (from 150 to 100), the system profit doesn’t change because the transfer price has no economic meaning in itself. The value is artificial, in that, if we change the transfer price, the only implications are with the tax authorities; the overall profit situation doesn’t change.

When managers make business decisions that treat intercompany prices as “real,” they often create unnecessary headaches for themselves in two areas: human resources/performance management and make/buy decisions.

Transfer pricing isn’t a meaningful measure of personnel performance

MNEs seek ways to effectively hold entity-level and team-level managers and personnel accountable for their performance. In a well-run MNE, every entity or team would be measured against meaningful productivity metrics and against their contribution to overall profitability. But metrics that depend on transfer pricing aren’t meaningful measures of contribution or profitability because transfer prices are completely artificial, and are a tax-only concept.

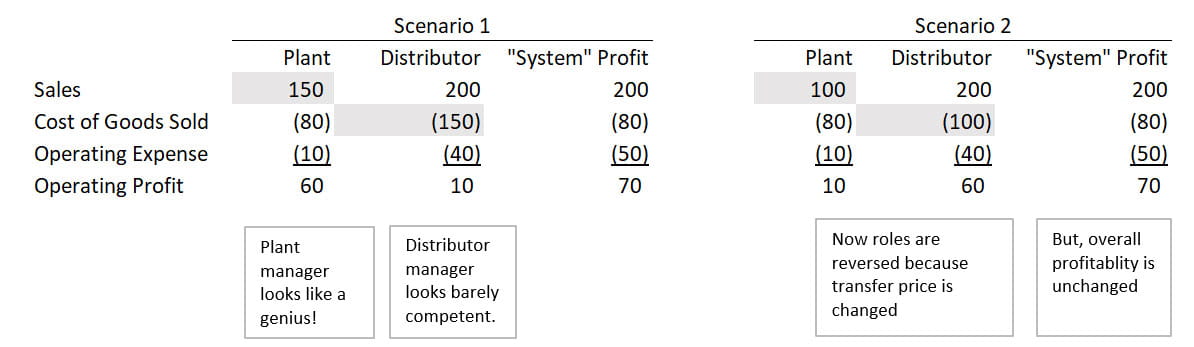

Returning to the earlier example, assume that the personnel and management of both the plant and the distributor are all compensated based on the operating profit of their legal entity.

In the first scenario, it appears that the plant is very profitable. Management concludes that the plant is exceptionally well-run, and since performance is measured by separate entity profitability, the plant personnel are well-rewarded. The distributor, on the other hand, has a low profit, and this entity’s personnel are rewarded accordingly. Looking at the system profit, we see that the MNE as a whole is also very profitable, but this information isn’t considered when evaluating personnel performance.

In the second scenario, the MNE is told by a transfer pricing advisor that the transfer price is too high, which creates tax exposure for the distributor. Consequently, the transfer price is adjusted; however, nothing changes in terms of performance or efficiency. Whereas under the new pricing, the plant personnel appear to have become much less efficient because their operating profit has plunged, while the distribution team now appears very effective and is rewarded based on the increased operating profit.

Understandably, the distribution team is delighted, while the plant personnel are angry. Team compensation has changed, but nothing in the underlying facts has changed other than the artificial transfer price. We can confirm that there wasn’t a change in the performance of the individual teams because the system profit (eliminating the transfer price) hasn’t changed at all.

It was essential to change the transfer price to correctly abide by the tax rules, but this meant nothing with respect to measuring the contributions of either the plant or the distributor. Nonetheless, the personnel at the plant are at risk of being disgruntled, poorly evaluated, and undercompensated under the new transfer pricing because of the misdirected focus on separate entity profitability.

In this situation, the MNE should consider alternative approaches such as:

- Evaluating manufacturing personnel and management based on cost reduction, subject to minimum quality or throughput standards.

- Evaluating distributors based on sales performance, subject to limitations on discounts and other sales incentives.

- Evaluating both sides jointly based on system profits.

- Evaluating based on separate books that assume a fixed internal price purely for internal benchmarking purposes, where this internal price isn’t connected with the transfer price for tax purposes.

MNEs that insist on measuring performance on separate entity performance metrics that are tied to the transfer price risk demoralizing their staff — or they could discover that protecting their staff makes it difficult to manage transfer pricing in an appropriate manner. The two concepts should be delinked.

Focusing on the transfer pricing can lead to irrational purchase or make/buy decisions

Cost can be an important element in selecting a vendor, but when considering related-party vendors, the transfer price to be paid can be a misleading metric of actual cost to the MNE as a whole.

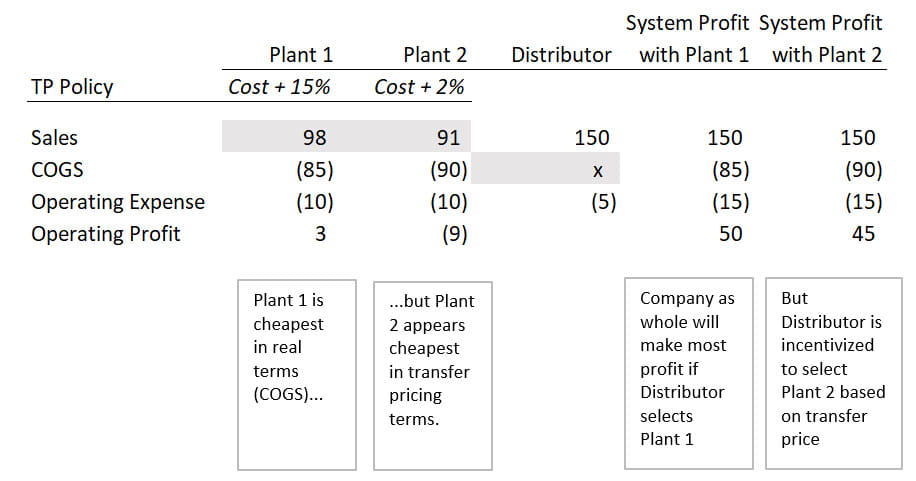

Consider the distributor (below) who can select between two related-party plants producing an identical good. Plant 1 has the lowest cost of production and is the optimal choice for the MNE as a whole to maximize profit. But if the distributor focuses on the transfer price paid to the plant, then the distributor may erroneously choose to purchase from Plant 2 because Plant 2’s transfer pricing policy has a much lower markup on cost. Plant 2 is a high-cost producer, but because the distributor focuses on the transfer price paid rather than the actual cost, selecting Plant 2 results in a lower profit for the group as a whole, which becomes apparent when comparing the system profits based on the two plants.

The scenarios with two related-party plants with different markups is a bit artificial, but imagine if Plant 2 is actually a third-party supplier. We wouldn’t know a third party’s cost structure, but we might still be tempted to compare the sales price ($91 versus $98) and choose the apparently lower-cost third party over related-party Plant 1. The correct comparison is the end price of the third party with the COGS of the related party ($91 versus $85). Focusing on the intercompany transfer price rather than the true underlying values leads to an unfavorable purchase decision.

Conclusion

When correctly administered, transfer pricing is an essential component of managing a multinational enterprise; however, transfer prices shouldn’t be treated as though they contain meaningful economic value or financial information. Basing management and performance metrics on the transfer price risks incorrectly measuring performance and spuriously rewarding or punishing entities and teams — which, unfortunately, creates incentives for making suboptimal purchase decisions.