The current geopolitical situation remains highly fluid and may continue to evolve at a rapid pace. While uncertainty remains regarding how developments may unfold, we’ll continue to monitor the situation and provide insights and perspectives as warranted.

What happened?

As has been widely reported over the past 36 hours, on Saturday evening, the United States launched a targeted military strike against key Iranian nuclear facilities. While the full effect of the operation is still being evaluated, the primary objective was to significantly impair Iran's nuclear program, which has long been a point of contention due to concerns over potential nuclear weapon development. On Monday afternoon, Iran launched missiles at a U.S. air base in Qatar in retaliation. These events marked an escalation in tensions between the United States and Iran and for the ongoing conflict within the Middle East.

Capital markets: Wait and see

Perhaps surprisingly, investors seem to be shrugging off concerns of further escalation. When markets opened today, U.S. equities were trading modestly higher, Treasury yields were lower, and the price of oil was relatively flat, having already risen roughly 20% over the last month. While there’s no way to reliably predict how developments will unfold in the coming days, for now, it appears that markets are weighing the potential that neither the U.S. nor Iran wants to extend the hostilities and will look for a way to de-escalate.

A key risk remains: the potential closure of the Strait of Hormuz, a narrow passage that connects the Persian Gulf to the Gulf of Oman, through which about 20% of the global oil supply transits daily. This would be a significant complicating factor — raising the stakes economically, geopolitically, and militarily. Although the Iranian parliament voted on Sunday to close the strait, it remains to be seen whether or not Iran’s Supreme Council will follow through. As an important buyer of Iranian oil, China has warned them against taking that action. Doing so would choke off the supply of oil from several Gulf states, interrupting its flow and greatly increasing the probability of a larger conflict. In that scenario, a more pronounced reaction for stocks and risk assets can’t be ruled out. If recent developments don’t escalate materially, market reaction may remain subdued; a more protracted conflict could prove more disruptive though.

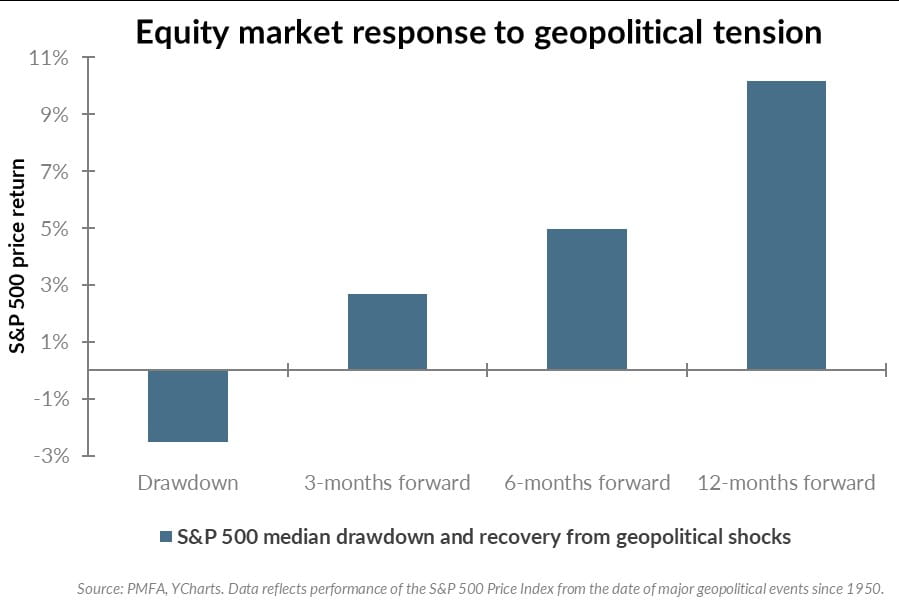

However, it’s important to note that market volatility precipitated by geopolitical events tends to be short-lived. If we look back across prior geopolitical shocks, markets have on average recouped equity losses within just three months as the chart illustrates below.

Economic and policy impact: Watch the oil market

From an economic perspective, the primary risk is a sustained increase in the price of crude oil. The Middle East is a critical region for global oil production, and any disruption can lead to significant price fluctuations. Higher oil prices would be an inflationary catalyst, while also curtailing consumer sentiment and spending and creating an additional hurdle for hiring and business investment, ultimately weighing on growth.

Moves in the oil market don’t yet represent a significant threat to the global economy; in fact, prices remain below the level this time last year. Given its recent policy meeting, it seems unlikely that the Fed would be persuaded to lower its benchmark rate before policymakers reconvene on July 29, but a preemptive cut can’t be ruled out if conditions were to deteriorate. Other central banks may respond with near-term cuts to mitigate the potential economic drag that could arise from a sharp, prolonged spike in energy costs, but we’ve yet to see significant dislocation for that to be warranted. A larger and more prolonged rise in oil prices would likely be needed to have a meaningful impact on monetary policy.

While uncertainty remains heightened, any de-escalation of tensions could allow oil prices to ease from here. And that potential certainly shouldn’t be ruled out.

Volatility in the sources of volatility

The range of concerns that investors have faced in recent years has been wide and disparate, and the first half of this year has been no exception. From DOGE cuts to trade policy to higher-for-longer interest rates against the backdrop of a feared tariff-driven inflation surge and slower growth, investors have had much to absorb. Now, with the United States putting itself even more firmly into the Middle East conflict and the potential for oil prices to surge, investors have another significant development to consider.

As noted earlier herein, geopolitical events tend to disproportionately affect the prices of stocks and other risk assets in their immediate aftermath but tend to have more limited lasting impact. Of course, that presumes that a more protracted period of escalating tensions or uncertainty is avoided. At this stage, it’s far too soon to conclude whether or not tensions will escalate further or subside in the coming days. Much will depend on the nature and magnitude of Iran’s response. If today’s actions are any indication, Iran’s response may be measured — enough to signal to its citizens that it is responding — while not going so far as to provoke a U.S. response.

Investors should be prepared for the possibility that oil prices could rise in the near term and risk assets, including stocks, could come under pressure. However, if neither side significantly ratchets up tensions from here, a more benign outcome is still possible — as we have seen thus far — even without a complete cessation in hostilities across the region. As with any increase in uncertainty, investors should be prepared for the potential of stock market volatility in the near term. We encourage investors to not lose sight of their investment time horizon, maintain broad-based diversification, and ensure adequate liquidity to cover near-term spending needs during these times.

As always, we’ll continue to closely monitor developments in the coming days and keep you apprised of any developments that we believe to be meaningful from a macro-perspective. Please feel free to reach out at any time to discuss the situation and any questions you may have.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.

© 2025 YCharts, Inc. All rights reserved, The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided “AS IS” with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.