The Tax Cuts and Jobs Act (TCJA) changed the rules for deferring gains on the sale of business assets. It modified an existing provision (Internal Revenue Code Section 1031, or “1031”) that permits taxpayers to defer taxes on gains if they replace an asset with like-kind property via a “like-kind exchange.” The new law also created an additional option for deferral known as “Opportunity Zones.”

As with most tax-planning opportunities, the answer will depend on the specific facts and circumstances of the taxpayer in question.

Following is an overview of some similarities and differences between the two provisions and highlights areas where one option might be preferable over the other.

Property eligible for deferral upon sale

1031

- As of Jan. 1, 2018, only real property held for production of income in trade or business or for investment, regardless of location in the United States.

Opportunity Zones

- Any property that generates capital gain upon sale, including stocks and real property.

- At this time, we anticipate that only the portion of the gain taxed as capital gain (long term and short term) is eligible for deferral.

Advantages

- Opportunity Zone: Greater range of property eligible for gain deferral.

Property eligible for reinvestment

1031

- As of Jan. 1, 2018, only real property held for production of income in trade or business or for investment, regardless of location in the United States.

- Must be like-kind property.

- Stock and partnership interests are not eligible.

Opportunity Zones

- Tangible property (real and personal) used in a trade or business, substantially all of which is located in a designated Opportunity Zone.

- No like-kind requirement.

- Original use of property in the zone must commence with the Qualified Opportunity Fund or the Fund must substantially improve the property.

- Tangible property can be owned directly by the Fund or by a corporation or partnership owned by the Fund.

Advantages

- 1031: Geographic flexibility within the U.S (not restricted to distressed areas). Can be existing property without substantial improvements.

- Opportunity Zone: Greater range of property eligible for investment.

Timeline

1031

- Identify replacement property within 45 days.

- Close on replacement property within 180 days.

Opportunity Zones

- Invest in Qualified Opportunity Fund within 180 days. The Fund then is allowed additional time to invest these funds into Qualified Opportunity Zone Property.

Advantages

- 1031: Options available to identify and acquire replacement property before sale of existing property.

- Opportunity Zone: Eliminates intermediate step of identifying replacement property. Allows more time for purchase of replacement property.

Required amount of reinvestment

1031

- Entire proceeds from sale (including proceeds used to repay debt) are required to be reinvested to achieve 100 percent tax deferral.

Opportunity Zones

- Only the capital gain from the sale needs to be reinvested.

Advantages

- Opportunity Zone: Allows the taxpayer to use proceeds allocated to basis without restriction.

Access to proceeds

1031

- Proceeds of sale cannot be available to the taxpayer and must be held by a “qualified intermediary” until invested in replacement property.

Opportunity Zones

- The proceeds from the initial sale are not directly traced and are available to the taxpayer until the gain is invested in a Qualified Opportunity Fund.

- The Fund then acquires Qualified Opportunity Zone Property.

Advantages

- Opportunity Zone: Taxpayer has access to proceeds for up to 180 days before investing in a Qualified Opportunity Fund.

Timing of deferred gain recognition

1031

- When replacement property is sold, unless another like-kind exchange is used or the gain is invested in a Qualified Opportunity Fund.

- Deferral also reverses through reduced depreciation since basis is reduced by the deferred gain.

Opportunity Zones

- Deferred gain recognized at earlier of sale of Qualified Opportunity Fund or Dec. 31, 2026.

- Deferral could effectively reverse earlier if losses from Qualified Opportunity Fund are deferred due to basis limitations

Advantages

- 1031: Longer potential gain deferral. No phantom income. Ability to continue to defer gain (e.g., via a subsequent 1031 exchange)

Exclusion of gain via basis step-up

1031

- Generally none as original basis of relinquished property carries over to the replacement property.

- Asset is stepped-up to fair market value at death when passed to an heir.

Opportunity Zones

- 10 percent of original gain if Qualified Opportunity Fund held for five years before Dec. 31, 2026.

- 15 percent of original gain if Qualified Opportunity Fund held for seven years before Dec. 31, 2026 (5 percent additional exclusion for 2 additional year hold).

- Elect to step-up basis in Qualified Opportunity Fund upon sale to fair market value after 10-year hold.

- Original gain cannot be excluded via a step-up in basis upon taxpayer’s death.

Advantages

- 1031: Original gain can be excluded upon death of taxpayer. More flexibility in structuring sale of replacement property.

- Opportunity Zone: Permanently eliminate up to 15 percent of initial capital gain. Permanently exclude gain from sale of Qualified Opportunity Fund investment from tax.

State and Local Taxes

1031

- The vast majority of states conform to the federal tax treatment of 1031 exchanges.

- The states that do not conform (e.g., CA, MA, PA,VT) either disallow the deferral, require the replacement property to be in the same state, or impose a clawback provision that triggers tax when the replacement property is sold.

Opportunity Zones

- State and local conformity with Opportunity Zone gain deferral and exclusion provisions differs by jurisdiction and may change over time as states update their tax code to incorporate or decouple from the provisions of the TCJA.

- The state and local treatment may depend upon facts such as the taxpayer’s state of residence, the type of property sold, the location of property sold, and if the taxpayer is a corporation or individual.

Advantages

- Consult your tax advisor to determine which deferral provision is more beneficial for state and local tax purposes.

Related party transactions

1031

- Can acquire replacement property from related party, but triggers a two-year holding period requirement.

- Can sell relinquished property to related party without holding period requirement

Opportunity Zones

- No deferral on gain from sales to related parties

- Restrictions on Qualified Opportunity Fund purchases of property from related parties with 20% common ownership.

Advantages

- 1031: Can defer gain on sale to a related party.

Expiration

1031

- None

Opportunity Zones

- Dec. 31, 2026

Advantages

- Tax law is always subject to change. There is currently a House bill proposed to extend Opportunity Zones.

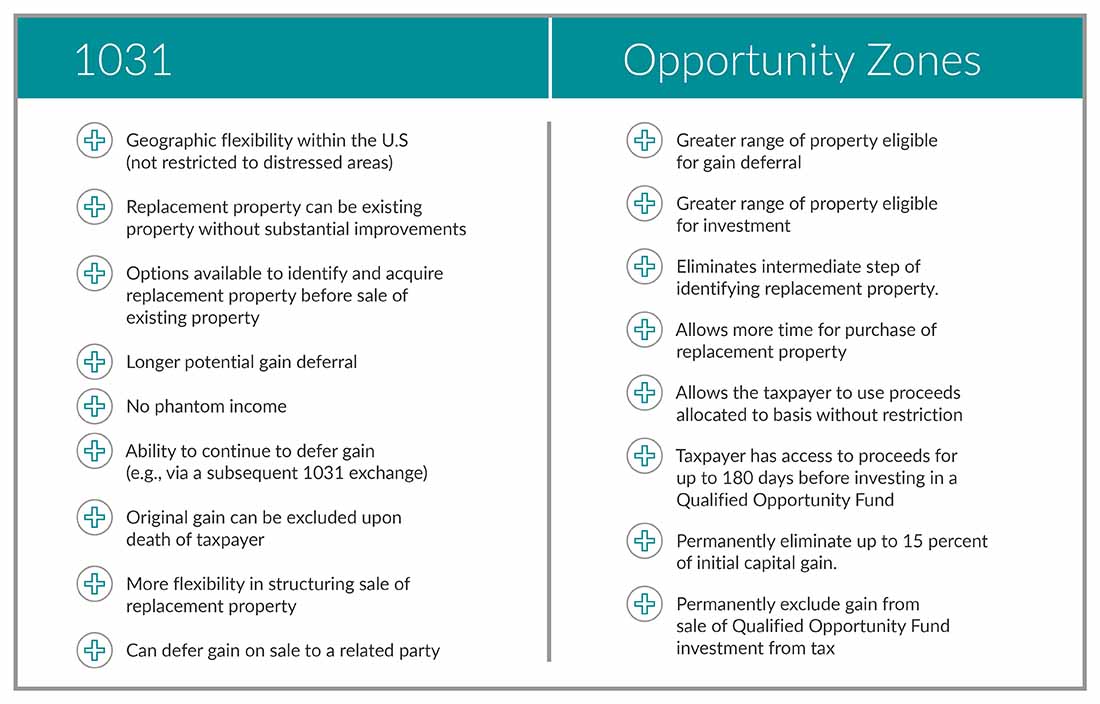

Following is a summary of the advantages of each deferral provision:

These tables provide you with a basic understanding of two options available to defer gain and their respective advantages. Each situation is unique, and having two alternatives with both similarities and differences provides options for taxpayers. One option may be more ideal for a specific fact pattern. Alternatively, some situations can provide optimal deferral opportunities by using a combination of both like-kind exchanges and Opportunity Zones. For example, a Qualified Opportunity Fund could utilize a 1031 exchange to help extend the holding period of its investors beyond the 10 year minimum required to exclude gain from the sale of their interest in the Fund.

If you’re considering a sale of real estate that will result in a gain and are interested in deferring the tax consequences, please give us a call so we can help determine the best tax strategy for your situation and assist you with properly structuring the transaction.