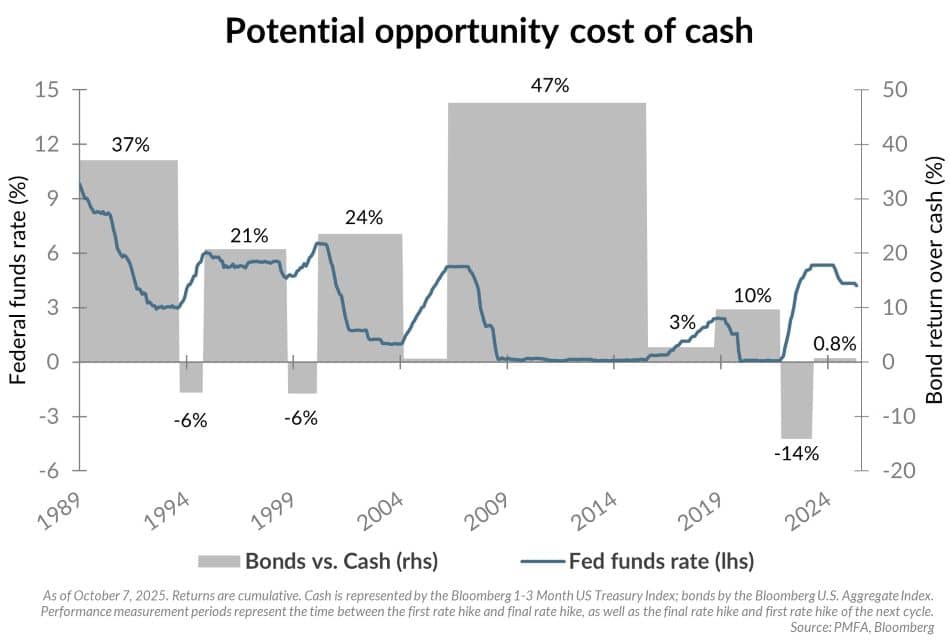

Since the Fed’s final rate hike in mid-2023, cash and cash equivalents have offered an attractive short-term return for investors seeking safety and liquidity. In fact, cash returns have been nearly identical to core bonds since the Fed’s last hike, as shown in the chart above. However, those with a longer investment horizon should be mindful of the opportunity costs of remaining too heavily allocated to cash.

At its September meeting, the Federal Reserve reduced its benchmark short-term interest rate by 0.25% and signaled the likelihood of further cuts through year-end. These policy decisions have a direct influence on short-term rates across the economy, including those on cash and short-term instruments. As the rate-cutting cycle progresses, investors with heavy allocations to cash face heightened reinvestment risk — the challenge of reinvesting maturing assets at increasingly lower yields.

Conversely, core bonds offer the ability to lock in current yields for longer as a benefit of their longer maturity. In addition, as rates decline, core bonds not only maintain their income stream but also stand to benefit from price appreciation as they roll toward maturity. This makes them particularly attractive outside of rate hiking cycles — generally outperforming cash when short-term rates are stable or declining.

The takeaway? While cash has provided a healthy yield in recent years, stepping out on the curve to lock in yields for longer may be prudent. Cash remains an important source of liquidity, but lower yields will diminish its relative attractiveness. For many investors, this approach can more appropriately align one’s investment portfolio with longer-term goals.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.