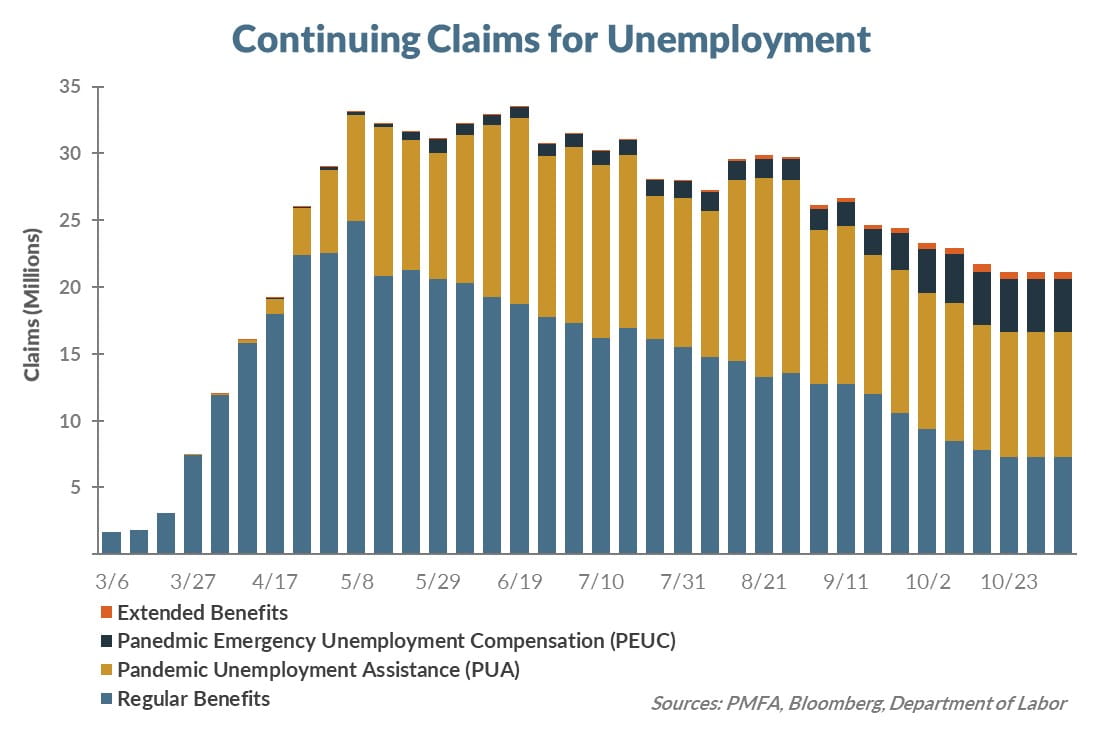

The ongoing COVID-19 pandemic has taken a significant human toll, while affecting day-to-day life to varying degrees. Those changes have also impacted the U.S. economy with widespread effects on businesses and consumers across the country. Of particular note is the disruption to the labor market, as millions of workers faced layoff — either temporary or permanent. Despite the significant gains since May, more than 21 million Americans are still collecting unemployment benefits, down from the peak of approximately 35 million earlier this year.

The ongoing COVID-19 pandemic has taken a significant human toll, while affecting day-to-day life to varying degrees. Those changes have also impacted the U.S. economy with widespread effects on businesses and consumers across the country. Of particular note is the disruption to the labor market, as millions of workers faced layoff — either temporary or permanent. Despite the significant gains since May, more than 21 million Americans are still collecting unemployment benefits, down from the peak of approximately 35 million earlier this year.

Government policymakers sought to soften the impact of job losses by providing enhanced unemployment benefits to bridge the financial gap for many households that experienced a loss of income. As the chart illustrates, a majority of benefits being collected today are from two pandemic-specific programs: Pandemic Emergency Unemployment Compensation (PECU) and Pandemic Unemployment Assistance (PUA), both of which expire at year-end. Without an extension of benefits, the economy could be faced with an income cliff that could add further pressure to an economy where the newest wave of COVID-19 is forcing many states to initiate lockdown measures.

While bipartisan support for further fiscal stimulus still seems clear, the devil is in the details: how soon, how much, and who will benefit are all critical questions yet to be answered. However, with further lockdowns likely to constrain economic growth and over 60% of unemployment benefits set to expire, policymakers should be motivated to find a compromise — a critical step to sustaining the recovery.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.