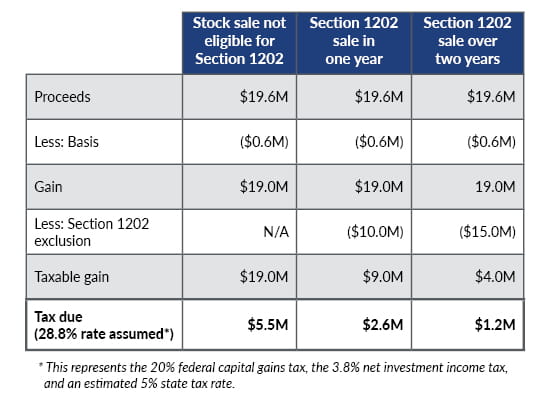

While recent years have seen unprecedented amounts of M&A activity, more taxpayers have been realizing the benefits of selling stock and excluding all or a portion of their gain under Section 1202. Previously, we explained the mechanics of Sec. 1202, including how noncorporate shareholders selling C corporation qualified small business stock (QSBS) can become eligible for up to a 100% gain exclusion. Although the gain exclusion under Sec. 1202 is subject to limitations, thoughtful planning can minimize the impact of the limitations and maximize the tax benefits for selling shareholders. Here, we explain how the maximum gain exclusion functions under Sec. 1202 and how shareholders can improve their results by timing the sale of stock.

Understanding the gain exclusion limitation

Taxpayers selling QSBS issued on or after Sept. 28, 2010, may receive up to a 100% exclusion of the eligible gain realized from the sale. Taxpayers selling QSBS issued between 1993 and 2010 may receive a 50 or 75% gain exclusion, depending on the date the QSBS was issued. A taxpayer’s maximum Sec. 1202 gain exclusion may not exceed the greater of:

- The cumulative limitation: A lifetime limitation of $10 million of eligible gain with respect to the sale of the QSBS from each corporation, reduced by the aggregate amount of eligible gain taken into account in prior taxable years.

- The 10X basis limitation: 10 times the aggregate adjusted bases of QSBS sold by the taxpayer during the tax year.

Taxpayers apply the most beneficial limitation to their eligible gain from the sale of QSBS, which is evaluated separately each year. When a taxpayer sells QSBS from different corporations, the taxpayer is allowed to apply the full $10 million or 10X basis limitation to the stock of each corporation separately. Each taxpayer also applies their limitation independently from other shareholders in the corporation, so each shareholder can exclude up to $10 million or 10 times their basis. These nuances allow taxpayers significant planning opportunities to maximize their exclusion of eligible gain and retain more money on an after-tax basis.

The $10 million cumulative limitation

The $10 million cumulative limitation diminishes by the amount of eligible gain taxpayers have excluded in previous sales of QSBS with respect to each corporation. This results in a smaller cumulative limitation each time the taxpayer excludes eligible gain from the sale of QSBS.

For example, if a taxpayer sells QSBS from a single corporation in Year 1 and excludes $4 million of eligible gain, the taxpayer’s remaining cumulative limitation for a sale of that corporation’s QSBS in later years will be $6 million. Additionally, if the taxpayer holds QSBS in a second corporation, the total cumulative limitation available to the taxpayer in the second corporation would still be up to $10 million because the cumulative limitation applies separately to QSBS issued by each corporation.

The 10X basis limitation

The 10X basis limitation allows taxpayers to exclude up to 10 times the basis of the QSBS sold in a given tax year, regardless of the number of QSBS sales or the amount of gain the taxpayer previously excluded. The 10X basis limitation becomes the “default” amount of gain exclusion a taxpayer can take after depleting the cumulative limitation.

For example, if a taxpayer sells QSBS of corporation X with a basis of $1.5 million, the potential exclusion for that year is equal to $15 million, which exceeds the $10 million cumulative limitation.

Taxpayers should consider the benefit of their QSBS basis when planning a sale because using the 10X basis limitation on a sale of QSBS with high basis may provide a gain exclusion limitation that exceeds the amount available under the cumulative limitation. Importantly, the 10X basis limitation is calculated based on the basis of the QSBS stock sold in that particular year. The basis of any QSBS the taxpayer still owns or sold in previous years will not be considered, which is particularly relevant when shares are sold over time or certain shares have greater basis than others.

Applying both limitations to maximize savings: 100% exclusion

When considering a large sale of QSBS, taxpayers should consider the potential benefits of splitting the sale up over two or more tax years. Specifically, a taxpayer can plan to sell low-basis QSBS in one year, utilizing the $10 million cumulative limitation, while utilizing the 10X basis limitation in subsequent years on higher-basis shares.

Example: Bob was issued stock in ABC, Inc., on various dates starting in 2012. All shares are held more than five years and meet the QSBS requirements for 100% exclusion. In 2020, Bob completed his first sale of ABC stock for $10.1 million. Because Bob had a basis of $100,000 in the stock he sold, Bob had $10 million of eligible gain ($10.1 million amount realized less $100,000 of basis). Bob could exclude the entire $10 million of gain under the cumulative limitation. He would not apply the 10X basis limitation to the 2020 sale because it would have allowed him to exclude only $1 million of gain ($100,000 basis multiplied by 10), which is less than the available cumulative limitation.

In 2021, Bob sold the rest of his ABC stock for $9.5 million, which had $500,000 of basis. The sale generated $9 million of eligible gain ($9.5 million amount realized less $500,000 of basis). Bob used his entire cumulative limitation in 2020, so he may not use it in 2021, but Bob may use the 10X basis limitation to exclude 10 times the basis of the stock he sold in 2021. Since Bob’s basis in the stock he sold in 2021 was $500,000, Bob was able to exclude $5 million of the $9 million of eligible gain in 2021.

If instead of spreading the sale over two years, Bob had sold all of his stock in 2020, he would have realized $19 million of eligible gain and would have been taxed on $9 million of that gain (maximum exclusion of $10 million or $6 million, 10X his basis of $600,000).

Recognizing the power of planning around strategically selling high basis shares in a later year is critically important because it’s contrary to traditional tax planning. In many cases, taxpayers are motivated to minimize their current tax by minimizing taxable gain. This usually results in selling the highest basis shares first. However, that can lead to worse results for QSBS. For example, if Bob in the example above had reversed the transactions, he would have been able to exclude the entire $9 million of gain recognized in 2020 when he sold his high-basis shares but then would have only been able to exclude $1 million of gain recognized in 2021 when he sold his low-basis shares.

Taxpayers can’t accomplish the results illustrated in the examples by using the installment method to sell their stock. Stock sales must be executed in separate years to see the benefits discussed above because the Sec. 1202 gain exclusion is determined in the year the stock is sold, rather than the year that the income is recorded.

Taxpayers trying to maximize their exclusion should take care to ensure that all legal documents identify the proper shares that are being sold. A taxpayer’s intent to sell their high-basis or low-basis shares isn’t necessarily sufficient. The legal documents should identify the specific stock certificates of the QSBS the taxpayer intends to sell.

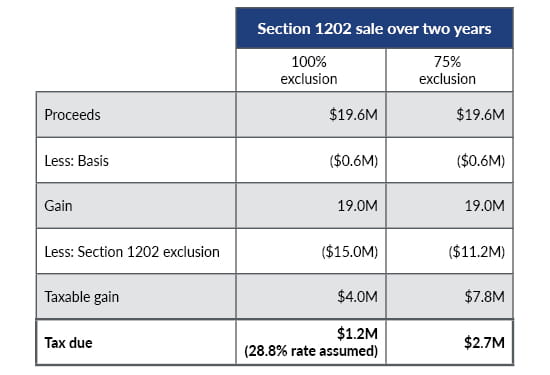

Applying both limitations: Mechanics of the 50 or 75% exclusion

As discussed above, taxpayers selling QSBS issued between 1993 and 2010 may receive up to a 50 or 75% gain exclusion, depending on the date the QSBS was issued. For such taxpayers, applying the Sec. 1202 limitation is a little different, so it may be helpful to understand how these rules operate. First, the $10 million cumulative limitation or the 10X basis limitation is applied to determine the amount of eligible gain resulting from the sale. Next, the taxpayer determines actual amount of gain exclusion by multiplying the eligible gain by the 50 or 75% limitation.

But there’s still a little more to the story when applying the 50 or 75% exclusion. First, the taxable portion of the eligible gain (either 50 or 25%, as applicable) is subject to federal tax at a higher rate of 28%, instead of the normal 20% capital gain rate (the 3.8% net investment income tax would also apply to the taxable portion of the gain). In addition, the taxpayer must include an alternative minimum tax preference equal to 7% of the excluded gain, which may increase the effective federal tax rate by 0–2%. These rules are illustrated by the example below.

Example: Assume the same facts as the previous example, except that Bob acquired his ABC stock on various dates in 2009, so the shares qualify for the 75% exclusion. In 2020, when Bob completed his first sale, he had $10 million of gain, $7.5 million of which was eligible for exclusion under Sec. 1202 ($10 million x 75%). The remaining $2.5 million is subject to federal tax at 28% rate instead of 20% (it would also be subject to the 3.8% net investment income tax). Bob also has an unfavorable alternative minimum tax preference of $175,000 ($2.5 million x 7%).

In 2021, Bob sells the remaining ABC stock for $9.5 million. Bob doesn’t have any of his cumulative limitation left after the $10 million eligible gain in 2020. It doesn’t matter that only 75% of that gain was eligible to be excluded. Since Bob’s basis in his stock is $500,000, he can exclude $5 million of gain under the 10X basis limitation ($500,000 x 10). Thus, when Bob applied the 75% exclusion to the $5 million of eligible gain, Bob was able to exclude $3.75 million of that portion of the gain. Bob will be taxed on the $1.25 million of eligible gain not excluded from income at a 28% federal rate (plus the 3.8% net investment income tax), will have an alternative minimum tax preference of $87,500, and will be subject to standard capital gains taxes on the remaining $4 million ($9 million total gain less the $5 million of eligible gain).

How we can help with Section 1202

Taxpayers seeking to maximize Sec. 1202’s gain exclusion should carefully consider the many tax planning strategies available. While the planning in this article is accomplished at the time of sale, many other strategies must be addressed far in advance. Effectively structuring a sale of QSBS depends on a taxpayer’s unique facts and circumstances. Contact us if you have questions about how to maximize the tax benefits of Sec. 1202 when selling your stock.