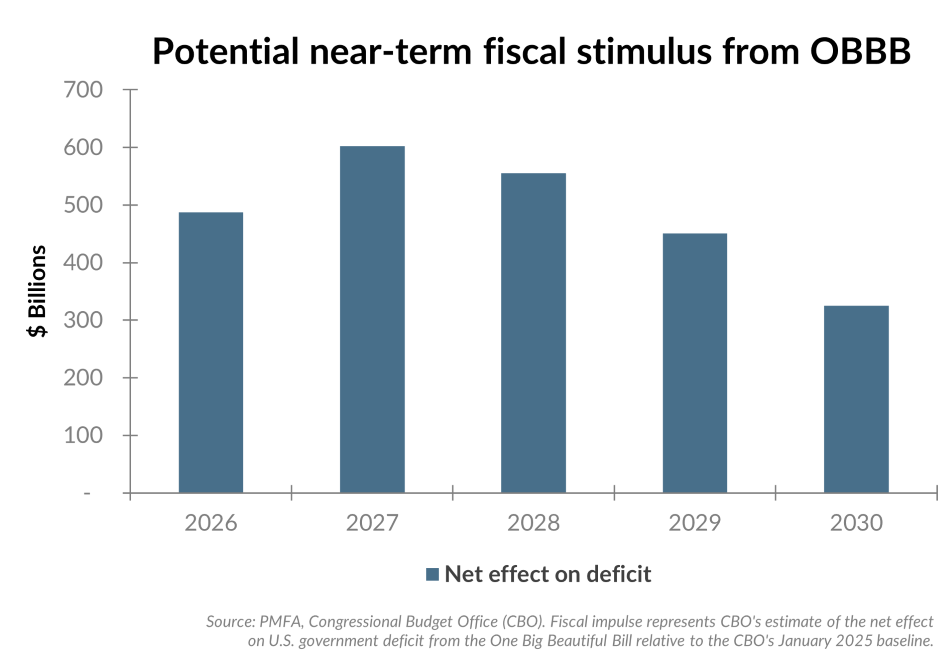

The Congressional Budget Office’s recent scoring of the One, Big, Beautiful Bill (OBBB) paints a complex fiscal picture for markets and investors alike. Between the 2026-2030 period, the legislation is projected to provide additional fiscal stimulus while increasing projected deficits over the next five years relative to baseline expectations had the provisions from the 2017 tax cuts been allowed to sunset at the end of this year.

The Congressional Budget Office’s recent scoring of the One, Big, Beautiful Bill (OBBB) paints a complex fiscal picture for markets and investors alike. Between the 2026-2030 period, the legislation is projected to provide additional fiscal stimulus while increasing projected deficits over the next five years relative to baseline expectations had the provisions from the 2017 tax cuts been allowed to sunset at the end of this year.

Meanwhile, targeted tariffs remain in place, aimed at mitigating the impact of other tax cuts and resulting deficits and potentially benefiting some domestic industries. These revenues will be helpful, but they’re modest compared to the scale of tax relief.

For investors, aspects of these changes could be constructive, with sectors like industrials, technology, and manufacturing potentially benefitting from increased capital spending fueled by favorable tax treatment. However, broader economic implications are more nuanced. Rising deficits could put additional pressure on interest rates over time, although quantifying the effect is difficult.

The near-term and long-term market implications are varied. Equity investors may see some stimulus-driven tailwind in the short run, boosting economic growth and lifting earnings. Over the long-term, larger deficits and higher interest rates could have an impact as well. A higher-rate environment over the long term could provide more attractive yields for bond investors but could rein in valuation multiples for stocks to some degree. It remains to be seen how these competing forces play out, but the near-term effects shouldn’t be significant enough to prompt most investors to deviate from their investment policy.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.