First, the bottom line: Q2 growth was good but with a big asterisk

- Coming off a negative Q1 print, an expectations-topping rebound in growth in Q2 may alleviate some concern about the near-term runway for the economy. The underlying sources behind the strong Q2 growth pace are nuanced though and arguably less rosy than the headline growth number would suggest.

By the numbers: Whipsaw from trade, a significant growth tailwind in Q2

- The trade deficit remains in the crosshairs as the Trump administration continues to advance discussions with the country’s trade partners. Beyond the forward-looking policy impact, uncertainty surrounding trade policy was a major driver of GDP volatility in the first half of the year. The impact of the whipsaw effect in trade was clear again in Q2, but unlike in Q1, it provided a boost to GDP.

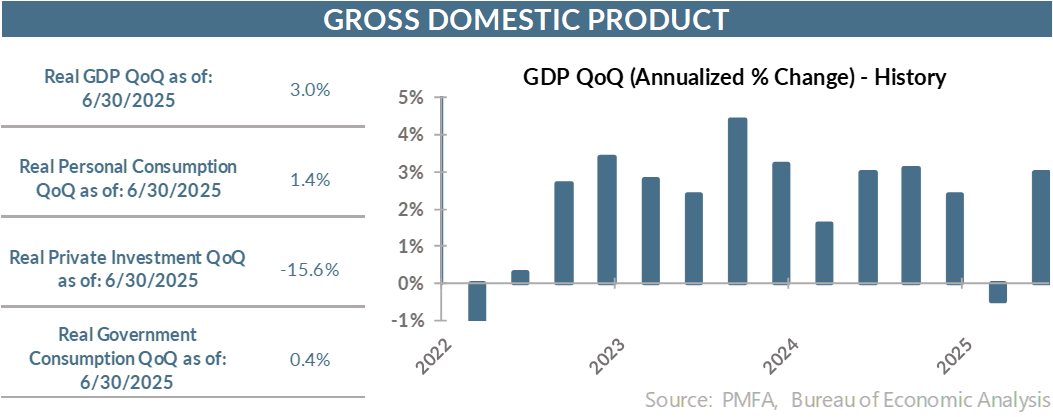

- The economy grew at a solid 3.0% clip in the second quarter, topping forecasts, as the first-quarter headwind from trade turned to a tailwind in recent months.

- The backdrop wasn’t universally positive though, as personal consumption expenditure growth remains subdued, rising at a tepid 1.4% annualized rate. That topped the 0.5% Q1 advance but was still soft by recent measures — a sign that consumers were increasingly thinking twice about opening their wallet to spend.

- Final sales to domestic purchasers grew by a moderate 1.2%. Given the noise in the trade and inventory numbers since January, that may provide a better indicator of the underlying growth trend — one that illustrates more clearly a weaker consumer backdrop and more limited contribution to GDP. The Q2 increase was easily the softest since Q4 2022.

- Whether it’s the cumulative impact of rising prices in recent years, weaker job creation, slowing wage growth, or a general wariness about the pace of developments and uncertainty concerning their economic impact, consumers have become more restrained in spending since the end of last year.

Trade noise is fading; consumer spending will return to center stage

- Tariff frontrunning in Q1 shaved 4.6% off growth in Q1 as businesses attempted to build up inventories in anticipation of higher costs ahead. That reversed in Q2 as imports fell sharply, providing a 5.0% boost to GDP, offset by reductions in inventories that knocked down top-line growth by 3.2%.

- The net impact of falling imports and declining inventories was significant to second-quarter GDP in both a qualitative and quantitative sense. Those factors alone lifted GDP by 1.8 percentage points — a material piece of the 3.0% growth pace for the quarter.

- Qualitatively, the disruptive effect of trade and inventory management masks comparatively lackluster consumption, contributing to the potential for a “strong growth” narrative that belies weakness in the primary spending engine for the U.S. economy.

- It’s the mirror image of Q1, where those same factors tipped top-line GDP growth into negative territory, arguably exaggerating the loss of momentum early this year.

- With more trade deals being reached and greater certainty on the tariff front, it’s likely that the worst of the whipsaw effect from imports and inventory stockpiling is behind us.

- As the focus on trade recedes and businesses adapt to the new tariff regime, attention should return to the state of U.S. consumers — their mindset and their willingness and ability to spend — to assess the economy’s strength and direction in the months ahead.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.