After two consecutive months of record-breaking nonfarm payrolls – one being incredibly poor and the second, surprisingly good — the June report is yet another for the record books. And once again, the news is good.

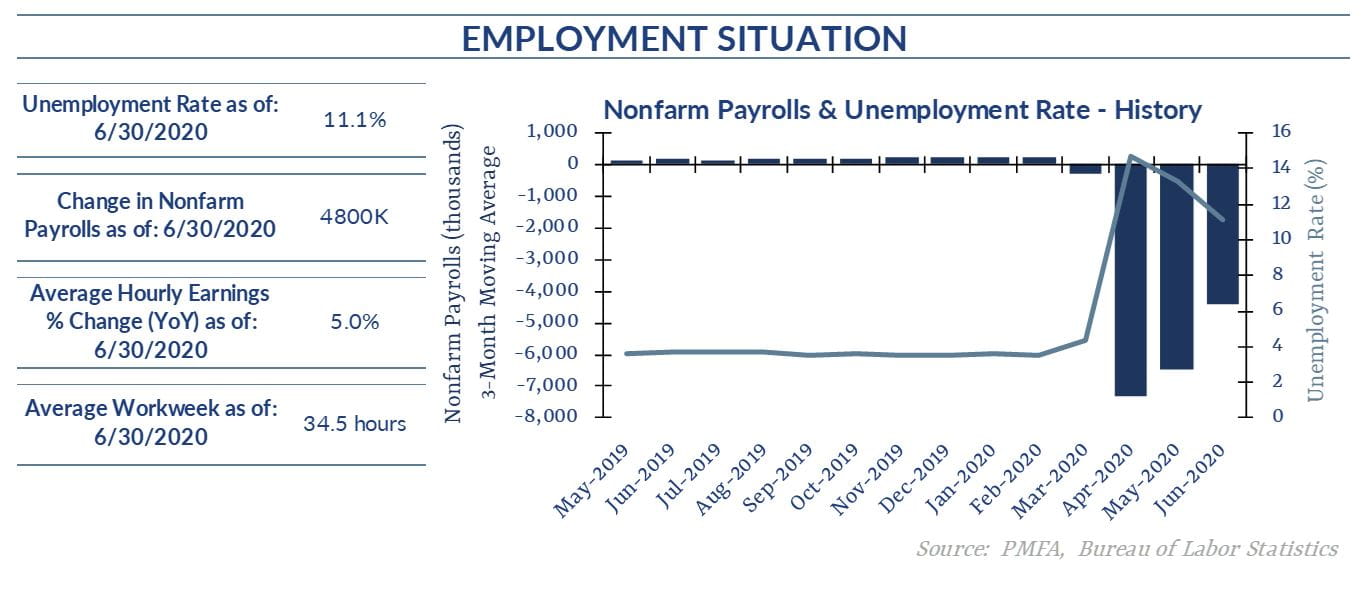

The monthly change in nonfarm payrolls reached 4.8 million in June, far surpassing expectations for a gain of 3 million. Revisions to the preceding two months trimmed previously reported losses moderately.

The sizable gain in payrolls last month drove unemployment down to 11.1%. The jobless rate had soared to 14.7% in April — a level not seen since the 1930s. Directionally, that was expected, but forecasts were for a less pronounced decline to around 12.5–13.0%.

Job gains were broad-based again in June, but heavily weighted toward areas that were among the hardest hit as the economy was shut down. Nearly 2.1 million jobs were added in leisure and hospitality; the two-month gain of nearly 3.5 million still accounts for only about half of the jobs lost in April. Similarly, 740,000 jobs were added in retail trades lifted the two-month increase to 1.1 million — a large number, but one that still leaves half of the 2.3 million workers sidelined in April out of work.

When viewed in isolation, June’s record amount of jobs added to the economy would be hard to believe. However, when taken in context of April’s massive job losses, it’s clear that the United States is still a long way from seeing the kind of labor market at the beginning of the year. This aside, an increase in payrolls is good news for the economy and an additional sign that a recovery may be underway.

The risk, and a significant reason for caution, is the dual threat posed by surging outbreaks of COVID-19 across the country and the policies that will be employed to attempt to arrest the spread of the virus. Already, restrictions that had been lifted in some areas of the country are being reimposed, while other regions that hadn’t yet fully experienced the first wave are clamping down.

It’s quite possible that the economy could take a step back as the effects of those restrictions are felt. The gains of May and June have provided reasons for optimism, but the underlying cause of the economic weakness — the health threat posed by COVID-19 — still exists and has surged anew in recent weeks.

The path back from any economic shock or recession is never an unambiguously positive straight line; this one won’t be either. So far, the recovery has exceeded expectations. Whether it can continue will hinge almost exclusively on the balance between policies taken to manage the virus from further spreading with the detrimental effects those policies have on consumers, businesses, and workers.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis non-factual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.