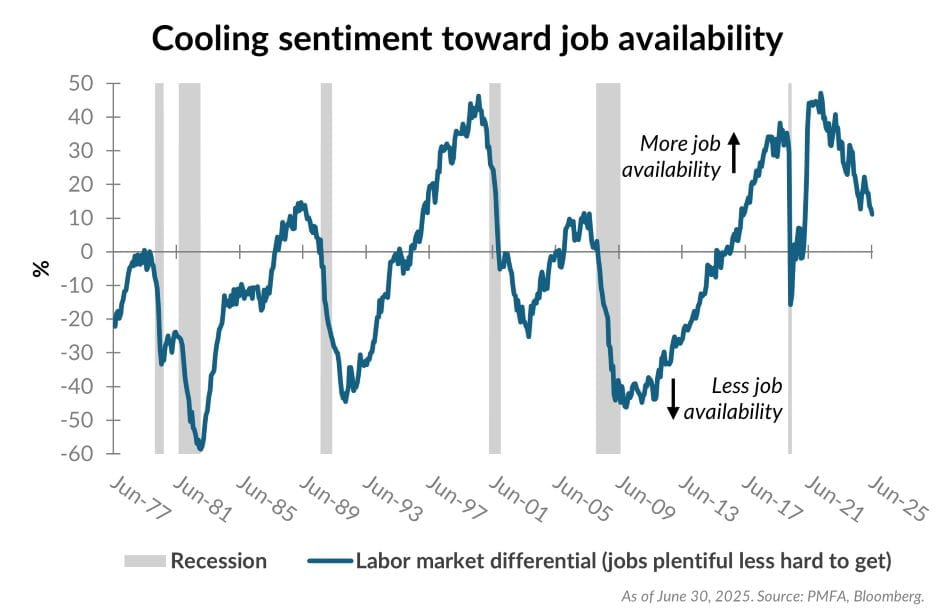

Recent surveys, including that on Consumer Confidence from the Conference Board, reveal a nuanced view on labor conditions. While unemployment remains low and job creation, despite slowing, has remained solidly positive, households appear increasingly less optimistic about the ease of finding a job. The share of people who believe jobs are “plentiful” has declined steadily over the past three years, while the share of those who say jobs are “hard to get” has ticked higher. The difference between these two — referred to as the labor market differential — is shown in the chart above. An upward trend indicates an increasingly positive outlook, whereas a downward movement represents a waning optimism or even growing pessimism.

This shift in sentiment doesn’t always correlate with a weak labor market — it may instead signal moderating conditions and growing caution. Factors like inflation, policy uncertainty, and headlines surrounding layoffs in specific industries can heavily influence public perception. By several measures, the overall labor market remains fairly tight. Wage growth, while slowing, is still above its pre-pandemic trend, and the supply of unemployed workers and hiring demand are relatively balanced.

While the labor market remains reasonably solid, public perception is cooling. For investors, this divergence between sentiment and data is worth watching. Shifts in consumer confidence can influence future spending behavior, which in turn affects broader economic momentum. The disparity between actual conditions and consumer perception can be resolved in multiple ways. It’s possible that consumers have become excessively pessimistic; that mood could improve if labor conditions stabilize or improve. Conversely, a cautious consumer may signal a pause — or even a turning point — in the cycle, a potential precursor to slower job creation ahead.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.