The Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Families First Coronavirus Response Act (FFCRA) have provided considerable tax relief in the form of employer tax incentives, easing and technical corrections of provisions enacted as part of the Tax Cuts and Jobs Act of 2017 (TCJA), and other favorable federal tax provisions for businesses and individuals.

In many cases, these federal changes will lead to additional changes at the state and local tax (SALT) level. It takes SALT authorities time to issue guidance or enact legislation that will conform or decouple their rules, where necessary, to the tax provisions and consequences of the CARES Act and FFCRA. Here are some of the high-level SALT issues for taxpayers to consider during preparation of original or amended tax returns and as part of tax planning.

Conformity with federal law

Much of the SALT impact of the CARES Act and FFCRA derives from the fact that many states have tax codes that are based on the federal Internal Revenue Code (IRC). “Rolling IRC conformity” states effectively adopt all provisions amending the IRC automatically. In those states, the new provisions would be effective in the state’s tax law at the same time they are effective at the federal level. A rolling conformity state would need to take some kind of legislative or administrative action to decouple from specific provisions in order for them not to apply in the state.

“Fixed IRC conformity” states maintain their tax law based on the IRC in effect as of a certain date, so any changes made to the IRC by the CARES Act or FFCRA would not carry through to the state level until the legislature takes action. Often, when a fixed conformity state updates its reference to the IRC to a version in effect on or after recent changes like the CARES Act, the update might apply only for current and future years. This can lead to confusion when it comes to CARES Act provisions that have retroactive effects. Each state may take its own approach on how those changes will apply retroactively for state purposes. The bottom line is that until a fixed conformity state updates its tax code to conform with the IRC in effect as of a date on or after the CARES Act or otherwise adopts the CARES Act provisions, the federal impact of the CARES Act needs to be eliminated at the state and local level.

Qualified improvement property

Due to a technical error in the TCJA, qualified improvement property (QIP) has been ineligible for both 100% bonus depreciation and a 15-year recovery period since 2018. The TCJA also required that this asset class be depreciated over a 40-year life span. The new legislation corrects these errors, making QIP eligible for 100% bonus depreciation and depreciable over a 15-year recovery period. The change is retroactive to the effective date of the TCJA.

The federal correction will generally apply in states with rolling conformity currently and rolling conformity in all years since enactment of the TCJA. However, some rolling conformity states have provisions in their tax codes that decouple from bonus depreciation. Others may choose to enact legislation to decouple from this change. To the extent a rolling conformity state decouples from bonus depreciation, the state impact of the technical correction to the IRC will be to accelerate state depreciation using the new TCJA 15-year recovery life for QIP versus the previous 39-year life. The state tax base would need to be modified to back out any federal bonus depreciation claimed.

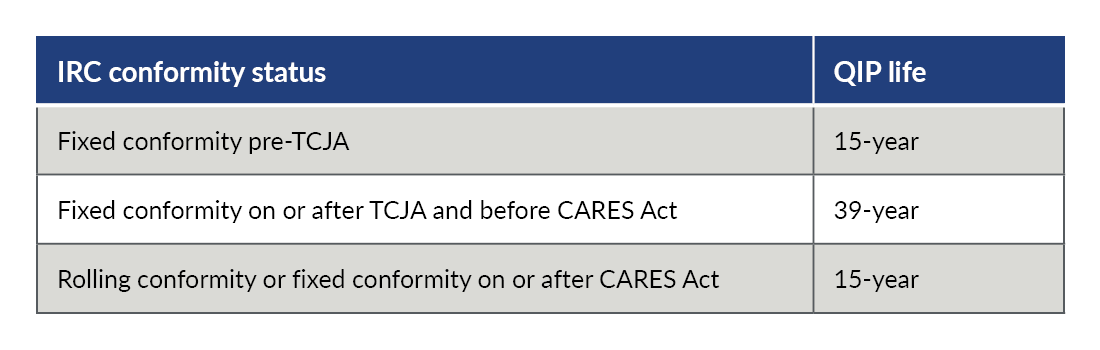

Fixed conformity states will generally fall into one of two groups. One group encompasses states with a fixed conformity date effective on or after the TCJA but before the CARES Act. For this group, state depreciation for QIP will need to be calculated using a 39-year life. The second group is states with a fixed conformity date effective before the TCJA or after the CARES Act. Here, state depreciation will need to be calculated using the depreciation rules in effect as of the IRC conformity date referenced in state law.

State fixed asset and depreciation records may need to be adjusted to back out federal bonus depreciation or Section 179 expensing, and they may also need to calculate QIP depreciation with different recovery lives.

The chart below reflects the general treatment of QIP based on a state’s IRC conformity. This chart doesn’t consider any state-enacted changes to follow or decouple from the federal treatment enacted by TCJA or the CARES Act, nor does it address state modifications related to bonus depreciation.

Increase to TCJA interest expense limitation

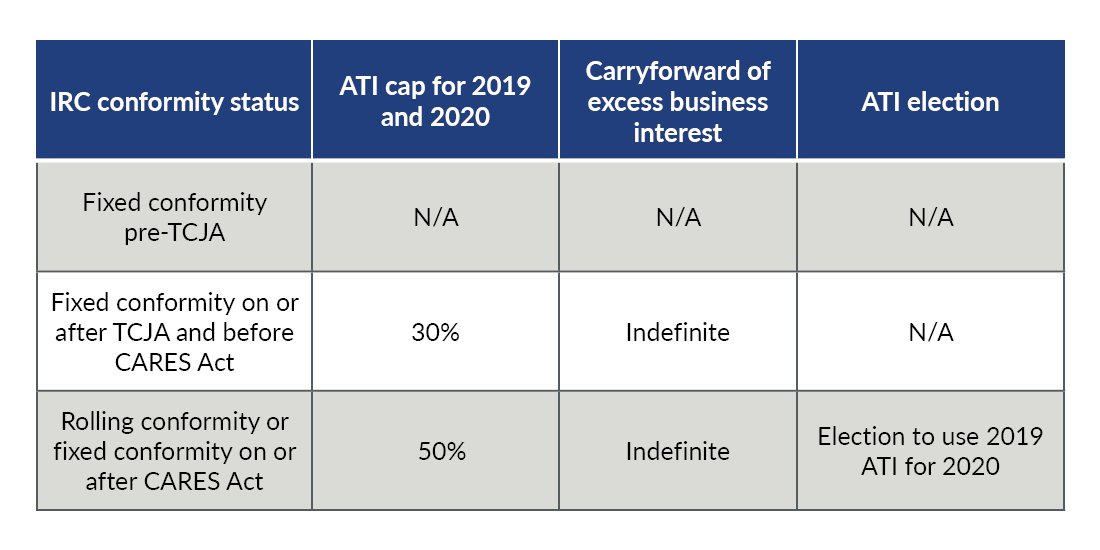

The CARES Act modified a provision enacted under the TCJA that limits the deductibility of business interest. The change is in effect only for 2019 and 2020, and it generally provides businesses greater interest expense deductions. This is accomplished by increasing the limitation from 30% of adjusted taxable income (ATI) to 50% of ATI. Again, rolling conformity states effectively adopt this favorable change for 2019 and 2020 unless the state decouples. For fixed conformity states, the effective conformity date referenced in state law will impact the deductibility of interest expense.

The chart below reflects the general treatment of the interest expense limitation based on a state’s IRC conformity. This chart doesn’t consider any state-enacted changes to follow or decouple from the federal treatment, whether those were enacted before or after the CARES Act.

As state tax revenue collections diminish due to economic conditions and state-granted payment relief, more states are likely to decouple from the interest expense limitation relief as well as other federal provisions aimed at reducing taxpayer burden. For example, New York has rolling conformity but has enacted S.B. 7508, effective April 3, 2020, to decouple from the 30 to 50% increase in the interest expense limitation.

Net operating loss (NOL)

The CARES Act included a provision allowing businesses to carry back net operating losses (NOLs) on a limited basis; most states have their own specific NOL rules. In these states, the NOL claimed federally is generally a state tax base addition. Then, to the extent available, a state-based NOL subtraction is allowed. However, some states piggyback the federal NOL or require a federal NOL to be utilized as a condition of utilizing a state NOL. Most states don’t provide NOL carryback. For those that do, a separate state election may be required if the taxpayer prefers to forgo a carryback. As federal NOLs are created or carried back, it’s necessary to carefully examine the state’s treatment.

Excess business loss limitation

The TCJA limited the ability of individuals to utilize business losses to offset nonbusiness income. Specifically, net business losses could only offset $250,000 of nonbusiness income for a single individual or $500,000 if married filing jointly. The resulting excess business losses were then treated as NOLs carrying forward to the next tax year.

The CARES Act suspends the application of this loss limitation until 2021 and makes other technical corrections that will not apply until 2021. This means that losses that were treated as excess business losses in 2018 or 2019 will need to be updated to correct such treatment. There is no federal election out of this provision, so its application is mandatory.

The suspension of the loss limitation will apply in rolling conformity states, absent state legislation to decouple. Conversely, taxpayers filing in a fixed conformity state with a conformity date effective on or after the TCJA, but before the CARES Act, will need to apply the TCJA loss limitation unless the state previously decoupled from this TCJA provision. The CARES Act suspension of the loss limitation won’t impact states with a fixed conformity date effective before the TCJA that didn’t enact a provision to conform with the TCJA’s business loss limitation.

PPP loan forgiveness

The Paycheck Protection Program (PPP) has provided over $525 billion in SBA loans to eligible businesses. The loans provide cash-flow assistance through 100% federally guaranteed loans to eligible employers who maintain their payroll during the COVID-19 emergency.

Proceeds may be used for covered expenses, including payroll (such as paid sick, medical, or family leave and costs related to continuation of group healthcare benefits), mortgage payments, rent, utilities, and certain other existing debt obligations. Amounts used for covered expenses will effectively convert to a grant and only accrued interest will have to be repaid.

The CARES Act provides that forgiven loan proceeds under the PPP aren’t taxable gross income for federal income tax purposes. Specifically, the CARES Act states “for purposes of the Internal Revenue Code of 1986, any amount which (but for this subsection) would be includible in gross income of the eligible recipient by reason of forgiveness shall be excluded from gross income.” In April 2020, the IRS issued Notice 2020-32 that deemed the corresponding expenses as nondeductible expenses attributable to tax-exempt income. In recent months, the American Institute of CPAs (AICPA) as well as many business and trade organizations have asked congressional leaders to change that position and allow the corresponding expenses as deductible.

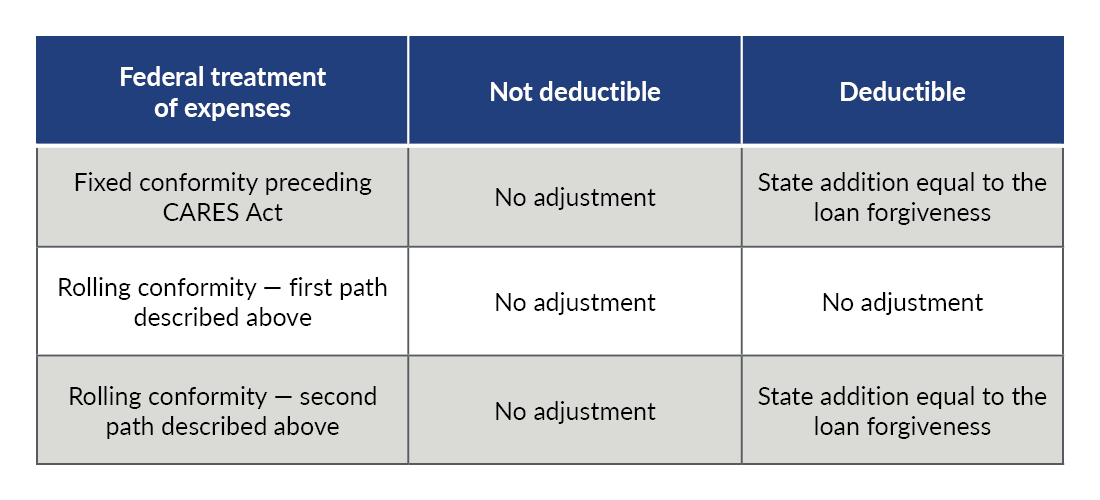

Most states have yet to issue any guidance on whether the forgivable PPP loan proceeds are taxable, or if the federal treatment will be honored at the state level. Fixed conformity states with a conformity date preceding the CARES Act are likely to determine the loan forgiveness is taxable income under the version of the IRC that applies in the respective state. In this case, the expenses funded with the loan proceeds would generally be deductible at the state level, but, as discussed previously, may not be federally. If both the loan forgiveness and the associated expenses are excluded in determining federal taxable income, yet both the loan forgiveness and the expenses are included in determining state taxable income, the net effect is the same. The only instance that’s expected to cause a difference in the federal tax base and the state tax base for pre-CARES Act fixed conformity states is if expenses funded by the loan proceeds remain deductible for federal purposes.

Rolling conformity states could take one of two paths. The first path is to follow the federal treatment on the basis that federal taxable income or federal adjusted gross income, both of which exclude the PPP forgiveness from the tax base, is the state tax base starting point. The second path would treat the PPP forgiveness as state taxable income on the basis that the CARES Act provides for the loan forgiveness directly without amending the IRC.

Due to the present uncertainty related to the federal deductibility of expenses funded by forgivable PPP proceeds, your business could benefit from preparing federal taxable income projections under two scenarios; one assuming the expenses aren’t deductible and one assuming they are deductible. Below are the current recommended state adjustments to the two federal projection scenarios in the absence of specific guidance issued by a state.

Other CARES Act considerations

States have also started to address the tax treatment of other provisions of the CARES Act in their jurisdictions. For example, the California Franchise Tax Board updated its COVID-19 Frequently Asked Questions (FAQs) page to provide information on the following:

- Economic impact payments: Economic impact payments that individuals receive from the federal government under the CARES Act aren’t subject to California income tax.

- Increased unemployment compensation benefits: The emergency increase in unemployment compensation benefits that individuals receive under the CARES Act aren’t subject to California income tax.

- Early withdrawal penalty waivers: California conforms to the federal waiver of early withdrawal penalties for distributions from qualified retirement accounts under the CARES Act.

State and local tax considerations beyond the CARES Act

Nexus, apportionment, and withholding related to telecommuting employees: Risk and opportunity

In general, telecommuting employees would normally create nexus in the states where they work unless there is an exemption. Because most states are requiring nonessential employees to work remotely during the pandemic, employers may be creating state tax nexus in more states. That nexus could apply to business taxes in the jurisdiction and also to state and local taxes withheld from employee pay. Working remotely can also impact business and individual local income taxes. For example, consider the situation where an employee normally works in Cleveland, which taxes an individual’s income, but works remotely at home in a location that doesn’t impose an income tax.

Some states have addressed whether telecommuting employees create income tax nexus due to COVID-19, and more guidance is expected in the future. Employers should undertake an evaluation of employee work locations in order to mitigate exposure where possible, comply with tax requirements where necessary, and to identify beneficial opportunities (e.g., reduction to sales factor throwback for clients selling tangible goods).

State return filing and payment relief

Many states and local authorities have followed the IRS’ lead and provided filing and payment relief to taxpayers for their state and local income tax returns and payment obligations. Some states have extended tax payments for all taxpayer types, but others have extended relief only to targeted groups (for example, Illinois did not defer partnership payments).

In conclusion

As the country continues to work through the challenges of the COVID-19 pandemic, state legislatures will be making additional decisions about the applicability of federal relief in their jurisdictions. If you have any questions about the relief discussed in this alert or about future actions taken by your state, please contact your Plante Moran advisor.