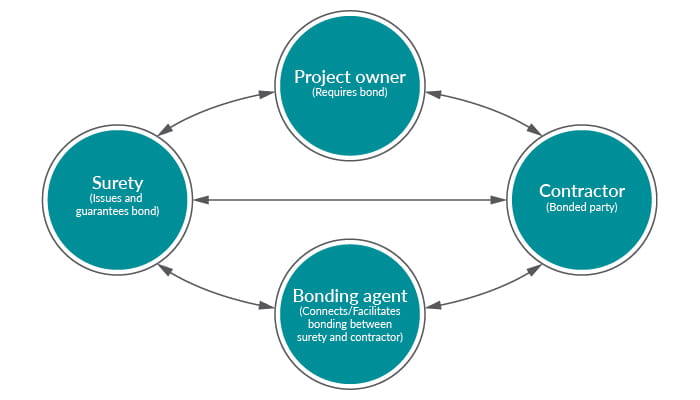

Bonding is a three-way relationship between an owner, a contractor, and a surety (a company that issues a bond).

For certain construction projects, especially governmental, quasi-governmental, and larger commercial jobs, bonding is a necessity; however, there’s no guarantee that a contractor will be able to secure it. A contractor must convince a surety that it meets certain requirements, some of which can take time to get in order. That’s why construction company owners and managers need to think about bonding now rather than later when a project that requires a bond it is about to bid or construction is supposed to start.

Fortunately, well-run companies are likely to be very close to meeting the requirements. There are several specifics that bonding companies and their agents look for, and several ways companies can position themselves most favorably.

The three Cs

Traditionally, bonding companies have looked closely at the “three Cs:” character, capacity, and capital to qualify contractors for surety capacity.

- Character: Ultimately, bonding companies want to know that a contractor will do the job they were hired to do and honor their various business obligations, including repaying debts. These qualities encompass a contractor’s character. To make their best determination, sureties assess the company’s reputation and record of previous performance, business and personal credit records, payment practices, and may seek out relevant references. Many sureties also prefer to hold face-to-face meetings and jobsite visits to gauge the character of business owners and to witness their operations firsthand.

- Capacity: Bonding agents are more likely to obtain bonding for a contractor when they can demonstrate to a surety that the company has the resources, skills, and experience to perform the work. Resources and skills consist of crew, equipment, and tools, and experience includes previous work under similar circumstances, such as project location, scope of work, complexity, and project owner.

- Capital: There is a proportional relationship between the size of project a contractor wants to bond and the required strength of their balance sheet. To be considered for bonding, a construction company must have strong financials, including sufficient working capital and equity. While working capital equals current assets minus current liabilities, some current assets may be weighted differently in the calculation. For example, accounts receivable are generally considered current assets, but if any accounts receivable are aged over 90 days, they will most likely be discounted or removed when calculating working capital. In addition, costs in excess of billings is a current asset that’s sometimes removed altogether in the working calculation given that it can be an indication of contract issues on a project. Inventory and prepaid expenses are also typically discounted or removed, given that these current assets are considered less liquid. The owner’s personal financial situation is also a factor for capital; sureties will consider an owner’s personal liquidity and debt as part of their overall qualification of a contractor for surety capacity.

Two additional Cs, communication and collaboration, are highly important as well:

- Communication: It’s important for a contractor to stay in close communication with the bond agent throughout the year, regarding financial information, job schedules, and any major changes within the business.

- Collaboration: Bond agents and sureties prefer that contractors work with banks, insurance companies, attorneys, and CPAs who know the construction industry and are willing to work together toward the company’s success. A good bond agent will assist in the collaboration of all of these key advisors. Provided each knows and understands the unique risks and challenges of the construction industry, it will improve the contractor’s ability to run a successful business.

Next steps

Securing adequate bonding capacity takes time and effort and requires building a strong relationship with a professional bond agent and surety company. Contractors need to meet with their agents throughout the year to establish or further develop such relationships. Contractors should be prepared to provide internal financials and contract schedules throughout the year; disclose potential or actual transactions that could impact their capital; and be proactive about communicating operational issues, such as job problems or losses.

Contractors should also focus on strengthening the company’s balance sheet by staying ahead on billings whenever possible to minimize financing the project for the owner. Other smart moves include being diligent with collecting receivables, including project retainage, and with any potential new debt and equity transactions. Construction company owners should determine a reasonable amount of equity to have in the company based on the relative size of the balance sheet and income statement by working collaboratively with their bonding agents, CPAs, bankers, and attorneys throughout the year.

Build trust

The relationship between a contractor and surety is built on trust. Construction companies can do many things to proactively build that trust and increase their bonding capacity. Because building trust takes time, contractors should take steps now to get their companies’ financials and other factors in order and share this information regularly with their bond agents, CPAs, and other service providers. This approach can help contractors avoid a last-minute scramble to secure bonding higher limits of surety capacity for their future success.