Due to the marketplace becoming crowded with third-party advisors pushing employers to claim ERC refunds without proper documentation, the IRS has issued multiple warnings to taxpayers urging caution with advertisements and direct solicitations that seem “too good to be true.”

Acting IRS Commissioner Doug O'Donnell says “Anyone who is considering claiming this credit needs to carefully review the guidelines. If the tax professional they’re using raises questions about the accuracy of the Employee Retention Credit claim, people should listen to their advice. The IRS is actively auditing and conducting criminal investigations related to these false claims. People need to think twice before claiming this.”

The employee retention credit (ERC) has been a significant source of assistance to businesses that continued paying their employees despite COVID-19 shutdowns or significant downturns in receipts between March 13, 2020 and Dec. 31, 2021. The ERC remains a viable tax opportunity, but only for those who meet the eligibility requirements.

ERC eligibility is based on:

- A full or partial suspension of operations due to orders from an appropriate government authority.

- A significant decline in gross receipts during 2020 or a decline in gross receipts in the first three quarters of 2021.

- Qualification as a “recovery startup business” in the third or fourth quarter of 2021.

Businesses that meet these eligibility requirements should consult with a tax professional to properly document and claim the credit by amending affected Forms 941 Employer’s Federal Quarterly Tax Returns and accounting for the impact of the credit on their income tax returns.

Proper documentation of ERC eligibility

To support a claim for an ERC refund, employers should gather and maintain certain documentation that the IRS has specified. To establish ERC eligibility, that documentation should include (among other things):

- The governmental order(s) that suspended the employer’s business operations.

- Be mindful that this is likely a state or local order. In general, there’s no federal order suspending businesses during 2020 or 2021.

- Supply chain disruptions that aren’t the result of a governmental order and that don’t meet other criteria don’t result in a suspension.

- Any records that show that a governmental order resulted in more than a nominal effect on the employer’s business operations.

- Operational data linking the governmental order to a business impacts is likely best.

- Any records used to calculate a “significant decline in gross receipts.”

- Take care to identify quarterly gross receipts that reconcile with the aggregated employer’s tax return(s).

- Records of employees’ qualified wages and healthcare expenses and Paycheck Protection Program (PPP) data.

Employers have time to claim the ERC retroactively

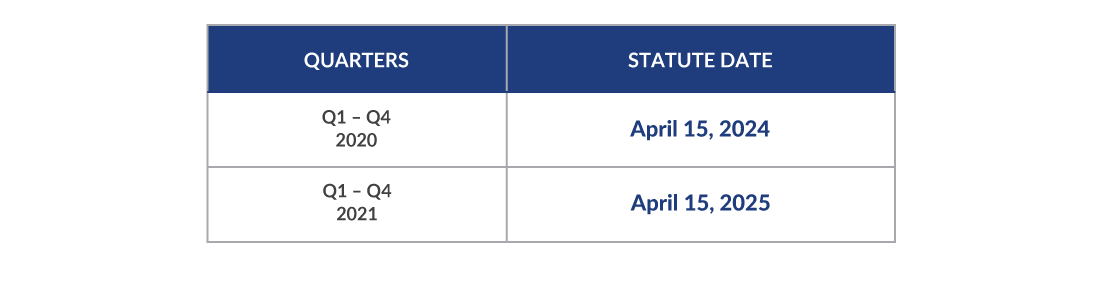

It’s helpful to understand that there is time to amend previously filed Forms 941 and still qualify for retroactive ERC claims. Employment tax returns for the year are deemed to be filed on April 15, so the three-year statute of limitations that would apply to the earliest affected returns won’t run out until April 15, 2024. That gives employers plenty of time to gather the proper supporting documentation and make accurate claims for an ERC refund. For 2021, employers have until April 15, 2025 to amend. The third and fourth quarters of 2021 are subject to a five-year statute of limitations on assessment, extending the time for the IRS to make adjustments until April 15, 2027 for legitimate claims.

Taking the time to properly file an ERC claim is worth it, particularly as the IRS is dealing with a major 941X backlog and coordinating efforts internally to audit many ERC claims.

An ERC refund usually affects prior-year income taxes

While employers that are ERC-eligible are better off filing for a refund of the credit, those that do so should be aware that it will likely require an amendment to their business income taxes for the corresponding years. Amounts received under the ERC are no longer eligible to be deducted from taxable income as wage expenses, meaning those employers that file amended Forms 941 to claim the ERC will need to file a corresponding amended income tax return reflecting the change in deductible wage expenses. This could result in income tax due now, while waiting for an ERC refund later.

Understand your ERC eligibility

If your business was affected by COVID-19 shutdowns or saw significant revenue declines in the periods described above, it makes sense to consult with your tax advisor about ERC eligibility and the potential for a retroactive ERC refund.

Tread carefully with any advertisements rushing you to act quickly and pay large upfront fees, as the multiple IRS warnings suggest that you’d be better served by discussing your circumstances with a known, trusted advisor.

To learn more about how your business could benefit from an expert, well-documented ERC claim, please contact your Plante Moran advisor.