FASB recently shared new guidance to help contractors present and disclose retainage with improved visibility in financial statements under Topic 606.

If you’re a construction contractor, this matters. Retainage plays a key role in revenue recognition — and how you report it can shape how your financial statements are understood. While there’s no new rule to follow, FASB does offer examples and formats to help you present retainage in an area where reporting has often varied.

Here’s what’s new, why it matters, and what to do next.

What changed?

The Private Company Council (PCC) considered a new standard that would have let organizations show contract balances on a gross basis by job. But after more feedback, it was clear a new rule would likely create more confusion.

So, instead, FASB issued this education paper to explain how you can already use existing guidance to improve clarity — especially around retainage. It includes optional examples that are already allowed under GAAP. No systems changes required.

Why this matters

How you report the retainage affects more than just compliance — it shapes how lenders, sureties, and other stakeholders understand your financial position. When retainage is buried in contract balances or mixed in with over and under billings, it creates uncertainty around what’s earned, what’s held, and what’s still due.

The guidance offers simpler, GAAP-compliant ways to present retainage, helping reduce confusion and improve clarity. If your year-end financials are still in progress, now’s the time to step back and ask, “Does my current approach make it easy for others to follow?”

What are your options?

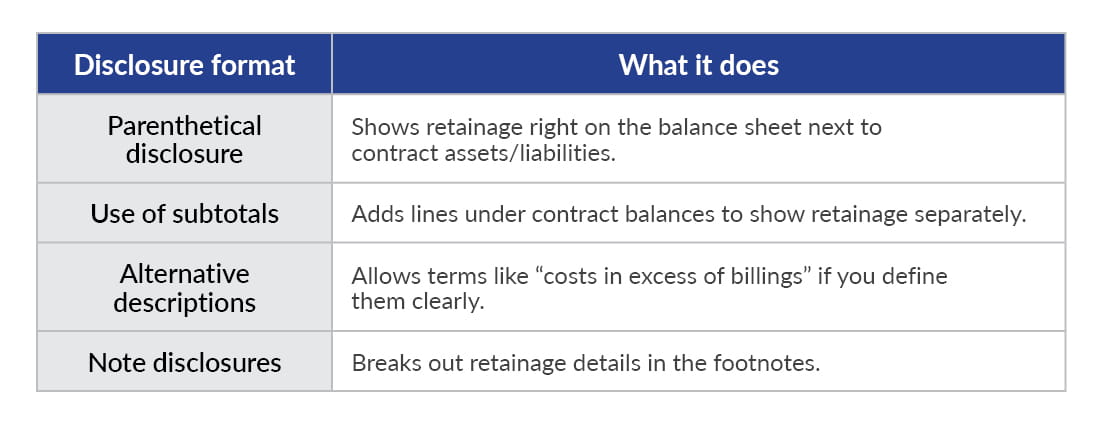

If you’re looking for a clearer way to report retainage, FASB gives you four flexible options — each designed to improve transparency without overhauling your current system. Here’s a quick breakdown:

Choose the format that works with your systems and makes retainage easier to understand. For many contractors, these options offer a more straightforward way to show what’s held, owed, or earned.

What to do next?

Still finalizing your year-end 2024 statements? It’s worth checking whether your retainage reporting tells the right story and if it gives stakeholders a clear view of where things stand. Consider the following:

- If your current approach works and time is short, it’s fine to keep using it — just be sure your reasoning is supported with documentation.

- Ask yourself if your classification meaningfully affects the overall picture. If the impact is small, a minor adjustment may be enough.

- Check your organization’s audit guidance to determine whether a reclassification is material, especially if it could affect debt covenants or financial ratios.

- With near-term decisions made, ask yourself, “Does your current approach support consistency over time, or will the same questions come up again next year?”

Looking ahead

We don’t expect further updates from FASB on retainage reporting. The takeaway is simple: current standards already give you the flexibility to present retainage in a more easily understood format — if you choose to use them.

Now’s the time to revisit your reporting approach and decide whether small changes could help others better understand your financials. Not just for this year, but long term. There’s no need to overhaul your reporting. FASB’s guidance just gives you better ways to show retainage using rules that already exist. If your current setup is working and makes sense to your stakeholders, you can keep it. But if there’s confusion, these new examples can help you clean things up — without a lot of extra work.