The Consolidated Appropriations Act, 2021 (CAA) signed into law on Dec. 27, 2020, included a host of energy-related tax initiatives aimed at stimulating renewable development projects across a broad array of sectors and applications within the industry. What follows is a closer look at the extensions and enhancements in the CAA that were specifically focused on wind, solar, and carbon sequestration.

Wind energy credits

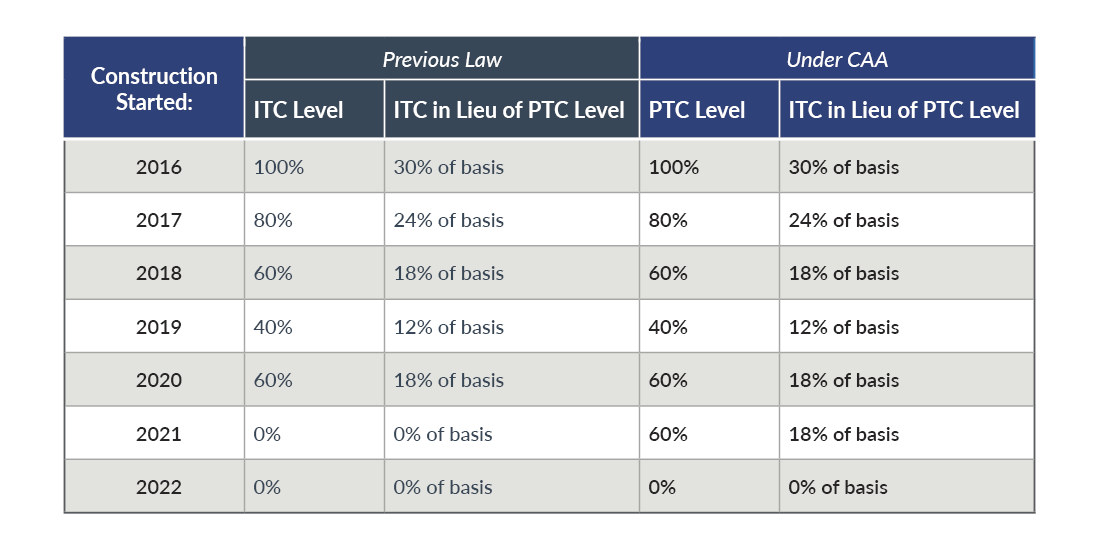

Wind projects can benefit from either the production tax credit (PTC), based on the kilowatt-hours produced by the project over a ten-year period, or the investment tax credit (ITC), based on the cost of certain equipment placed in service during the taxable year. The CAA extended the date by which qualified onshore wind projects must begin construction in order to qualify for either credit by a year, from Dec. 31, 2020, to Dec. 31, 2021. The new law also extended the credits at their 2020 levels, as shown in the table below. Unless these provisions are extended by future legislation, the credits will be unavailable for onshore wind projects that begin construction after Dec. 31, 2021.

The following table summarizes the effects of the CAA on the PTC and the ITC in lieu of the PTC for onshore wind projects:

Offshore wind projects got additional support from the CAA as well. The new law extends the availability of the ITC at 30% for projects that begin construction before Jan. 1, 2026.

IRS guidance for businesses claiming these credits has also shown a willingness to allow for construction delays that may have arisen as a result of COVID-19 supply chain issues. Notice 2020-41 added an extra year to the four-year “continuity safe harbor,” so that if projects begun in 2016 or 2017 are placed in service in five years, construction will be deemed continuous. Notice 2021-05 went even farther for offshore projects, more than doubling the continuity safe harbor from four years to ten for these ventures.

Solar energy credits

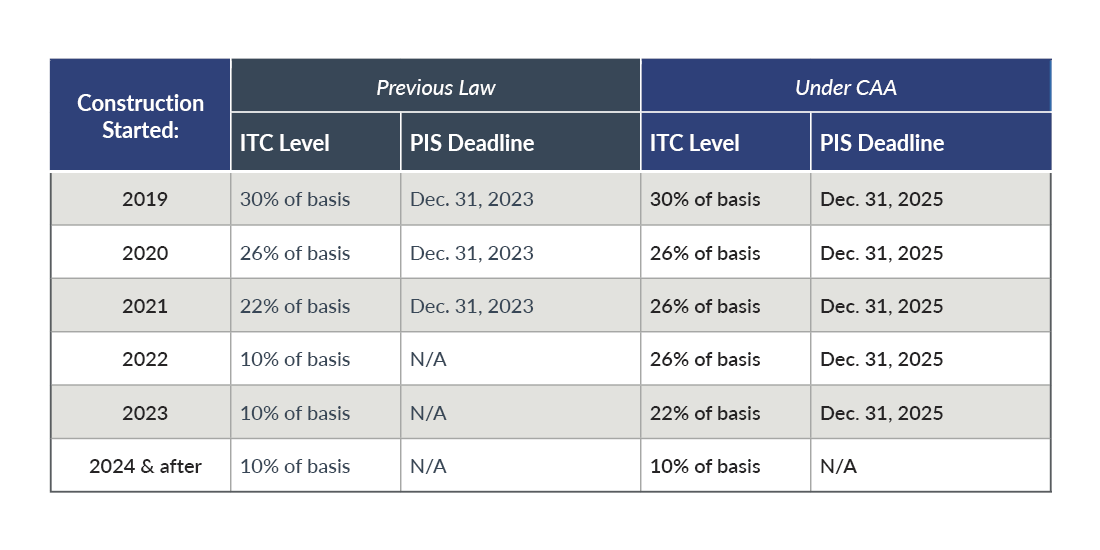

While the energy production tax credit is no longer available for solar energy products, this sector continues to benefit from the ITC. The CAA forestalled scheduled reductions in the solar energy credit percentage, extending the 2020 level of 26% to projects under construction before Dec. 31, 2022. Barring any change in future legislation, that will drop to 22% for projects that begin construction between Jan. 1 and Dec. 31, 2023 and settle at 10% for projects that begin construction after Jan. 1, 2024. Projects that qualify for the higher ITC rates by starting construction before the end of 2023 can see their rates retroactively reduced if they are not placed in service before Dec. 31, 2025.

The following table summarizes the effects of the CAA on the ITC for solar projects and on the related statutory placed-in-service deadlines to be eligible for the related ITC percentage (not accounting for the Continuity Safe Harbor):

Carbon sequestration credits

The CAA provided a two-year extension of the deadline to begin construction on facilities that qualify for the carbon oxide sequestration credit from Dec. 31, 2023 to Dec. 31, 2025. The provision allows taxpayers to generate credits based on the number of qualified carbon oxide metric tons that are permanently sequestered by a qualifying facility. A smaller credit that is available for enhanced oil or gas recovery projects was also extended. Neither credit is subject to a limit on the number of metric tons of qualified carbon oxide captured.

Renewed interest in renewable energy

The CAA’s extensions and enhancements to renewable energy credits demonstrate an interest at the federal level to promote continued investment in “clean” energy projects. With more time to begin and complete construction that qualifies for higher credit rates, some businesses whose projects may have been stalled as a result of the COVID-19 pandemic will get an opportunity to reap additional benefits from renewable energy investments in the months and years ahead. Coupled with other CAA provisions that increase research and development spending on renewable energy and efforts elsewhere to limit availability of federal lands for fossil fuel projects, the government is signaling a clear intent to decarbonize the energy landscape in the United States.

To learn more about how these credits and other government incentives for renewable energy could benefit your business, please contact the Plante Moran energy team.