The bottom line? Other labor market data points to a slowdown, but initial claims remain rangebound

- The economy remains in a weak patch, burdened by uncertainty on multiple fronts; how employers and consumers react as greater clarity is achieved will play a significant role in determining whether job creation regains momentum in the coming months or deteriorates further, ultimately leading to rising layoffs.

- The claims numbers should be watched carefully for signs of cracks in the coming months. For now, they remain pretty firm.

By the numbers

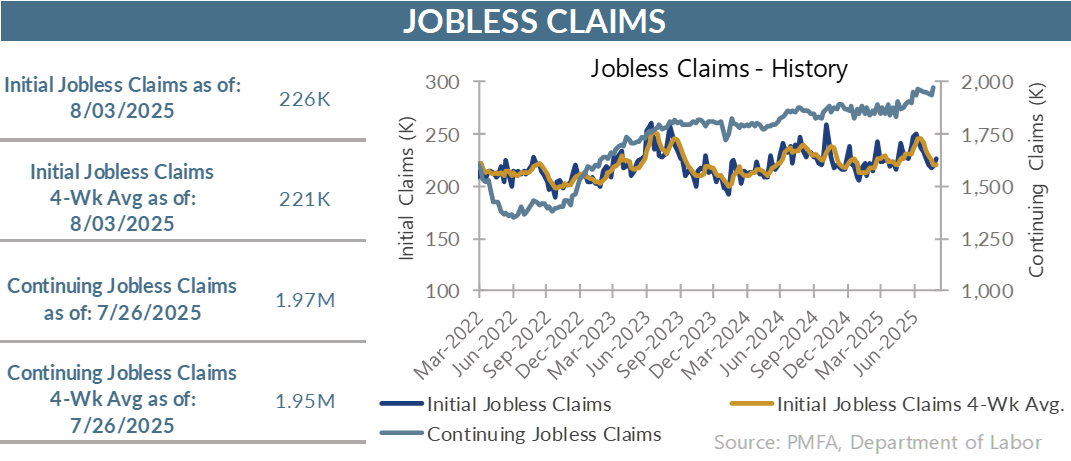

- Initial jobless claims edged higher last week, rising to 226,000 for the week ended August 2. Despite the increase, the 4-week moving average eased modestly, dipping to 220,750 for the period.

- Continuing claims also increased to 1.974 million from 1.936 million the week prior. Over the past year, continuing claims have risen by 98,000, with the insured unemployment rate edging up by 0.1%.

What’s the story? No cracks yet in claims data

- Other measures of labor market conditions have shown distinct evidence of weakening, but there’s been little of concern in weekly claims data to justify sounding the alarm bell.

- Despite clear evidence of a slowdown in hiring, employers don’t appear worried enough about the near-term outlook to start cutting their payrolls.

- Weekly claims numbers tend to bounce around a bit, but there’s been no sign of a breakout in claims that would suggest an acceleration in layoffs. The increase in continuing claims over the past year is similarly benign, given labor force growth of approximately 2 million over that period.

- From a big-picture perspective, the jobs market remains relatively balanced between job openings and the supply of available labor, although geographical and skills mismatches may mask on-the-ground conditions for both employers and workers.

- Today, the challenge is more notable for those seeking work than for those who are already employed. Finding a job has become increasingly difficult; for most workers, keeping one’s job has not — to this point at least.

- Employers have stomped the brakes on hiring in recent months, but there’s little evidence to suggest that they’re so worried about the near-term outlook that the mindset has shifted to a need to downsize their workforce.

- That could certainly change if the price impact of tariffs further restrains spending by consumers in the near term; that would be particularly notable, given the degree to which they’ve already curtailed spending since the beginning of the year. The impact on consumption will depend not only on shifting consumer sentiment but the degree to which higher costs are absorbed by businesses rather than passing them along to their customers.

- It’s not a robust labor market — that much is clear. The question is whether the notable slowdown in the pace of hiring will extend to outright job losses in the coming months. To this point, there’s been little evidence that that’s the case. With the passage of the One, Big, Beautiful Bill, businesses now have greater clarity on tax and fiscal policy. As the trade and tariff picture becomes a little clearer, they’ll be better suited to understand the practical impact and adjust as necessary to navigate a new trade landscape.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.