Compared to 2019, transactions by special-purpose acquisition companies, or SPACs, exploded in 2020, resulting in a 320% increase in the number of SPAC initial public offerings (IPOs) — and proceeds to date top $100 billion. According to the research firm Deal Point Data, a record 247 SPAC IPOs were completed in 2020, raising total gross proceeds of approximately $83 billion. Through February 2021, SPACs have raised an additional $38 billion.

With this level of market activity, we’re seeing valuations that make a public offering a very enticing exit strategy. But preparing for a public offering requires some key actions to consider for your audits, financial accounting, and internal controls.

PCAOB audits and independent auditors

First, if your exit strategy is to go public, then assume you’ll need audits performed in accordance with PCAOB auditing standards. Your auditor will need to be independent in accordance with both SEC and PCAOB independence rules.

If you’re a private company that’s been audited in the past, it’s likely your audit was performed in accordance with AICPA auditing standards and AICPA independence rules. The difference between SEC and AICPA independence rules is vast, and no auditor can pivot from AICPA to SEC on short notice.

Plan ahead with the following steps:

Step 1: Ensure independence.

In this initial step, the key question to ask your auditor is, “Can you audit my financial statements in accordance with PCAOB auditing standards and be SEC- and PCAOB-independent?” While the independence question can be difficult, you need a definitive yes/no answer.

Defining SEC independence

Let’s take a brief look at SEC independence. The three overarching principles of SEC independence are that the auditor cannot:

- Audit their own work.

- Function as a part of management.

- Advocate for their audit client.

For most private companies, auditor services that commonly violate SEC auditor independence are preparing financial statements and the tax provision. The SEC views these types of services as auditors both auditing their own work and functioning as part of management.

How do you correct an independence violation?

The only method of correcting an independence violation for financial statement and tax provision preparation services is the one thing most companies looking to go public don’t have: time.

Here’s an example:

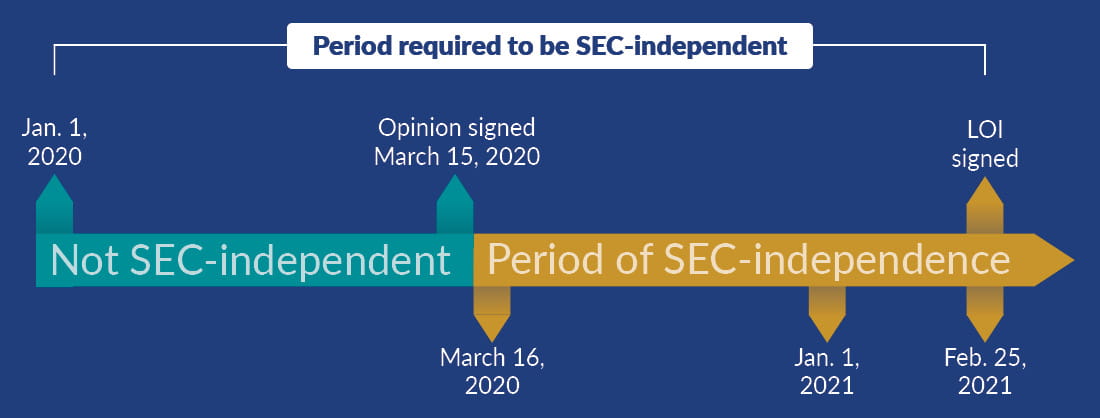

Company A receives an LOI from a SPAC on Feb. 25, 2021, and the SPAC informs Company A that its audited financial statements for the years ended Dec. 31, 2020, and 2019 will need to be included in an SEC filing. Audit Firm B has previously opined on the 2019 financial statements using AICPA standards and prepared the financial statements. As luck would have it, Audit Firm B has not started the 2020 audit, so the firm will conduct the 2020 audit under PCAOB audit standards, and Company A will hire a different firm to prepare the financial statements.

Is Company A in the clear with respect to SEC auditor independence? No.

Audit Firm B prepared the 2019 financial statements, and let’s assume the opinion date was March 15, 2020.

As you can see in the diagram, it can take up to two audits for an auditor to be SEC independent — a real conundrum when the right deal is available. Since planning ahead is challenging with the volume of transactions occurring, hiring out your financial statement and income tax provision preparation is a solid hedge against an unplanned public transaction.

Step 2: Upgrade the audit.

Luckily, the difference between an audit conducted under AICPA and PCAOB standards isn’t as significant as those in independence rules. However, if your prior audits were conducted under AICPA auditing standards, additional procedures will need to be performed.

Here’s what you might expect:

- Additional substantive testing due to the audit being in a public filing

- More communications with the board of directors or audit committee

- Requirements to use a valuation specialist for business combinations, stock option grants, or similar fair value measurements

- Expectation that a tax specialist prepares the tax provision and disclosures and assesses uncertain tax positions

- More of an extensive understanding of internal controls, especially surrounding fraud prevention and detection, information technology general controls, and cybersecurity

- In-depth audit procedures for related-party transactions and unusual and infrequent transactions

- Higher fees for the additional procedures

Step 3: Get ready to be a public company.

Operating as a public company carries a significant amount of responsibility to your new shareholders. The SEC’s primary objective when it comes to shareholders is to protect investors, and it takes its mission seriously. The SEC expectation is that financial statements will be materially accurate, timely, and with a sufficient amount of information to make investing decisions.

To start on this path, here are some recommended steps:

- Take inventory. Do you have the right number of qualified people on staff? If you were a private company, the answer would likely be “no.” Seek out a chief accounting officer, who is responsible for ensuring that the financial statements meet all regulatory requirements before being filed with the SEC.

- Perform an internal control check. The CEO and the CFO will need to certify on a quarterly and annual basis that the internal controls are properly designed and operating effectively. This requires the company to perform a self-assessment and over time could require an audit opinion. Expect a lot of scrutiny over internal controls.

- Hire experts. You’ll need valuation and tax experts as well as securities counsel. Identify your experts early, and develop a professional relationship so they will be responsive to your requests.

- Identify accounting performed in spreadsheets. Accounting that requires complex calculations should be performed in specialized software. Stock compensation and leases are examples of accounting that can be performed in a SaaS (Software as a Service) application, which can greatly reduce the risk of error.

- Close the books — timely. Every quarter, you’ll have a filing responsibility, which is easy to predict but also easy to fall behind. Focus on a timely close — two to three weeks is the norm, but one to two weeks is preferred because it gives you more time to do your financial reporting. Find inefficiencies and root them out.

Step 4: Seek advice.

SPAC IPOs may be an appealing exit strategy, but getting ready to take a company public requires some critical steps and advance planning, particularly for audits, financial accounting, and internal controls. Success depends on understanding the nuances and taking timely action. If you think taking a company public with a SPAC IPO might make sense, download our SPAC Readiness Tracker or give us a call. We can help you look ahead and plan, conduct your audits, and minimize the risk of missteps that costs you valuable time.