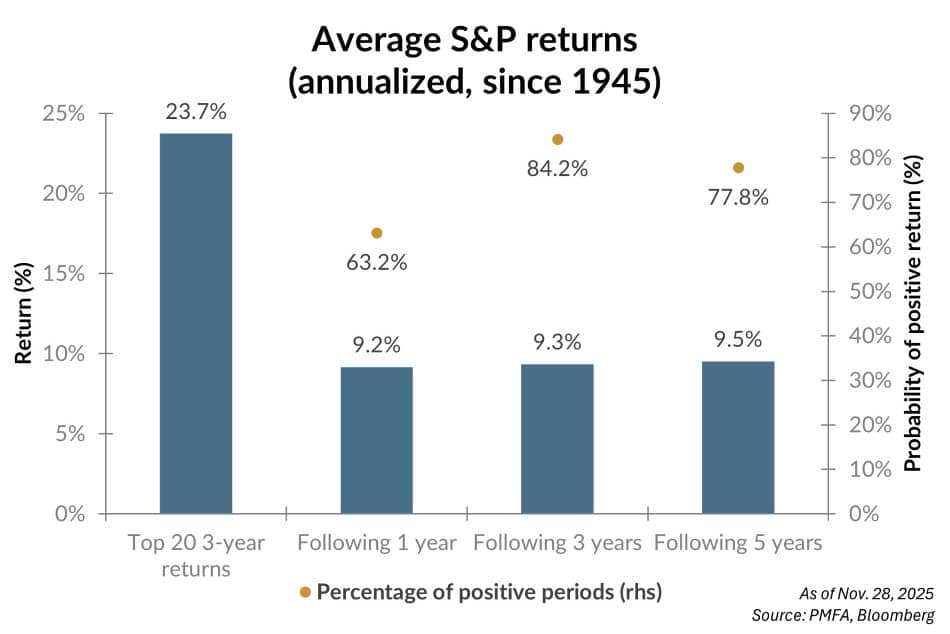

As noted in our accompanying piece, the S&P 500’s recent annualized return of about 23% is notable for its magnitude. It’s also very close to the average annualized return for the 20 strongest three‑year periods since 1945, with many being further defined by a string of what were at the time lauded as “all-time record highs.” What happened after those record-setting years is also important to understand.

As illustrated above, during the one-, three-, and five-year periods following the strongest three-year bull markets of the post-1945 era, stocks still typically provided solidly positive returns, albeit slightly below the long-term average return for the market. Underneath those averages though, it’s important to note that the range of potential returns was relatively wide, with periods of volatility, multiple instances of negative performance, and even some bear markets. Even so, the probability of positive returns was consistently better than 50%, particularly over a multiyear time frame.

That historical tendency is important to consider against today’s stretched valuations and narrow market leadership concentrated in the largest names in the S&P 500 index. Valuations could certainly stretch further from here if the economy remains on track and investor sentiment around the AI theme remains strong. Given expected near-term support from fiscal stimulus, lower interest rates, and brisk corporate investment, economic forecasts for 2026 remain largely positive. Even so, it may be difficult for the stock market to continue to advance at its recent pace. A reversion toward more normal equity returns wouldn’t be surprising.

The good news? History suggests that investors over a multiyear time horizon are likely to be rewarded for staying invested, even after periods of solid stock market returns. Short-term periods of volatility and periodic bear markets are always a risk. The longer one’s time horizon, the greater the probability of being rewarded for remaining invested in stocks and other risk assets.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.