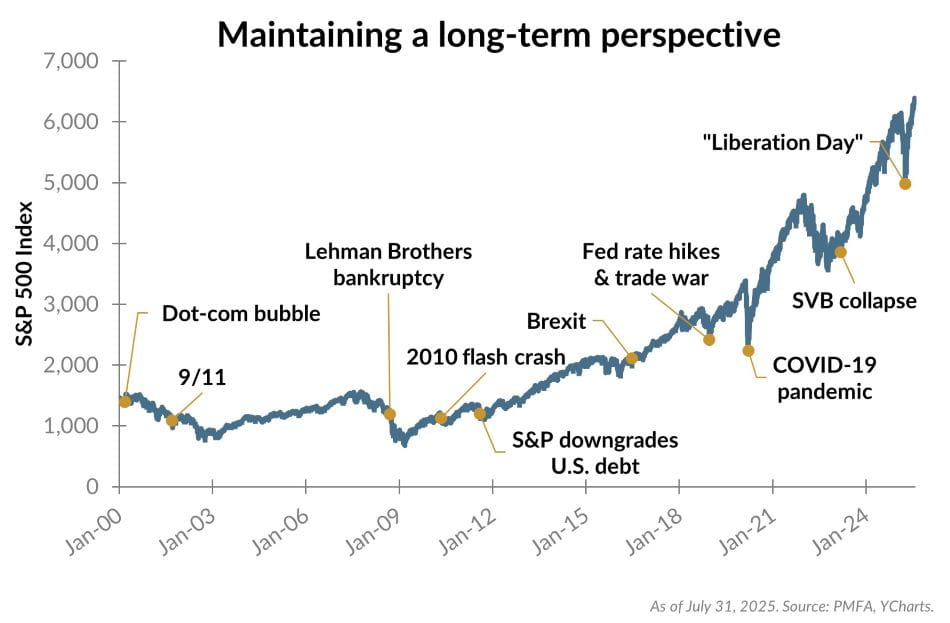

Since the S&P 500 adopted its current structure and name in 1957, the index has delivered an average annualized return topping 10%, despite multiple wars, economic recessions, inflation shocks, financial crises, and major global events. From the Great Depression to the 2008 Great Financial Crisis, and the pandemic-driven volatility of 2020, the index has faced a variety of steep declines (with three of about 50% since 1957), only to recover and reach new highs in the years that followed.

The average bear market has also been much shorter (13 months) than the average bull market (70 months) since World War II. This underscores the resilience of equity markets, as illustrated in the chart above, which highlights various critical events that impacted the markets since 2000.

Short-term market movements, however, remain notoriously difficult to predict. Events such as geopolitical conflicts, policy shifts, or economic shocks can trigger sharp swings in sentiment and market pricing. History has proven that reacting to these episodes by exiting the market often means missing out on the strongest recovery days — returns that can significantly influence investors’ long-term outcomes.

While the path forward is never certain, the long-term trajectory of the S&P 500 has been broadly upward and resilient. Maintaining a disciplined and strategic investment approach — anchored in diversification and time in the market rather than attempting to time the market — remains one of the most effective strategies for building and preserving wealth. Staying invested through market cycles allows portfolios to benefit from compounding growth and avoid the pitfalls of making critical investment decisions in response to periodic volatility.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.

© 2025 YCharts, Inc. All rights reserved, The information contained herein: (1) is proprietary to YCharts, Inc. and/or its content providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided “AS IS” with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.