The bottom line? “No hire/no fire” may be evolving

- The “no hire/no fire” characterization of the labor economy may be evolving, but the “no fire” component still appears to be intact.

- The surprisingly strong January jobs report provided a hopeful sign that the extended period of weak hiring may finally be showing signs of breaking out of its slump, fueled by resilient spending and an economy that grew at a brisk pace in the latter half of last year. Today’s report on claims reinforces that layoffs remain contained in a constructive range, also reaffirming that if the labor economy is poised to move away from “no hire/no fire,” it could be heading in a more constructive direction.

- Whether better hiring momentum can be sustained remains to be seen, but some improvement in the pace of job creation would be a welcome sign that the labor economy may be transitioning toward a “moderate hire/no fire” backdrop.

By the numbers: Initial claims lower than expected; continuing claims steady

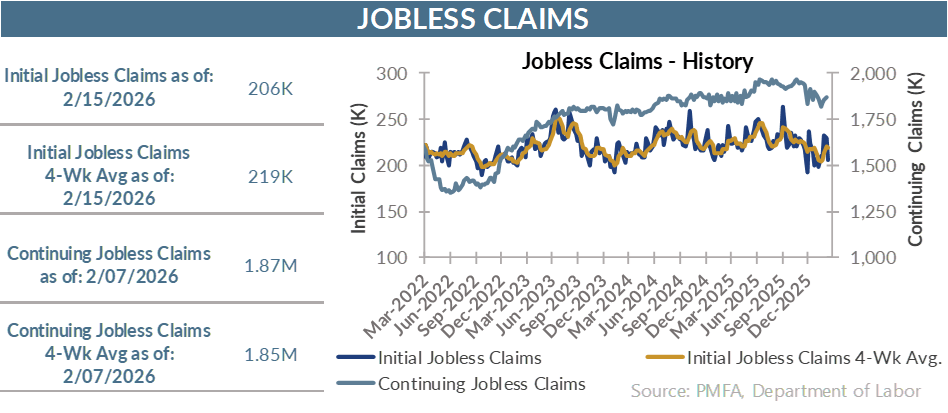

- Initial jobless claims declined unexpectedly last week, falling to 206,000 for the week ended February 14. The consensus forecast had called for 225,000, which would have been little changed from the prior week’s level. Revisions nudged the total for the week ended February 7 gently higher to 229,000, but not enough to materially alter the picture.

- The surprise decline also pulled the 4-week moving average modestly lower to 219,000 from 220,000 a week ago.

- Continuing claims increased moderately for the week ended February 7, climbing to 1.869 million from 1.852 million the prior week. That’s a result that’s virtually unchanged over the past year, suggesting virtually no sign of deterioration in conditions by that measure.

What’s the story? Claims data shows a stable labor market

- The labor market appears to be stabilizing, if not strengthening, following an extended period of lackluster hiring since last May. The solid January payroll report released last Wednesday highlighted growing participation in the private sector, although job creation remains uneven across various sectors of the economy.

- Multiple factors have contributed to weak payroll gains reflective of both limits on the availability of workers and softer hiring demand in the face of last year’s increased economic uncertainty and a mixed policy backdrop.

- Concerns about the potential impact of tariffs were among the more significant perceived headwinds to growth that appeared to dampen hiring enthusiasm, although resilient growth in the latter half of the year and subsequent developments that reined in the magnitude of tariffs considerably went a long way toward easing those concerns.

- Even so, employers have been slow to add to payrolls in the aftermath of the “Liberation Day” tariff announcements. That dynamic may finally be showing some signs of turning.

- Despite weak hiring, layoffs didn’t surge. Initial claims remained quite low and relatively rangebound with the exception of a few periodic spikes that proved temporary.

- The fact that continuing claims have barely budged since the same period one year ago also lends credence to the “no fire” part of the “no hire/no fire” nature of the labor economy.

- That’s good news for currently employed workers and helps to explain why consumption growth hasn’t been significantly dented despite various indicators that suggest consumer sentiment remains quite negative.

- It’s a different story altogether for those seeking a job. By virtually any measure — job openings, voluntary turnover, or job creation — it remains a comparatively challenging environment for those looking for work.

- That’s part of what made the January jobs report as encouraging as it was. The 130,000 gain in nonfarm payrolls was the strongest monthly gain in over a year. With the economy still growing at a solid pace, it appears that the table could be set for a modest reacceleration in job creation.

- Whether a better pace of job creation can be sustained is a separate question. Immigration had been a key source of new workers in recent years — one that has been dampened considerably over the past year. Demographics in the United States will continue to challenge the workforce, as the aging population leaves a large cohort stepping away, with fewer young workers poised to fill the void created by baby boomer retirements.

- That may not present an immediate challenge, but it will be one that will create a practical ceiling for job creation in the years ahead in the absence of stronger immigration.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.