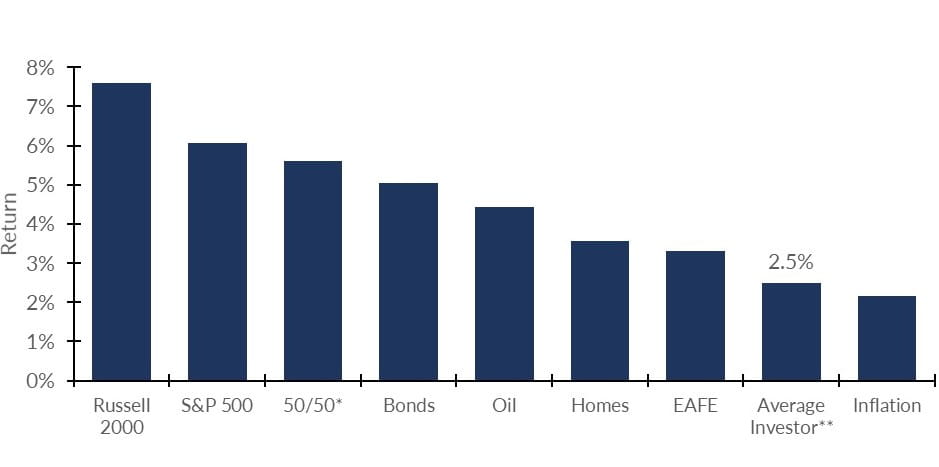

Without a plan, it’s hard to navigate a storm. It’s human nature to react to recent news, be it positive or negative, and forecast it into the future. That emotional response to market volatility is part of why the average investor has underperformed virtually every asset class over the last 20 years.

NOTES: *Average investor return is based on analysis by Dalbar Inc. which utilizes the net aggregate mutual fund sales. redemptions and exchanges each month as a measure of investor behavior for period ending 12/31/2019. Source: PMFA, Morningstar Inc., JP Morgan

At the peak of a bull market, investors are typically euphoric. But as soon as things take a turn (as they always do), euphoria gives way to despair. Disciplined investors know to be patient and stay the course — markets cycle, and conditions will eventually improve. Unfortunately, many investors lack that discipline, which is why the average investor consistently underperforms buy and hold strategies.

That’s where investment guidelines come in. Guidelines take emotion out of the equation and protect both institutional and individual investors from reactionary decisions. Crucially, they can also offer continuity to investment committees serving as fiduciaries on behalf of an organization or institution. Committees turn over, and when new members join, they’ll need to understand the investment strategy. Investment policies should tell the story of why you’re investing in a particular manner. Without the context that this documentation provides, committees may not buy in to the existing investment approach and suggest changes that may be detrimental to the long-term plan.

What to consider when creating your investment policy

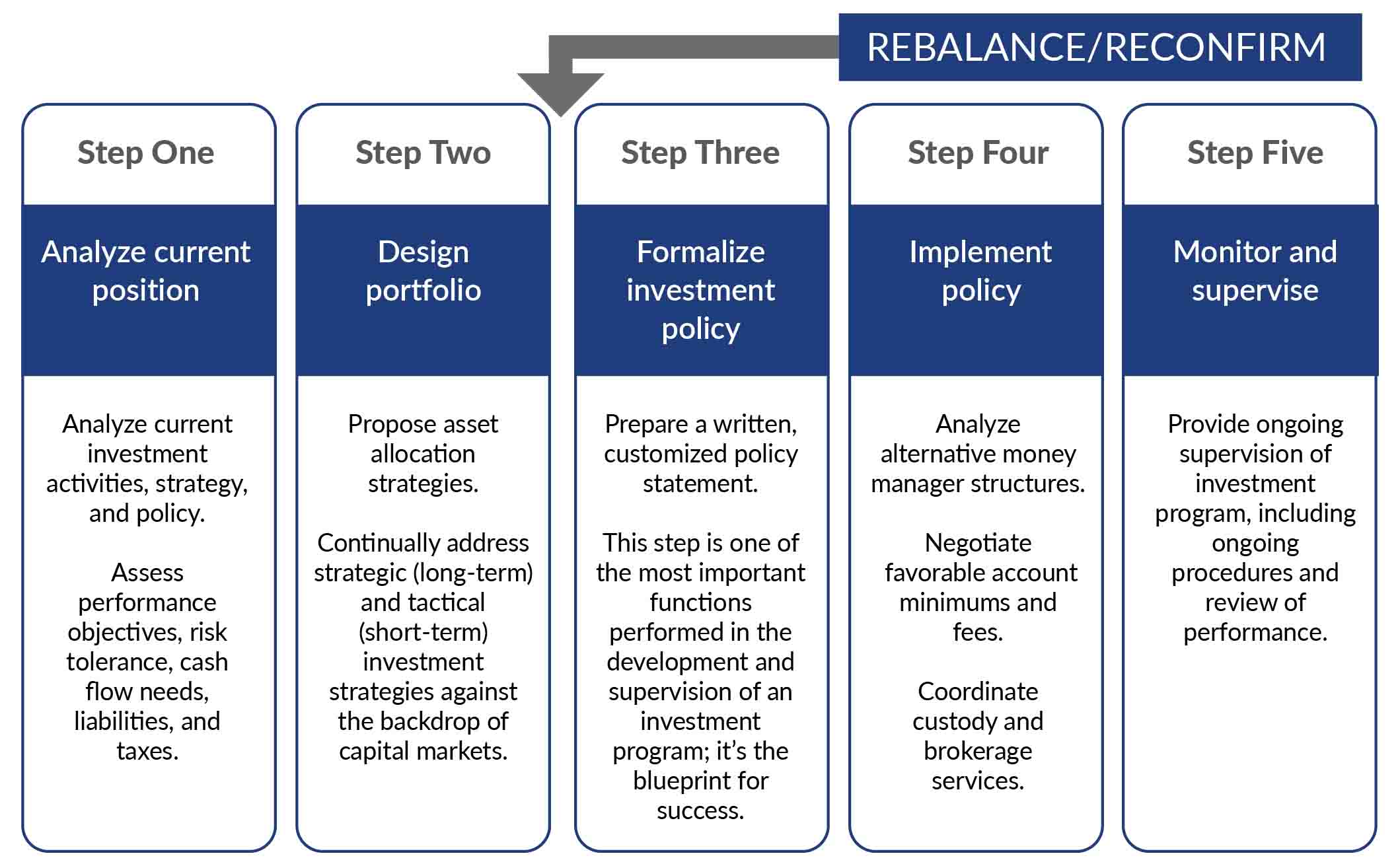

When creating guidelines, first consider your current position — that’s step one of the disciplined investment management process. What’s your risk tolerance? Over what time horizon will the assets be needed? How much income needs to be generated? How have you reacted to prior market volatility? What is your current tax situation? The answers to these questions will inform step two, which is to build a diversified portfolio to meet your investment goals and objectives.

Caption: The disciplined investment management process

Step three is to formalize the investment policy — document the philosophy, the plan, the goals, and the roles. This will promote consistency over time, even amid committee turnover. Documenting a policy requires a delicate balance. Too much detail can be unnecessarily restricting and might mean the guidelines aren’t honored. It’s better to create guidelines you can stick to. Keep guidelines flexible, but not so flexible that they don’t provide any control.

For instance, we often see policy statements that show allocation thresholds that are too broad, like equity investments with a target of 50% that can range from 20 to 80%. This range is so broad that it can allow for market timing — not exactly a disciplined approach. Tighter controls provide less opportunity to derail a long-term investment strategy in volatile times. At the very least, the investment policy should require the committee to put appropriate effort and reflection into any decision to change the investment strategy.

It’s also important to consider whether there are proper checks and balances within your investment structure, which can be achieved by making sure your custodian, advisor, and manager(s) are all independent. These lines are often blurred, and many people don’t have a clear understanding of exactly how, or how much, all three of these parties are being paid. Not to mention the conflicts of interest that can arise when one provider serves multiple roles.

Monitoring and honoring your guidelines

Honoring guidelines is, arguably, the most difficult part of the process because long-term plans require patience. Volatility and periodic underperformance in the short run are basically a given, but they can scare people into making changes at the exact wrong time.

Changes to an investment policy should only be made when your goals and objectives, or your circumstances, have changed. For instance, let’s say an institution has invested money for the “long run,” but a construction project pops up and they now need to spend those assets within the next 18 months. Given that the time horizon for the funds has changed, the strategy will also need to change.

Conversely, market volatility alone isn’t a reason to change investment policy. Typically, if one asset class experiences a period of extreme downside, the disciplined investment process would suggest that you rebalance the portfolio back to targets by buying into the underperforming asset class. That’s why the policy is in place — to help guide such decisions.

Through this process, you may realize that your tolerance for risk is significantly lower than you anticipated when the policy was created. Generally, when setting investment policy, you should understand the short-term volatility — particularly volatility to the downside — associated with your investment portfolio. Saying you can withstand a market downturn, and actually living through one, are two very different experiences. This, among other things, is why it’s important to revisit your investment policy at least once a year. Reassess your tolerance for risk, and confirm your investment strategy is still appropriate.

Suffice it to say, creating and honoring investment guidelines has long been a well-established way of helping fiduciaries meet their investment objectives through a disciplined process. Said another way, investors should have a well-thought-out plan that they stick with, unless their circumstances change.