For many businesses, growth leads to operations in other countries. What starts off as a few transactions outside of the United States often turns into a significant focus of management efforts and a considerable revenue stream. If things go well, executives will probably end up facing some fairly complex decisions about creating a new entity in the foreign country and determining how the business will treat that entity from a U.S. tax perspective. Similarly, if things have gone well, there may come a point where it makes sense to reevaluate and possibly revise the global entity structure that has grown up around the company.

These decisions will need to be based on the individual circumstances of each business, and those circumstances will include the tax rules in the foreign countries where the business operates. Nevertheless, it helps to have an overview of some of the key considerations from the U.S. end of things. An understanding of some of the basic concepts is the first step toward creating an efficient global organizational structure that works effectively from an operational, legal, and tax perspective.

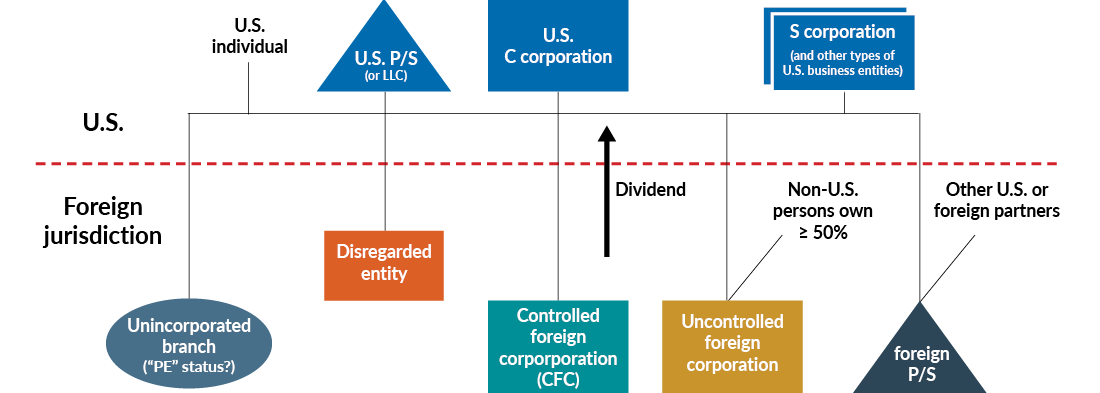

Global entity structure

As this graphic shows, the U.S. operation can be run as a sole proprietorship, partnership/LLC, S corporation, or C corporation. The foreign operation can be an unincorporated branch, a disregarded entity, a controlled foreign corporation (CFC), an uncontrolled foreign corporation, or a foreign partnership. It all seems pretty basic until you start to talk about the potential tax consequences of the choice of entity in the United States and overseas.

Until recently, the choice of an entity structure to support overseas operations traditionally boiled down to whether the business wanted to defer U.S. taxation of foreign earnings and profits or not. The use of unincorporated branches, disregarded entities, and some forms of partnership generally resulted in real-time flow through of foreign income to the U.S. business. Foreign corporations and some partnerships afforded the U.S. business some control over when, if ever, foreign earnings would be repatriated and subjected to U.S. income taxes.

Global tax provisions affecting U.S. businesses

Some changes introduced by the Tax Cuts and Jobs Act (TCJA) have made the global tax landscape more complicated for U.S. businesses operating overseas and, in some cases, limited their ability to hold earnings offshore beyond the reach of U.S. taxes. The changes include:

- Global intangible low-taxed income (GILTI), which requires businesses to pay some tax on amounts earned overseas in excess of a deemed return on tangible assets. A variety of elections are available to corporations and individuals to manage the impact of the new tax, but the overall intent of the provision is to prevent U.S. businesses from permanently keeping valuable income streams offshore.

- Foreign-derived intangible income (FDII), which offers a lower U.S. tax rate to businesses as an incentive to sell, lease, or license products and provide services to foreign persons. (The combined addition of GILTI and FDII to the tax law has made intellectual property one of the most important components of cross-border tax planning.)

- Dividends-received deduction, which has been modified to permit 100% deduction for certain dividends that a qualified U.S. corporation receives from a foreign corporation in which it holds at least a 10% ownership stake.

- Restrictions on restructuring under Internal Revenue Code (IRC) Section 367 that effectively serve as an exit tax on assets leaving the United States. The new law’s repeal of an “active trade or business” exception has limited some options for tax-efficient restructuring of a business’s global tax entity structure. In effect, this TCJA change put a little more financial pressure on businesses to get their global structure right the first time around as it makes restructuring more complicated and potentially more expensive.

These provisions operate alongside the existing foreign tax credit provisions in the IRC that attempt to give businesses credit for foreign taxes paid on income earned outside of the U.S. Complex changes have been made to the existing foreign tax credit provisions as a result of the new rules described above and require careful attention.

Seeing the big picture

Any one of these provisions could affect the choice of entity structure when you’re looking to formalize your business operations in another country, and all of them should be considered together when planning your global growth strategy. Proper global structuring can minimize the global effective tax rate of the business, provide operational efficiencies, and improve exit strategies. To learn more about structuring your business interests outside of the United States with a focus on tax efficiency and simplicity, please contact a Plante Moran advisor.